Outlook:

The consensus of economists is that the US faces a 20% probability of a recession, according to the FT survey of 51 economists cited yesterday. This is a low number. So why is the fixed income crowd in such a lather—and the FX crowd going along with it? We wonder if it’s not a bet on the cowardice of the Fed, which is judged to have only one hike left this year, if that. We could even be “one and done.”

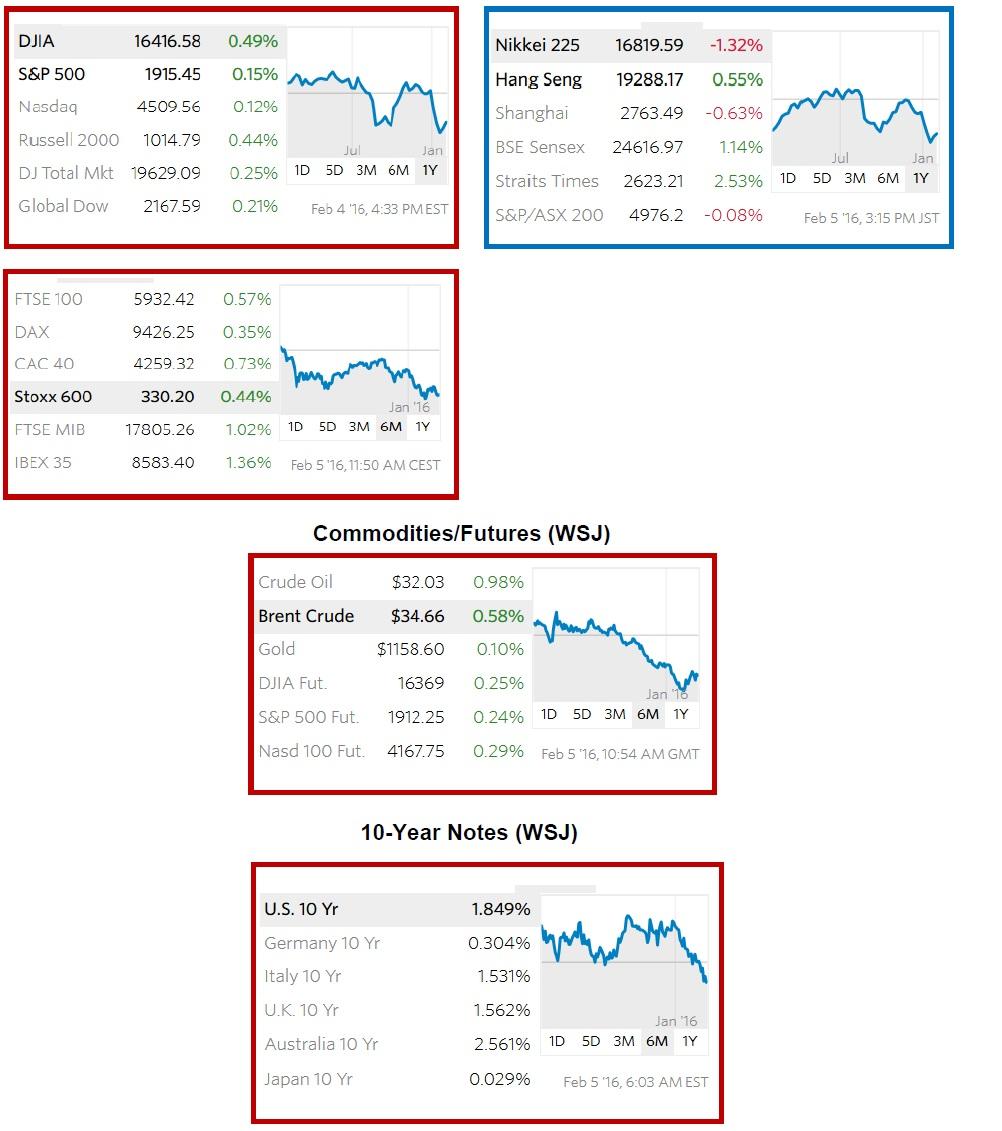

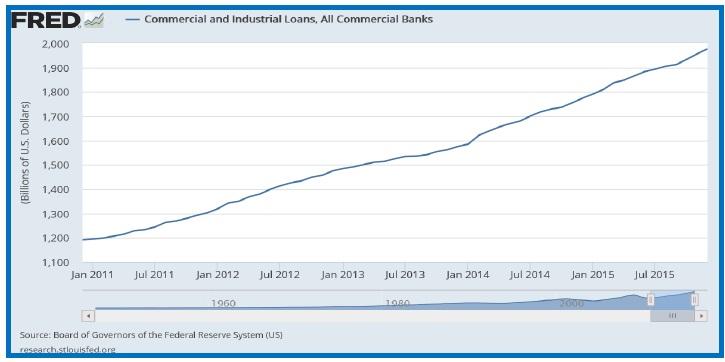

Dudley’s comments stirred a hornet’s nest. He sees condition already tightening, whatever that means. It can’t be a pullback in commercial bank lending. When in doubt, check FRED, the ST. Louis Fed database. While commercial and industrial lending slipped back to $12.5 trillion in Dec from $14.3 in Nov, Q4 was $10.9 from $8.1 In Q3. This data might be a bit backward looking since we are in Feb, but it’s the very latest—release data Jan 29.

No pullback here, but the Fed’s quarterly Senior Loan Officer Opinion Survey released on Monday did show that "Modest net fractions of banks stated they expect to tighten their lending standards on C&I loans"—with 20% of banks expecting to tighten standards for C&I loans.” For commercial prop-erty loans, around 90% of banks—depending on the type of loan—expected to tighten standards. And there slower bank lending tends to feed into employment, with a lag. The implication is slower job growth this year.

So we have 20% of economists seeing recession and 20% of banks expecting a tightening of lending conditions. This should not be enough to set off a gloom-fest and yields down to pre-hike levels—should it?

Analysts point to another factor—the widening of credit spreads in the market for high-quality corporate bonds. According to Reuters, “The yield on U.S. investment grade bonds has mushroomed relative to safer U.S. Treasuries to the widest since July 2012, according to Bank of America Merrill Lynch Fixed Income Index data. That indicates investors are demanding a richer premium to own these securities rel-ative to Treasuries and signals that corporate borrowing costs are on the rise.”

