Outlook:

We still do not know whether the euro can match-and-surpass the previous intermediate high, 1.1208 from May 22. We may not know for several days—until Friday or even Monday—whether the Greek deal is real. We are also still confused about the bond market.

Greece first. Analysts have been saying for months that Greece is a drag on the euro but traders have not been willing to make bets on the euro on Greece alone. Everyone is following developments, but opinion is divided 50-50 on default. Half the folks think the troika will cave and deliver the €7.2 billion, if only out of self-interest. Half think the troika feels it can’t afford to cave for reputation and precedent reasons. Both cases are strong.

If hope about a Greek deal was really the driver yesterday, it was the triumph of hope over experience. We tend not to see a take-it-or-leave it stance from bureaucrats, and that’s probably what it will take to corral the Greeks back into the eurozone herd. It is almost certain that Greece will reject whatever the troika has devised and make a counter-offer.

We are not likely to get a resolution today, but of course everyone will anticipate. The obvious implication is that announcement of a real deal will propel the euro higher but by an unknown amount. “Buy on the rumor, sell on the news” may sound too slick to motivate markets, but it does. It’s equally the case that a Greek refusal at this late hour could be terribly, horribly toxic for the euro. It could lose everything it has gained and a lot more, and then we might be back on the path to 1.05 and parity. The tiny rise in inflation and the improvement in economies (employment) is not really enough to support a rising euro, not when the ECB is engaged in QE and the US is engaged in the debate about the First Rate Hike. At least not normally, although the Teflon euro has surprised us before and we are always wary of anything resembling a dollar rally, given the anti-dollar bias built-in over the decades.

Since we can’t forge a forecast out of the Greek situation, let’s consider the bond market. Again yesterday and today, both the US and Bund yields rose. What’s going on? One idea is that liquidity waxes and wanes, and sometimes disappears. London-based bond trading firm ICAP is proposing something used in stock markets but never before in bond markets—a circuit breaker. The US market is $12.5 trillion, so you’d think such a thing would not be needed. But bond price volatility is scary and brokers have already talked about circuit breakers with the US Treasury. The Chicago Mercantile Exchange already has breakers for futures, put in place last December.

The WSJ reports “Such procedures would be vastly more difficult to apply to bonds, observers say. While much of the bond markets are traded electronically today, trading doesn’t take place on exchanges and the handful of platforms catering to bonds don’t coordinate with each other on how to handle extreme price moves.” Worse, “The Treasury Market Practices Group, an expert panel convened by the Federal Reserve Bank of New York, in April wrote that automated trading strategies now account for more than half of Treasury trading on some platforms, and that its increasing adoption would lead to ‘the risk of sharp, short-term disruptions to the Treasury securities market of the kind experienced in the equities and futures markets.’”

“Others finger a decline in liquidity, or the ease of trading at given prices, as a result of new rules in the wake of the financial crisis targeting bank risk-taking. In April, Treasurys traded by banks that act as primary dealers of U.S. government securities hit their lowest monthly volume seen since 2009, according to Haver Analytics.” Noteworthy is the event on Oct 15, when a rally sent the 10-year yield to 1.87%, the biggest one-day decline since 2009. We say equally noteworthy is yesterday’s 17-point yield gain in the Bund—isn’t it?

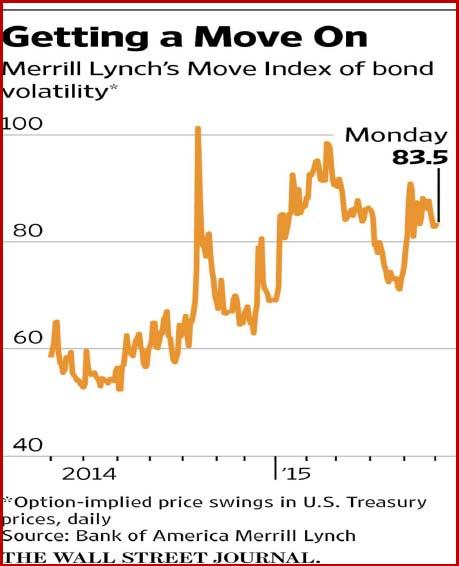

We don’t pretend to understand the bond market, but we can read volatility on a chart. See below. This leaves us with a deep sense of unease. What if the US 10-year yield slips back under 2% while the Bund yield returns to closer to 1%? The dollar needs a 2.5% yield advantage—it’s only our guess, but probably not a bad one. One percent won’t cut it. Deduction—euro up, dollar down.

As for today’s data, Greece probably trumps it. We imagine the biggie is Draghi’s press conference. The ECB is not likely to make any policy changes but Draghi may have been appointed to deliver a message or two. We also get the ADP private sector jobs growth estimate. We get the service sector ISM, expected to disappoint on the downside (57.0 from 57.8) and in the afternoon, the Beige Book. There’s nothing much here that is dollar-supportive. The wise course today would be to bow out of the market altogether. The probability of getting it right is a crap-shoot.

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.