Outlook:

Everything Draghi said yesterday was perfectly reasonable and mostly expected. The part that was a surprise was increasing the proportion of any single issue the ECB is allowed to buy from 25% to 33%, which suggests the ECB is the girding its loins for a long, hard trek. Also, there was maybe a bit more emphasis on the drag being felt and being feared from emerging markets, including China. So, we expected dovish but got dovish squared.

With so many expecting a decent payrolls today that will keep alive the expectation of a Sept rate hike, policy divergence is back in vogue. But everyone knows that Aug has a seasonal effect the statisticians have not been able to winnow out—it is often a low number that later gets revised up. Last year the revision was from 142,000 to 203,000. Chandler reports “In 17 of the past 20 years, the initial estimate for August has been revised higher.” The WSJ says “don’t panic” if the number is low, but that’s silly. Of course we will panic if the number is low. We are impressed by commentary from several analysts predicting 170,000 rather than the expected 220,000.

The FT notes that some data supports the idea that Sept is off the table, even before payrolls. “Futures markets just a month ago were pricing in a 54 per cent probability of a September Fed rate hike, according to Bloomberg calculations. That fell to 24 per cent a little over a week ago when financial market turmoil — amid worries about China’s economy — caused traders to reckon the US central bank would be more reticent about tightening policy. It is now 26 per cent. A December rate rise, with a probability of 55.1 per cent, is currently seen as more likely.”

The more important comparison is the ECB vs. the Fed when it comes to global distress. The Fed has long taken the view, buttressed last May by a Fischer speech, that the US’ responsibility is first and foremost to keep its own house in order and the US responsibility to the rest of the world is limited. Now that Draghi has placed emphasis on global conditions influencing ECB policy, can the Fed persist in downplaying external conditions? It makes the Fed look heartless, or out of touch, or at least out of step with the other big reserve currency central bank. If Draghi is so worried, can the Fed afford to be cavalier?

To be fair to the Fed, China is not as important to the US as it is to Europe. Exports to China are a mere $165 billion, under 1% of GDP. Goldman estimates 2% of S&P revenues come from China. A 1% drop in Chinese GDP translates into a 0.06% drop in US GDP. We do not have the comparables for Europe but we do know German exports to China are about 15% of total exports. Bottom line, if China indicates at G-20 this weekend that growth will be some horribly lower number than the 7% official forecast today, the economic effect will be felt more in Europe than in the US.

But so what? The thread linking all the countries is stock markets. The Shanghai re-opens next Monday when the US is closed, so next Tuesday could be a day of horror. Even in the absence of the Shanghai today, European bourses are down over 2% so far today on the fear factor. Normally a dovish central bank is good for equities, but not when the central bank governor names China dread.

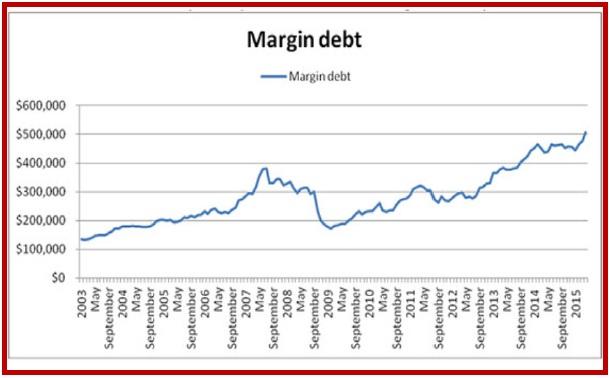

So now we have to wonder whether we are in for a repeat of earlier global stock market crises. Some analyst say no, because in 1997-98 and 2007-09, underlying the crashes were vast piles of unpayable debt. This time, however, China is a creditor country. The over-indebtedness of state companies and local governments is a domestic issue, not an international one. China has over $4 trillion in reserves, anyway. We are not sure this argument holds. If we need over-indebtedness to support the thesis is a global equity market crash, we don’t have far to look. There’s the US margin investor, and there’s the US government, too. See the margin chart below (from Market Watch).

As for US debt, it will be $18.628 trillion by year-end, probably 100% of GDP. We tend to focus on the rates of change in debt and GDP rather than the outright numbers, but the conventional wisdom has it that sovereign debt over 80% of GDP is a warning cry. You don’t have to be a sky-is-falling extremist to feel at least a little alarmed.

From a German brokerage we get a confirming view. “A reasonable proxy for understanding the damage done to markets is that less than 20% of the Dow Jones Industrial Average’s components are trading above their 200-day moving average and less than 30% for the Euro Stoxx 50. The big question for developed markets is whether this is likely to be a 1998 or 2011 type of correction or something more akin to 2000 or 2007. We are firmly in the 1998 and 2011 camp as, like the late 1990s, this is heavily skewed to emerging markets. However, while these markets are more important, the question is less about broad emerging market credit and more about falling commodity prices and related credit, as Glencore’s shift toward junk status evidences. As we have highlighted before, we view the fall in commodities as a long-term positive for domestic Europe and here it is worth noting that the strongest European markets are currently those with a significant domestic skew: Italy’s main index has some 58% of stocks still above their 200-day moving average and France 38%, whereas it is just 10% for the German DAX.”

The trajectory of a crisis is spelled out in advance—on-going declines in global commodity prices, distress among oil and mining companies that contaminates other companies, sovereign debt distress in emerging markets, contagion to seemingly unrelated equity markets. The biggest fear is that China stops being a key buyer of US sovereign paper and even starts selling some. Suddenly smaller companies with a purely domestic input and output feed look good (Italy), and so does Germany’s otherwise impractical adherence to balanced budgets. We rail against austerity as unnecessarily harsh, as in Greece, but it sure does come in handy in a global crisis.

This is not to say we are going to get a global crisis. It is to say that after a long bull run, traders and analysts are both more than usually prone to the fear factor. It turns out that TreasSec Lew is right when he says China needs to communicate better with the rest of the world.

In the end, we say Mr. Draghi took the September Fed rate hike off the table. If the Fed were looking only at domestic conditions, a Sept hike is not unrealistic—get it over with, start normalization, full employment means inflation someday, etc. But when Draghi is this worried, the Fed cannot be seen as indifferent. The problem is communications. The Fed can’t come right out and say it will delay at the Sept meeting. The Fed never, ever signals in advance so clearly. It wants to avoid surprises, but not give smart insiders any real insight.

At a guess, the 170,000 crowd is right and markets will respond appropriately—equities will stabilize or go up on the expectations of Fed delay and the dollar will lose ground, maybe a lot of ground. As always on payrolls day and never more than when it’s a holiday weekend, we see spikes ahead that even deep pockets have trouble handling. We advise everyone to get out and stay out.

Note to Readers: Next Monday, Sept 7, is a national holiday in the US. We will not ublish any reports.

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.