Dollar struggles

Yesterday, Fx trading took a calm start for the week. Eco data were second tier and events were few and basically ignored. Earnings or guidance from Philips, SAP and IBM disappointed, putting European equities in the defensive. EUR/USD kept a sideways trading pattern, but USD/JPY turned south during the European session (on weaker equities) after rising higher in Asia (on stronger equities). US equities succeed a nice rebound later in the session. Remarkably, this was a negative rather than a positive for the dollar. EUR/USD regained the 1.28 mark and USD/JPY closed the session below 107.

Overnight, the dollar remains under pressure, especially against the yen. Profit taking on Japanese equities after yesterday’s rally is weighing on USD/JPY. The pair is changing hands in the 106.35 area. China Q3 GDP was reported marginally better than expected at 7.3 Y/Y. Chinese September industrial production was better than expected, too. However, the data fail to inspire further equity gains in the region. This investor caution keeps the dollar in the defensive across the board. EUR/USD is changing hands in the 1.2825 area. In an interview, US Treasury secretary Lew said he was watching FX moves that are the result of interventions and policy by governments to depreciate currencies. However, the recent decline in EUR/USD apparently doesn’t belong to this category as it is the result of differences in economy outlook.

The Chinese eco data are a positive for the Aussie dollar, too. The Aussie dollar regained 0.88 barrier. In the Minutes from the latest RBA meeting, the bank repeated that the Aussie dollar remains high by historical standards and indicated that a period of interest rate stability is likely.

Today, there are few important European eco data. In the US, the September existing home sales will be published. A moderate monthly gain is expected. We expect the report to be only of intraday importance. Global factors will set the tone for EUR/USD and USD/JPY trading. Yesterday, the ECB started its ABS buying, but currently without impact on the euro. The market is not convinced it will create enough additional euro liquidity to put the euro under pressure. It looks that global sentiment on risk will remain fragile despite the strong close in the US yesterday evening. This is in the first place a negative for USD/JPY. For EUR/USD to picture is less clear.

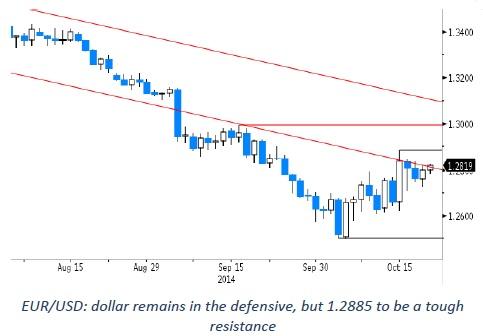

Delayed market expectations on the first US rate hike are dollar negative, but there are a lot of issues for Europe too, which makes the topside in EUR/USD difficult. In this respect, rising volatility in the intra-EMU credit spreads suggests some nervousness that might have impact on the currency market, too. So, it might be hard work for EUR/USD to make a sustained rebound beyond the 1.2886 correction top, even if global sentiment turns risk-off.

The technical picture of EUR/USD deteriorated after the break below the key 1.2662 support level (Nov 2012 low). We have a LT negative bias on EUR/USD. The trend is intact, but the price action over the last two weeks suggests that the market was too long USD. In the meantime, dollar overbought conditions have been worked off. The 1.2043/1.1877 support is the next LT target, but a drop below 1.25 is needed before the picture should be again dollar bullish ST. A re-break above 1.2995 would be really significant and suggest a real loss of momentum in the longstanding EUR/USD downtrend. This is not our preferred scenario though.

EUR/GBP holding below the 0.80 barrier

On Monday, sterling trading was uneventful and boring. The eco calendar was empty and EUR/USD traded mostly sideways. In the absence of new impetus, EUR/GBP closed the session marginally higher at 0.7919, compared to 0.7928 on Friday evening. Overall dollar weakness propelled cable to the high 1.61 area.

Later today, the monthly UK budget data will be published. The reaction of sterling to this report is usually very limited. So sterling trading will stay at the mercy of global factors.

Of late, sentiment on the UK currency remained rather constructive even as expectations for a first BoE rate hike are pushed back further out in time. More sideways trading might be on the cards awaiting key eco data (PMI’s) Thursday and the Minutes of the BoE meeting Wednesday. The EUR/GBP 0.7755/0.8066 consolidation range looks well in place. We look to sell into strength for return action lower in this range.

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.