Outlook:

We might get some dollar-favorable data this week from housing. We get the FHFA housing price index, Case-Shiller, and new and existing home sales. On Friday we get the Fed’s preferred inflation gauge, personal consumption expenditures. And starting Friday is the Kansas City symposium in Jackson Hole. Yellen is not attending but Vice Chairman Fischer will speak on the topic of “inflation developments.”

Oh, goodie. The main reason the Fed is hesitating, or presumed to be hesitating, is that while the employment part of the dual mandate is being met, mostly, the inflation part is simply missing. As we wrote last week, if the Fed hikes in Sept, it is not following its own rules, raising a credibility issue. If it does hike at either meeting, it will have to tap-dance very skillfully indeed around the idea that somehow inflation is going to materialize.

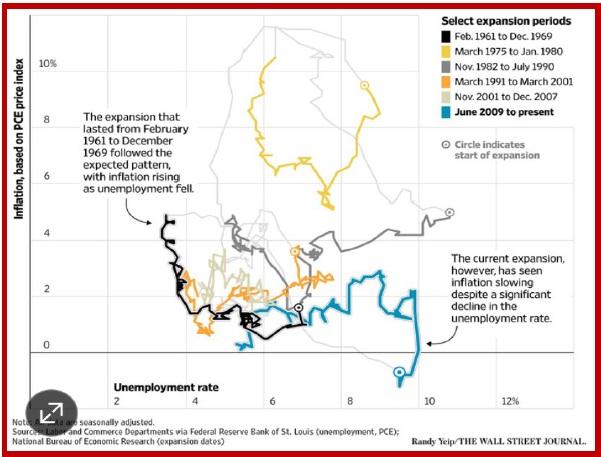

The idea comes from the much maligned Philips curve, which postulates that a rise in employment automatically raises inflation via the income effect, if with a lag. Ever since the paper came out in 1958, mean-spirited economists have tried to shoot it down, especially in the 1970’s in the US, when we had both high inflation and high unemployment, and Saint Milton Friedman said the connection was temporary and short-lived. Philips had data from on the UK economy from 1861 to 1957 to backstop the theory, but other data from other periods and countries fails to deliver the curve. The WSJ reports David Stockman, he of the supply-side budget disclosure scandals, saying “Everyone knows it’s a bad model. The problem is, no one has put a better one on the table that outperforms it.”

Yellen and Atlanta Fed Pres Lockhart are among the top Feds who are sticking with the Philips curve.

So, will Mr. Fischer try to revive the Philips Curve at Jackson Hole? The WSJ provides a chart of the Philips curve for the US. Hilarious and dangerous at the same time. Fischer is widely respected and had better come up with some fancy footwork to overcome this chart.

The other issue for Fischer is whether and how much the Fed is influenced by the equity and fixed income bloodbath, the falling dollar and crisis in emerging markets. Fischer is the Fed’s international guy and also charged with a committee on instability. He gave a speech in May in Tel Aviv titled “The Federal Reserve and the Global Economy.” We had to read it twice because Fischer speaks with forked tongue. Bottom line, yes, the US is responsible for spillover effects but responsibility is very limited and should not interfere with the US keeping its house in order.

Fischer points out that total foreign investment in the US is over $30 trillion. “In a progressively integrating world economy and financial system, a central bank cannot ignore developments beyond its country's borders, and the Fed is no exception. This is true even though the Fed's statutory objectives are defined as specific goals for the U.S. economy… The state of the U.S. economy is significantly affected by the state of the world economy. A wide range of foreign shocks affect U.S. domestic spending, production, prices, and financial conditions… international effects in turn spill back on the evolution of the U.S. economy, we cannot make sensible monetary policy choices without taking them into account.”

So far, so good. Then we get Hume, Fleming and Mundell. It’s enough to make a strong man cry. Seventeen footnotes later, we get to the part about global interconnectedness that we care about today—normalization. “… the normalization of our policy should prove manageable for the EMEs. We have done everything we can, within the limits of forecast uncertainty, to prepare market participants for what lies ahead. … markets should not be greatly surprised by either the timing or the pace of normalization.” The more vulnerable economies (those with fixed exchange rates) might find the road to normalization a tough one, which is their problem and why the IMF was brought into existence.

The US is not just any economy and the Fed is not just a run-of-the-mill central bank—the US has a global responsibility—but our first responsibility to keep our own house in order. The Fed is mindful it should “minimize adverse spillovers.” But there is a limit to the Fed’s global responsibility. It will not act as the world’s central bank.

We can’t wait to hear what Fischer has to say about inflation, but whatever it is, it will be the best and most cogent statement we will get for many a moon. That doesn’t mean we will understand it. Numerous analysts are salivating over it. But given global conditions, the Fischer speech may end up on the dump heap of history. Larry Summers has a piece in the FT today saying a Fed hike this year would be a dangerous mistake. We may think the US economy has normalized, but “more plausible is the view that, for reasons rooted in technological and demographic change and reinforced by greater regulation of the financial sector, the global economy has difficulty generating demand for all that can be produced. This is the ‘secular stagnation’ diagnosis, or the very similar idea that Ben Bernanke, former Fed chairman, has urged of a ‘savings glut’. Satisfactory growth, if it can be achieved, requires very low interest rates that historically we have only seen during economic crises. This is why long term bond markets are telling us that real interest rates are expected to be close to zero in the industrialised world over the next decade. “New conditions require new policies. There is much that should be done, such as steps to promote public and private investment so as to raise the level of real interest rates consistent with full employment.