Also, as Market News reports yesterday, fixed income analysts are worried about too many knee-jerk reactions to prices in other markets that are not founded on fundamentals and thus misleading. We start-ed the year with China, then moved on to oil, and now we have US yields falling to pre-hike levels. Watching everybody else is not really a valid trading plan. This is especially relevant in terms of pricing the Fed out. Aside from that one lending survey, and don’t forget it names a “modest net fraction” ex-pecting to tighten lending conditions, we do not actually have signs of recession.We will look at payrolls for signs, anyway. We can’t help it. The current estimate is 180,000-190,000, after an average of 284,000 in Q4 and 174,000 in Q3. The topmost comparison is to Dec’s 292,000, probably an aberration and subject to revision. Quick, what does 190,000 mean? The unemployment rate may tick down to 4.9% but will more likely remain at 5%, but again, earnings are likely a measly 0.3% and the year-over-year slipping back from 2.5% to 2.2%, according to the FT. We also get revisions to past data. But don’t forget that some consumer-related data, like auto sales, show the consumer in fine fettle, if saving a bit more than before.

Honestly, we cannot and should not draw grand conclusions about the state of the US economy from this one data set. But Dudley got our mindset geared to the dark side. Dudley blew it. By speaking of a “tightening” that is very small in the first place and sending all of us searching madly for what he was talking about, he set off a totally unwarranted panic.

Looking ahead, the Chinese markets will be closed next week for the Lunar New Year holiday (year of the monkey). Hong Kong will continue to trade the offshore yuan, but unless China reports giant drop in reserves (due out over the weekend), it’s likely nothing much happens. Some folks want a big one-time devaluation, but this is wishful thinking. Last week the Deutsche Bank FX strategist Ruskin flew a flag for a joint US-China intervention (like the Plaza Accord) to hold down the dollar. It got attention in the Washington Post and Bloomberg, but never gained traction. That’s because Ruskin is a smart guy but the idea is stupid. The Plaza Accord was a disaster and so was the Louvre Accord that followed it. Be-sides, we now have an entirely different world—instant global communications, better data, financial institutions not as fearful of central bank herding, and so on.

