Outlook:

If we had a title for the Morning Briefing, today it would have to be “Here We Go Again.” China’s sub-par performance scares the pants off the equity gang and they panic-sell willynilly. Bond yields fall as demand for fixed income ramps up, although in this new China-dominated world, there is no safe-haven. Commodity prices fall on the expected decline in demand, whatever OPEC says.

The real news is China’s abandonment of free market mechanisms for a return to the command economy. This is a signal to the world that China’s foray into free markets is a failure and had to be retracted. The FT reports that “Four Chinese regulatory agencies have issued a joint statement “encouraging” listed companies to hand out more dividends, buy back their own shares and carry out more mergers and corporate restructurings to boost slumping share prices. The statement from the finance ministry and the regulators in charge of securities, banking and state-owned assets was issued after Beijing’s decision to end its large-scale but unsuccessful programme of direct stock purchases.”

In addition, the government is managing the yuan again, too. The PBOC set the reference rate for the yuan up 0.2% at ¥6.3752, the biggest one-day gain since November 10, according to the FT. So much for on-going devaluation. Also, one report has it that traders in the forwards will now have to deposit a 20% margin (instead of operating on credit lines alone). This is a good way to tamp down speculation, if only because it’s a form of taking names.

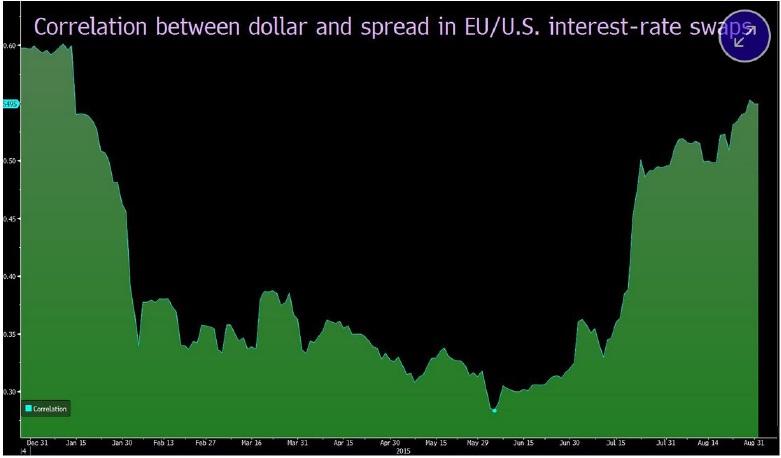

Bloomberg has a story titled “There's Only One Chart That Really Matters for Currency Traders” (see below). The thesis is that the correlation between the euro/dollar and 2-year swap rate is very strong this year. Specifically, “The 120-day correlation between euro-dollar and the gap between two-year swap rates reached the most since January.” And now with the Fed presumably not tightening in Sept, the spread can narrow some more. “Interest-rate differences were signaling a stronger dollar until about three weeks ago when China unexpectedly devalued the yuan, sending shock waves around the world and raising speculation the rout may delay Federal Reserve plans to raise interest rates. The gap between U.S. and euro-area two-year swap rates narrowed three basis points to 76 as of 10:37 a.m. London time, helping boost the euro by 0.6 percent to $1.1280.”

Oh, dear. At any one time, you can find a correlation between some set of interest rates and the euro/dollar. For many years the correlation was very strong in the relative 10-years and we thought we had a real winner… until the late 1980’s. We wrote about this is in The FX Matrix.

Of course there is a correlation. Interest rates are the price of money and FX is money. But which interest rates? In times of turmoil, the 2-year tends to be the dominant version. Note that Bloomberg has the 120-day correlation of the 2-year swap rate. What happened to the 60-day or 90-day or the plain old outright? At any one time, you can find some interest rate correlation that matches up well with FX rates.

That doesn’t mean it is causative and certainly not that it’s some universal truth. Besides, when you present a chart, it should be readable and pleasing to the eye. That is hardly the case with this hideous thing.

