Outlook:

The payrolls disappointment, only 142,000 new jobs when as many as 225,000 was forecast (high end of the Market News forecast range) may or may not mean the Fed is on hold forever. Some think it means QE4. The revisions to the previous two months at 59,000 is okay or at least acceptable, and what is most worrisome is the average earnings flat (after a gain of 0.4% in Aug) and the participation down 0.2 to 62.4%. In other words, a veritable flood of bad news with no succor anywhere in the report. If you think the official unemployment rate remaining at 5.1% is okay, then you are not reading the horror stories about U6.

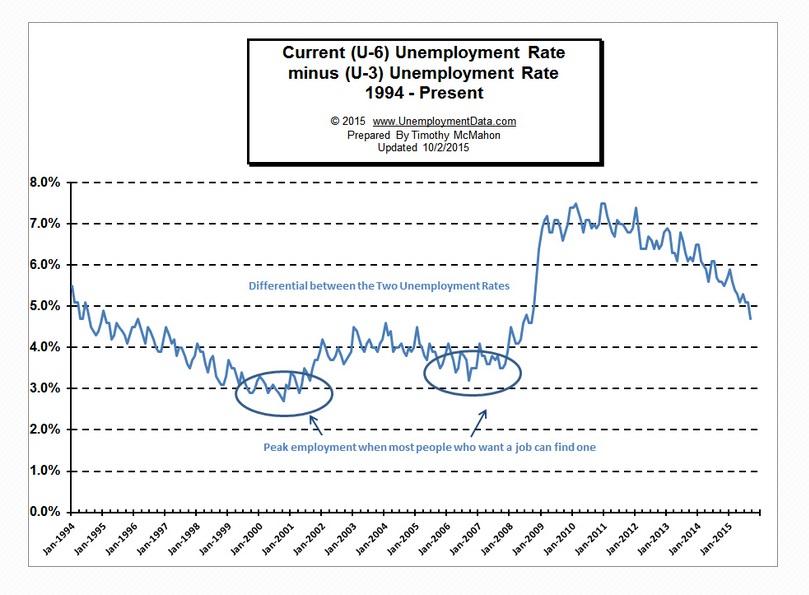

U6 measures those workers who are “discouraged” from job-seeking. In Sept, the U6 fell to 9.6% from 10.3% in August, better than the 200year average at 10.7%. This sounds nice until you see the Gallup estimate of the same number—14.1% as of September 2015, down from 14.2% in Aug. That kind of discrepancy makes you wonder which one has a statistical bias in its data collection methodology. Then there’s U3, the unadjusted official unemployment rate, at 4.9% in Sept. See the chart, from http://unemploymentdata.com/current-u6-unemployment-rate/. Subtracting one from the other is a measure of “jobs hard to get.” This is a wonky but useful picture of the economy—it’s still struggling to provide good-enough jobs. You don’t get a sustainable rise in consumption without good-enough jobs.

Former Fed chief Bernanke has an op-ed in the WSJ on Sunday (“How the Fed Saved the US Economy” saying the employment situation has a way to go to be satisfactory, but at least it’s better than at the height of the crisis. This is true but not useful. Bernanke goes on to criticize Europe for ridiculing QE back in the day (Schaeuble called it “clueless”) but then having to adopt that policy itself. “Today the U.S. jobless rate is close to 5%, while the European rate has risen to 10.9%.” And the UK is okay be-cause it, too, used QE. Bernanke says monetary policy is reaching the end of its tether and it’s time for lawmakers to step up on the fiscal side.

Well, that has been true for years. You have to wonder who, exactly, does Bernanke think is his audi-ence for this article. The only Republican who agrees with him on fiscal policy for getting more sustain-able long-term growth is Trump. Now that’s a scary thought.

Why keep a focus on payrolls when the tedious Event is over for another month? Because jittery stock and commodity markets are not going to give it up. We got a good ending in equities on Friday, but this may well be knee-jerk buying at deceptively good-seeming levels. Several analysts see a rally as only temporary, including Lynne at Wall Street in Advance. “Friday’s reversal up wasn’t a rally of duration that ends the late summer sell-off. A rally could last here for a few days or even a week, but given the predicted weakness in Q3 Earnings anticipated, [you should] seriously consider holding off until after October’s monthly options have expired. It’s interesting that markets will get a new indicator to watch, in the CBOE’s launch of Weekly VIX Options…. In sum, I wouldn’t fully trust a continuation of Friday’s rally, and wouldn’t be in rush to plunge into stocks. There’s a lot of earnings season to sur-vive first.”

In other words, bad news for the economy is not good news for equities, as the WSJ puts it. If the Fed does delay hiking on another bad jobs report, as Boston Fed Pres Rosengren said, bad news is just bad news. The Fed rate hike has very little real effect. Far bigger is the symbol of the hike—normalization. We say that if the Fed does not hike in Oct or Dec, the stock market will hit the ropes. Only some of it will be due to an economy perceived as faltering. The rest of it will be seen as the Fed having the colly-wobbles. First it delayed because of global market instability and now because of one month of bad jobs data. Both stories show the Fed to be silly, but if the Fed is fearful, we should all be fearful.

