Outlook:

The seeming resumption of the euro pullback to the upside is not really a surprise. It was always a realistic possibility, although we would be more comfortable having a hard, cold reason for it. The only explanation we have found--a rise in Bund yields—would be okay if the spread were not at the same time widening in the US’ favor. Theory has it that it’s the spread that counts. And why is the Bund yield rising in the first place? Yields rise when prices fall, implying some factor is driving safe-haven seekers out. Maybe a deal with Greece is realistic, after all. In a data-overload week, today in the US we get auto sales, Redbook chain store sales and factory orders, of which auto sales speak to consumer confidence and factory orders speak (maybe) to rising employment and exports.

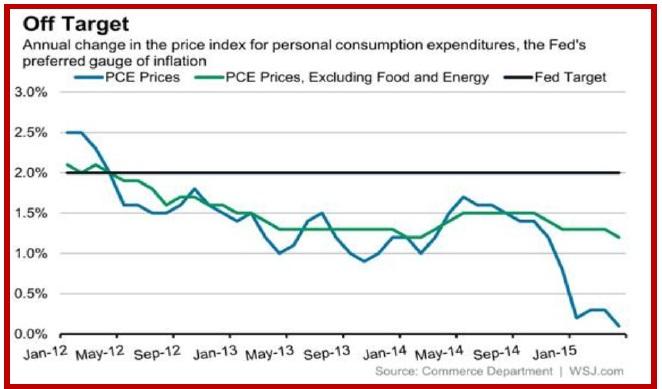

But we want to think about inflation. The personal consumption expenditures price index rose 0.1% y/y in April, the lowest since Oct 2009 and less than 0.3% in both Feb and March. The PCE price index is reportedly what the Fed prefers to look at, and it ain’t good. The WSJ notes that “April 2012 was the last time the inflation rate was on target. That’s the longest such stretch of sub-2% inflation since the 1960s.”

And core inflation, ex energy and food, was up 1.2% y/y in April—but 1.3% in the earlier four months. Economists like Ian Shepherdson tell us not to worry about it—the tight labor market means future inflation is in the cards. “It won’t be current inflation that prompts the first Fed hikes, it will be the tightness of the labor market and the signal it sends about future inflation risk, given the extraordinarily easy stance of policy.”

But see the chart below. Does this look like a rate hike to you?

Not to Boston Fed Pres Rosengren. He’s a non-voter but worries that the lousy Q1 performance means conditions are not close to being right for a hike. Rosengren was talking about GDP at -0.7%, but the hipbone is connected to the thigh-bone. Slow growth means price pressure is soft. Maybe the Q1 result was due to temporary factors like the weather and port strike, but maybe it’s “a reflection of broader changes in the economy.” Rosengren said “…an appropriately data-dependent monetary policy requires confirmation in the numbers, not just in forecasts of better times.” Besides, the Fed has no wiggle room to retreat if a new shock comes along, including a shock from foreign shores, Europe or China.

Delay past September is starting to look realistic.

Right now the action is pro-euro, not anti-dollar, except for the base-case anti-dollar sentiment that has pervaded the FX market for decades. But even though we still have the divergent monetary policy scenario that has the dollar the beneficiary of rising rates while everyone else is in QE, it’s looking a little threadbare just now.

It’s also not working, at least not today. As we have written all too many times before, the yield spread has to give the dollar a fat premium to overcome anti-dollar bias, probably 250 bp. If the Bund yield rises, it’s safe for the dollar only if that cushion has been built in. And it’s not getting built in. This is pretty scary. Right now, it looks like the euro can continue to rally to the previous intermediate high, 1.1208 from May 22. This is beyond the breakout bar mid-point but would still allow the bigger dollar rally to exist. Beyond the 1.208 level, we would have to re-think what’s going on.

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

AUD/USD defends 0.6400 after Chinese data dump

AUD/USD has found fresh buyers near 0.6400, hanging near YTD lows after strong China's Q1 GDP data. However, the further upside appears elusive amid weak Chinese activity data and sustained US Dollar demand. Focus shifts to US data, Fedspeak.

USD/JPY stands tall near multi-decade high near 154.50

USD/JPY keeps its range near multi-decade highs of 154.45 in the Asian session on Tuesday. The hawkish Fed expectations overshadow the BoJ's uncertain rate outlook and underpin the US Dollar at the Japanese Yen's expense. The pair stands resilient to the Japanese verbal intervention.

Gold price holds steady below $2,400 mark, bullish potential seems intact

Gold price oscillates in a narrow band on Tuesday and remains close to the all-time peak. The worsening Middle East crisis weighs on investors’ sentiment and benefits the metal. Reduced Fed rate cut bets lift the USD to a fresh YTD top and cap gains for the XAU/USD.

SOL primed for a breakout as it completes a rounding bottom pattern

Solana price has conformed to the broader market crash, following in the steps of Bitcoin price that remains in the red below the $65,000 threshold. For SOL, however, the sensational altcoin could have a big move in store.

Israel-Iran military conflict views and takeaways

Iran's retaliatory strike on Israel is an escalation of Middle East tensions, but not necessarily a pre-cursor to broader regional conflict. Events over the past few weeks in the Middle East, more specifically this past weekend, reinforce that the global geopolitical landscape remains tense.