Unless these new policies are implemented, inflation sharply accelerates, or euphoria in markets breaks out, there is no case for the Fed to adjust policy interest rates.”

Summers was a TreasSec and the top contender for Yellen’s job before a big movement began to nominate Yellen instead. He is a deeply annoying presence—as shown by this very article—but not to be brushed off. We say a Fed rate hike is almost certainly off the table.

We can draw two deductions. First, central bankers are almost certainly scared and striving to fend off panic in their own ranks. To a large degree, uncertainty over the Fed’s timing of the First Rate Hike gets some of the blame. The Yellen Fed was just wrong to focus on data rather than dates. The market obviously didn’t like the high level of ambiguity and lack of transparency even as the Fed was pretending to work hard at clear communication. Clear, my foot. It was not clear at all. It’s still not clear. We always have to guess but in recent years the guessing has been too big a burden. Now the Fed and other central banks should try to get out in front of this crisis and start talking about swap lines or at least some serious jawboning.

Nomura was among the first to grasp that the meltdown means an adjustment to FX forecasts. According to Market News, “Nomura has a new Q3 euro forecast of $1.13, versus prior at $1.05, and a new Q4 forecast of $1.10, versus $1.05 prior, and the strategists keep their Q4 2016 forecast of $1.0500 however. ‘We are now formalizing a new central case that the Fed delays in September, and that the market will start to question lift-off in December, allowing US rates to rally somewhat further than the levels observed currently.’ If the Fed is able to begin normalizing policy in Dec, the euro ‘should be able to trade lower again, towards $1.10.’ However, if there is a further delay until 2016, ‘a move to $1.15 and a test of the ECB QE announcement level around $1.16 is very possible,’ Nomura said.”

We think that the big picture is right but Nomura is underestimating the extent of the coming overshoot.

Out advice to hedgers and traders—get out of the way. We would not be surprised to see 1.2643, the 62% retracement of the drop from the high (1.3993 on May 5) to the low (1.0459 from March 16).

Footnote: It’s wrong to blame China for Friday’s turmoil. The tiny yuan devaluation—under 3% net—is less than we see in currencies that actually float. The yen, for example, fell 21% from a year ago (104) to June (125.86). Nobody was yelling about currency wars then. In fact, the whole currency war argument is nonsense from front to back. Remember that it was the Brazilian finance minister who brought the phrase back into prominence a few years ago at a G20 meeting in Seoul. He said the US was harming emerging markets by running its monetary policy for the benefit of US and ultra-low rates in the US were driving capital to EM’s and inflating their currencies. Imagine, complaining about capital inflow.

It’s perfectly true that China faces a serious problem trying to marry a more free market currency system to a rigid, centrally controlled banking system where interest rates are set by the government. It’s like marrying a squid to a giraffe. But it’s not fair to blame China for devaluations in other emerging market countries like Vietnam. At least Vietnam is marrying a donkey to a horse, which is how you get a mule.

Similarly, vast capital outflows from emerging markets can’t be laid at China’s door. These countries borrowed too much in dollars without having the trade to get the dollars for repayment, like Hungarians homebuyers taking mortgages denominated in Swiss francs without having a Swiss franc revenue stream. EM’s also probably lied about their economic data and used silly assumptions about company growth trajectories, for all we know.

It should be obvious that EM investments were riskier than the EM issuers wanted them to appear and investment managers were greedier for return than they told their bosses or investors. It’s the grand cycle of lie-and-get-caught that has prevailed in finance for centuries. Just wait—disclosure of scams and frauds comes next. Kindleberger taught us that you get bubbles and manias when you have excessive money supply growth and you get busts and panics when someone shouts “the emperor is not wearing any clothes.” The point is that the value of the local currency against the dollar is a tail, not the dog. The dog is the entirety of the local economy.

Globally, the US is traditionally the top dog. We sneeze, the rest of the catches cold. Look at Ireland and Spain. After the US financial system was disclosed to be very, very ill in 2008-09, Europe was okay until suddenly it emerged that banks in those countries had been engaging in their own shenanigans. At one point, a single Dublin bank had lent more than triple the entire Irish GDP in mortgages. It was not the euro or the dollar that brought down the Irish banking sector. It was the Irish banking sector.

Now those who want to blame China are treating the Shanghai/Shenzhen crash and devaluation as the shot heard ‘round the world. Poppycock. The US is still the top dog and China is the dog’s tail. This is not to be insulting to China, but rather to defend China as being falsely blamed. There are plenty of things to criticize China for, but causing a global panic is not one of them. The US stock market would not have fallen dramatically if the suspicion was not already present that equities might be overvalued given historical norms and the evidence that this recovery is tepid. The US 10-year note would not have fallen from 2.17% at the start of the year to 2.05% if we didn’t already have an inkling that the tepid recovery might stay the Fed’s hand past September and maybe December as well.

So stop blaming China. Having said that, the absence of any initiative over the weekend raises doubts about managerial capability. We expect China to do better than the Fed—also not fair!

Note to Readers: We will not publish any reports on Thursday, Aug 27 or Friday, Aug 28. We suspect readership is already very low this August and will be near zero by then.

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.