While we await some news from China, we need to examine the recession thesis that has so gripped the fixed income crowd. The falling yields indicate this is the outlook. While we may see negative yields in the US as unthinkable, the FT reports today that in Germany, “the average yield on all government debt is now negative, while Japan is on course to become the first major bond market with a 10 year bond that yields nothing. In Europe and Japan, government bonds worth nearly $6tn now trade at such highs that buyers will make a loss if they hold the paper to maturity. Across the Atlantic, talk of recession risk has grown louder in recent weeks among investors, with the 10-year Treasury yield, touching a nine-month low of 1.80 per cent this week.”

Everything depends on two factors: confidence in central banks and inflation expectations. These two are, obviously, joined at the hip. Today inflation expectations are a function of falling commodity prices, especially oil, so perhaps we should say that inflation expectations will return when oil can be said to have bottomed for sure. We are almost certainly not at that point yet. Maybe later this year.

The one good thing about the dollar’s downward correction is in emerging markets with dollar-denominated debt—unless they are oil producers or are mismanaging their economies. We already have three countries begging for an IMF handout on weak oil prices, plus Venezuela about to go under (again) and Brazil busy shooting itself in the foot. But we continue to think emerging market over-indebtedness and mismanagement should not be the primary factor in anything. Surely negative Europe-an and Japanese yields, plus genuine EM debt unsustainability, drives capital to the US. This drops yield some more but not because of an imaginary US recession.

We expect the market to interpret today’s payrolls as some 100,000 jobs less than Dec and therefore “bad,” even though that is not the right way to look at it. The markets will respond to payrolls as they always do—with a spike up in the dollar on a high number and a spike lower once the nuances are ab-sorbed. Payrolls disturbs a trend in place, but hardly ever reverses it. That means the only question is where to buy euros, which is why we have charts. We like 1.1160, the last intermediate low, or 1.1110 or so, just above the linear regression. But let’s admit it, guessing about levels on payrolls day is a fool’s game.

| Current | Signal | Signal | Signal | |||

| Currency | Spot | Position | Strength | Date | Rate | Gain/Loss |

| USD/JPY | 116.84 | SHORT USD | NEW*STRONG | 02/04/16 | 117.57 | 0.62% |

| GBP/USD | 1.4522 | LONG GBP | WEAK | 02/02/16 | 1.4386 | 0.95% |

| EUR/USD | 1.1187 | LONG EURO | NEW*WEAK | 02/04/16 | 1.1182 | 0.04% |

| EUR/JPY | 130.71 | LONG EURO | STRONG | 02/01/16 | 131.83 | -0.85% |

| EUR/GBP | 0.7703 | LONG EURO | WEAK | 10/23/15 | 0.7194 | 7.08% |

| USD/CHF | 0.9914 | LONG USD | WEAK | 01/04/16 | 0.9979 | -0.65% |

| USD/CAD | 1.3731 | SHORT USD | STRONG | 02/01/16 | 1.4031 | 2.14% |

| NZD/USD | 0.6716 | LONG NZD | WEAK | 02/02/16 | 0.6486 | 3.55% |

| AUD/USD | 0.7186 | LONG AUD | STRONG | 01/25/16 | 0.6980 | 2.95% |

| AUD/JPY | 83.96 | LONG AUD | STRONG | 01/25/16 | 82.66 | 1.57% |

| USD/MXN | 18.2379 | LONG USD | WEAK | 12/07/15 | 16.7258 | 9.04% |

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

AUD/USD pressured as Fed officials hold firm on rate policy

The Australian Dollar is on the defensive against the US Dollar, as Friday’s Asian session commences. On Thursday, the antipodean clocked losses of 0.21% against its counterpart, driven by Fed officials emphasizing they’re in no rush to ease policy. The AUD/USD trades around 0.6419.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu, WIF token’s show of strength was not just influenced by Bitcoin price reclaiming above $63,000.

Billowing clouds of apprehension

Thursday marked the fifth consecutive session of decline for US stocks as optimism regarding multiple interest rate cuts by the Federal Reserve waned. The downturn in sentiment can be attributed to robust economic data releases, prompting traders to adjust their expectations for multiple rate cuts this year.