While not saying so out loud, what the Fed fears is not actually job-creation, but persistence of ultra-low inflation, especially as wages are not keeping up with job creation. Let’s not go overboard on compari-sons, but Japan just reported that despite a tight labor market, wages are not keeping up. Cash earnings rose a mere 0.5% y/y after 0.9% in July, and bonuses were slashed. There is something inherently differ-ent about the return to labor in deflationary circumstances than in inflationary ones.

The FT notes that Morgan Stanley, among others, is freaking out over deflation in Asia, “The producer price index is at its lowest average point for six years in the 10 largest economies in Asia (excluding Ja-pan), according to Morgan Stanley. Only Indonesia among the 10 is experiencing any producer price inflation, while South Korea, Taiwan and Singapore have been in a deflationary funk for around three years. China has notched up 42 straight months of falling producer prices, making it the only large econ-omy other than Japan in the 1990s to show such a persistent deflationary trend…

“Overall, China’s producer prices are down a cumulative 10.8 per cent from their recent peak in 2011. The speed at which prices are dropping is a cause for alarm. As recently as August last year, the produc-er price index for commodities was showing only a 1.1 per cent drop; this August the decline was 12.8 per cent. Even a country such as India, with an otherwise robust economy, has slipped into producer price deflation over the past year.”

Now this is something that can obviously be contagious. Just ask Caterpillar.

We used to deny that Japan could export deflation, a theme from earlier years. After all, we have differ-ent demographics. But actually, European demographics are not that far off Japanese—fewer young peo-ple working to support those retiring and the birth rate at below replacement levels. Italy has 8.4 births per 1000 persons, the lowest since 1860. Europe as a whole has 9.9 births per 1000, with some counties (Denmark) devising remuneration schemes to boost the birth rate (but zero refugees, please). Russia had lost 4% of its population since the 1991 breakup when Putin announced really very big rewards for hav-ing babies at a cost of some $60 billion.

So, Japan and the West are contracting but labor shortages are not producing wage gains. The rest of the world, Latin America, Asia and Africa, are growing in population but with less money to go around as commodity prices stay on or near the floor and global demand for low-end manufactured goods keeps falling. As noted before, in the US the baby boomers are downsizing and have lost the urge to accumulate Stuff, while the millennials are somewhat footloose and fancy-free, as shown by a preference for renting over home-ownership. Just about every country is counting on the consumer to hold up its economy, from Germany to China as well as the US, the most advanced consumer economy, but it’s not working. The only things that are more expensive in the US these days are pharmaceuticals and cars—clothes are unbelievably cheap.

We say upcoming data is not going to wave a wand over market sentiment and turn it from gloomy exis-tential angst to sunshine and singing birds. We get a lot of data this week, starting with the PMI for ser-vices, ISM for services, and the labor market conditions index (2.1 last time and forecast at 2.0 or much lower this time).

We have yet to hear from some central banks (Australia), but with the world generally going for more easing, it’s hard to see the Fed getting brave. We need clear communication from Yellen and PDQ un-less we want to see “exported deflation” become the new theme. What was once a fringe, near-crackpot idea is going mainstream. There is no way the dollar can thrive in this environment. We thought China could drive fear? Wait ‘til we see the US drive it.

| Current | Signal | Signal | Signal | |||

| Currency | Spot | Position | Strength | Date | Rate | Gain/Loss |

| USD/JPY | 120.26 | LONG USD | WEAK | 09/28/15 | 120.16 | 0.08% |

| GBP/USD | 1.5208 | SHORT GBP | STRONG | 09/22/15 | 1.531 | 0.67% |

| EUR/USD | 1.1278 | LONG EUR | WEAK | 09/29/15 | 1.1226 | 0.46% |

| EUR/JPY | 135.64 | SHORT EURO | WEAK | 09/22/15 | 133.8 | -1.38% |

| EUR/GBP | 0.7415 | LONG EURO | STRONG | 08/13/15 | 0.7117 | 4.19% |

| USD/CHF | 0.9697 | LONG USD | STRONG | 09/28/15 | 0.9792 | -0.97% |

| USD/CAD | 1.3066 | LONG USD | WEAK | 06/30/15 | 1.2389 | 5.46% |

| NZD/USD | 0.6523 | LONG NZD | NEW*WEAK | 10/05/15 | 0.6523 | 0.00% |

| AUD/USD | 0.7101 | SHORT AUD | WEAK | 09/24/15 | 0.6946 | -2.23% |

| AUD/JPY | 85.40 | SHORT AUD | WEAK | 06/29/15 | 94.04 | 9.19% |

| USD/MXN | 16.5910 | LONG USD | WEAK | 05/27/15 | 15.2944 | 8.48% |

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

AUD/USD could extend the recovery to 0.6500 and above

The enhanced risk appetite and the weakening of the Greenback enabled AUD/USD to build on the promising start to the week and trade closer to the key barrier at 0.6500 the figure ahead of key inflation figures in Australia.

EUR/USD now refocuses on the 200-day SMA

EUR/USD extended its positive momentum and rose above the 1.0700 yardstick, driven by the intense PMI-led retracement in the US Dollar as well as a prevailing risk-friendly environment in the FX universe.

Gold struggles around $2,325 despite broad US Dollar’s weakness

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Bitcoin price makes run for previous cycle highs as Morgan Stanley pushes BTC ETF exposure

Bitcoin (BTC) price strength continues to grow, three days after the fourth halving. Optimism continues to abound in the market as Bitcoiners envision a reclamation of previous cycle highs.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Federal Reserve might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.