This is not to say the Bloomberg story is wrong. But it is misguided. Relative interest rates are the most powerful of the multiple factors that determine FX rates, but interest rates themselves are influenced by many of the same factors as FX. Key is that the 2-year takes the top spot under stress conditions because of something named liquidity preference. The Chinese devaluation, while having very little true economic effect, raised the liquidity preference—investors want to be able to get out fast. The Fed possibly staying its hand because of global turmoil also promotes liquidity preference. The prospect of the ECB possibly extending or increasing QE moves liquidity preference the other way, toward the longer end (get it while it’s still hot).

This is the sense in which the Chinese devaluation harmed the dollar. But like all panic situations, it’s short-lived. Traders literally cannot maintain a high level of anxiety for too long. At some point, the correlation touted by Bloomberg will weaken and some other tenor will hold the floor. In the long run, the 10-year is the Main Event. Which part of the two yield curves to watch depends on many, many factors and no single correlation is the Golden Rule.

The FT brings this to light in a troubling way. A September rate hike would move the 2-year yield “decisively” above the 0.75% level that has capped gains for several months. But for the longer tenor, the Wednesday oil inventory report is more important. WTI oil surged 27.5 per cent in just three recent sessions as evidence of slowing US shale production and talk that Opec might reconsider its supply policy caused energy bears to buy back short positions.

“Lower energy costs have been adding to global disinflation pressures, helping suppress long-term price rise forecasts. The US 5-year break-even rate, a gauge of inflation expectations, has been tracking the oil market pretty tightly of late. And it is clear from watching recent trading that such a correlation is being reflected in the intraday moves for 10- to 30-year US government paper. If the Fed were to raise rates soon and oil to fall back again, then it is possible that longer-term bond yields could actually decline in response to the central bank’s move as the market prices in a longer lasting disinflationary environment.”

So there. Watch the 2-year swap. No, watch the 2-year outright. No, watch the 5-year breakeven. No, the 10 and even 30-year tells you the ruling sentiment. Today we get some US data that will likely be ignored while everyone watches the stock market. We get auto sales, among other things. We also get Ca-nadian GDP, expected to be soft. But never mind—a big fat equity crash, as seems likely, will suck all the oxygen out of the markets. Just about the only sure thing today is the on-going rise in the yen.

Note to Readers: Next Monday, Sept 7, is a national holiday in the US. We will not publish any reports.

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

AUD/USD tumbles toward 0.6350 as Middle East war fears mount

AUD/USD has come under intense selling pressure and slides toward 0.6350, as risk-aversion intensifies following the news that Israel retaliated with missile strikes on a site in Iran. Fears of the Israel-Iran strife translating into a wider regional conflict are weighing on the higher-yielding Aussie Dollar.

USD/JPY breaches 154.00 as sell-off intensifies on Israel-Iran escalation

USD/JPY is trading below 154.00 after falling hard on confirmation of reports of an Israeli missile strike on Iran, implying that an open conflict is underway and could only spread into a wider Middle East war. Safe-haven Japanese Yen jumped, helped by BoJ Governor Ueda's comments.

Gold price jumps above $2,400 as MidEast escalation sparks flight to safety

Gold price has caught a fresh bid wave, jumping beyond $2,400 after Israel's retaliatory strikes on Iran sparked a global flight to safety mode and rushed flows into the ultimate safe-haven Gold. Risk assets are taking a big hit, as risk-aversion creeps into Asian trading on Friday.

WTI surges to $85.00 amid Israel-Iran tensions

Western Texas Intermediate, the US crude oil benchmark, is trading around $85.00 on Friday. The black gold gains traction on the day amid the escalating tension between Israel and Iran after a US official confirmed that Israeli missiles had hit a site in Iran.

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu, WIF token’s show of strength was not just influenced by Bitcoin price reclaiming above $63,000.