Yesterday, trading in the major dollar cross rates was still confined to tight ranges. USD/JPY hardly profited from a constructive sentiment on European and US equity markets. The euro was supported by a strong IFO business confidence, but the topside was capped as ECB’s Draghi reconfirmed the option of additional policy easing. Resurfacing tensions in Ukraine temporary spooked the equity markets, but the impact EUR/USD or USD/JPY remained limited. EUR/USD closed marginally higher at 1.3831 (from 1.3817). USD/JPY was a few ticks lower on a daily basis (102.32 from 102.54).

Overnight, Asian equities are again mostly in negative territory, but Japanese indices are marginally higher. The April Tokyo CPI jumped to 2.9% Y/Y after the sales tax hike. Even so, USD/JPY trades near yesterday’s close, as is EUR/USD. Today, the European market calendar is very thin. We keep an eye at the LTRO repayments, but of late, it was no big issue for trading. However, with excess liquidity dropping below €100 bln and with eonia under slight upward pressure, the figure might attract some more attention. A high loan repayment might be moderately euro supportive. In the US, the calendar is also quite light. The Final consumer confidence from the University of Michigan is the exception to the rule. An improvement from 82.6 to 83.0 is expected. We see an upside risk. However, it won’t be a game-changer for currency trading. Yesterday, the dollar hardly reacted to a significant positive surprise in the durable orders. The dollar obviously needs interest rate support to make further headway. With equities showing signs of running into resistance, the prospect for additional interest rate short term is meagre. Ukraine is a wildcard. Of late it was no big issue for EUR/USD. Uncertainty on the equity markets is at least as negative for the dollar as for the euro. So, we expect more of the same with the downside of the euro rather well protected.

Of late, we said it would be difficult for EUR/USD to rally sustainably beyond 1.40. This working hypothesis came under stress, but is still valid. The 1.3906/67 area is a tough resistance. Caution remains warranted, but a guarded sell-on-upticks strategy can be reconsidered. USD/JPY is off the recent low. For sustained further gains of the dollar (both against the euro and the yen), the US currency needs more interest rate support. In this respect, the recent core bond market movements weren’t dollar supportive. At the end of last week, there were cautious indications of US bond yields bottoming out. However, there is no follow-through price action on this move since.

Sterling blocked near the recent highs

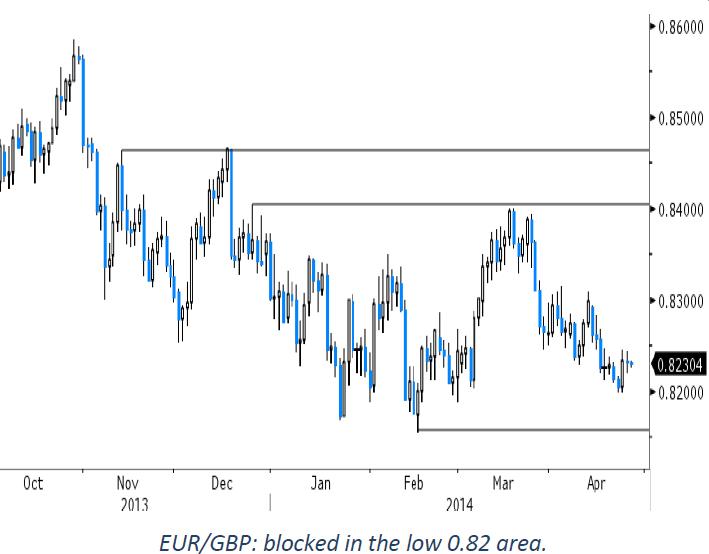

On Thursday, there were again no significant directional swings in the major sterling cross rates. EUR/GBP more or less copied the intraday price pattern of EUR/USD. The pair gained some ground after the strong German IFO, but returned those gains after ‘soft’ Draghi comments on monetary policy and on the euro. The CBI reported sales were stronger than expected, but the report hardly helped sterling. EUR/GBP closed the session little changed at 0.8232 area. Cable also held a tight sideways range close to, mostly just below 1.68. The 1.6823/42 area remains a tough resistance.

Today, the UK March ONS retail sales will be published. A slight decline (-0.4% M/M) is expected after a very strong February report (+1.7% M/M). Calendar effects due to the late timing of Eastern will play a role. We assume that markets will look through this temporary effect. In the respect, there is probably a big negative surprise needed to derail to UK currency. Sterling is holding strong near recent highs against the euro and the dollar. We expect more sideways trading as we don’t see a trigger for a break either way.

Of late, the technical picture in the major sterling cross rates was mixed. Cable recently rebounded off the 1.6460 low and the pair set a new minor cyclical top north of 1.6823. We maintain our view that a sustainable break of the 1.6823/42 area will be difficult.

EUR/GBP was under (moderate) pressure at the end of last week and drifted lower in the 0.82 big figure. While the sterling momentum is constructive, a sustained break below the 0.8200/0.8157 support will be difficult without high profile news from the UK or Europe. We keep a sell-on-upticks bias for EUR/GBP.

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

EUR/USD climbs to 10-day highs above 1.0700

EUR/USD gained traction and rose to its highest level in over a week above 1.0700 in the American session on Tuesday. The renewed US Dollar weakness following the disappointing PMI data helps the pair stretch higher.

GBP/USD extends recovery beyond 1.2400 on broad USD weakness

GBP/USD gathered bullish momentum and extended its daily rebound toward 1.2450 in the second half of the day. The US Dollar came under heavy selling pressure after weaker-than-forecast PMI data and fueled the pair's rally.

Gold rebounds to $2,320 as US yields turn south

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.