Briefly: In our opinion, speculative short positions are favored (with stop-loss at 2,030 and profit target at 1,900, S&P 500 index)

Our intraday outlook is bearish, and our short-term outlook is bearish:

Intraday (next 24 hours) outlook: bearish

Short-term (next 1-2 weeks) outlook: bearish

Medium-term (next 1-3 months) outlook: neutral

Long-term outlook (next year): bullish

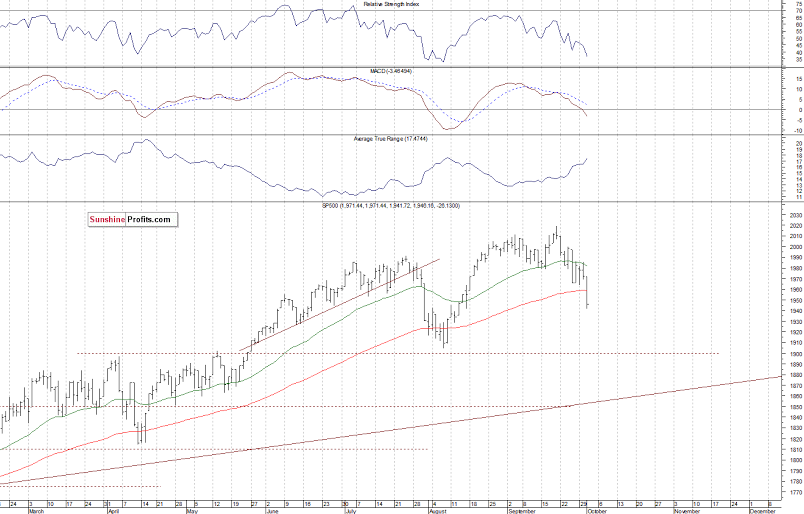

The U.S. stock market indexes lost 1.3-1.6% on Wednesday, resuming their short-term downtrend, as investors continued to take profits following August rally, ahead of some economic data announcements, as expected. Our Wednesday’s intraday bearish outlook has proved accurate. The S&P 500 index broke below the support level of 1,960-1,965. The nearest important level of support is at around 1,930-1,940, marked by July-August bottoming consolidation. On the other hand, the resistance level is at 1,960, marked by recent short-term consolidation, as we can see on the daily chart:

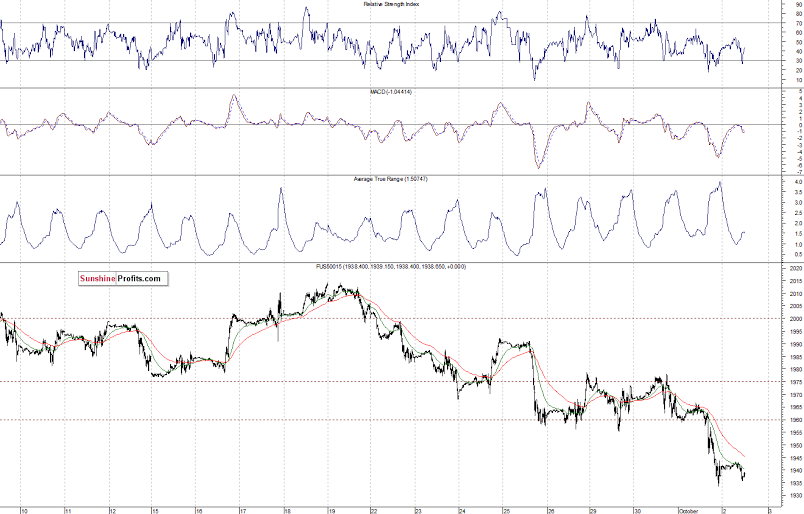

Expectations before the opening of today’s session are slightly negative, with index futures currently down 0.1%. The main European stock market indexes have lost 0.3-0.4% so far. Investors will now wait for some economic data announcements: Initial Claims at 8:30 a.m., Factory Orders at 10:00 a.m. The S&P 500 futures contract (CFD) is in an intraday downtrend, as it gets closer to yesterday’s low. The nearest important support level is at around 1,930-1,935. On the other hand, the level of resistance is at 1,940-1,950, among others, as the 15-minute chart shows:

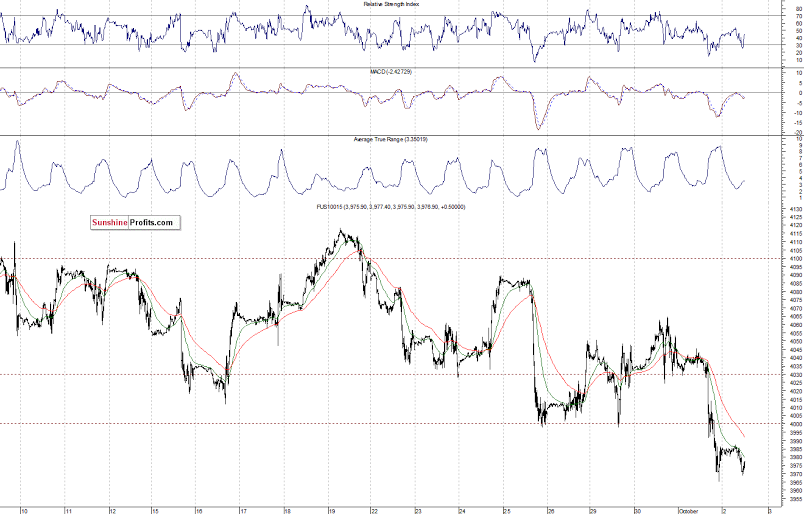

The technology Nasdaq 100 futures contract (CFD) remains in a downtrend, as it gets closer to yesterday’s low. The resistance level is at around 3,990-4,000, marked by previous level of support. There have been no confirmed positive signals so far:

Concluding, the broad stock market resumed its short-term downtrend, moving below recent consolidation. We remain bearish, expecting a downward correction or uptrend reversal. Therefore, we continue to maintain our already profitable speculative short position with entry point at 2,000.5 – S&P 500 index. The stop-loss is at the level of 2,030 and potential profit target is at 1,900 (S&P 500 index). It is always important to set some exit price level in case some events cause the price to move in the unlikely direction. Having safety measures in place helps limit potential losses while letting the gains grow.

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' employees and associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Recommended Content

Editors’ Picks

EUR/USD consolidates recovery below 1.0700 amid upbeat mood

EUR/USD is consolidating its recovery but remains below 1.0700 in early Europe on Thursday. The US Dollar holds its corrective decline amid a stabilizing market mood, despite looming Middle East geopolitical risks. Speeches from ECB and Fed officials remain on tap.

GBP/USD advances toward 1.2500 on weaker US Dollar

GBP/USD is extending recovery gains toward 1.2500 in the European morning on Thursday. The pair stays supported by a sustained US Dollar weakness alongside the US Treasury bond yields. Risk appetite also underpins the higher-yielding currency pair. ahead of mid-tier US data and Fedspeak.

Gold appears a ‘buy-the-dips’ trade on simmering Israel-Iran tensions

Gold price attempts another run to reclaim $2,400 amid looming geopolitical risks. US Dollar pulls back with Treasury yields despite hawkish Fedspeak, as risk appetite returns.

Manta Network price braces for volatility as $44 million worth of MANTA is due to flood markets

Manta Network price is defending support at $1.80 as multiple technical indicators flash bearish. 21.67 million MANTA tokens worth $44 million are due to flood markets in a cliff unlock on Thursday.

Investors hunkering down

Amidst a relentless cautionary deluge of commentary from global financial leaders gathered at the International Monetary Fund and World Bank Spring meetings in Washington, investors appear to be taking a hiatus.