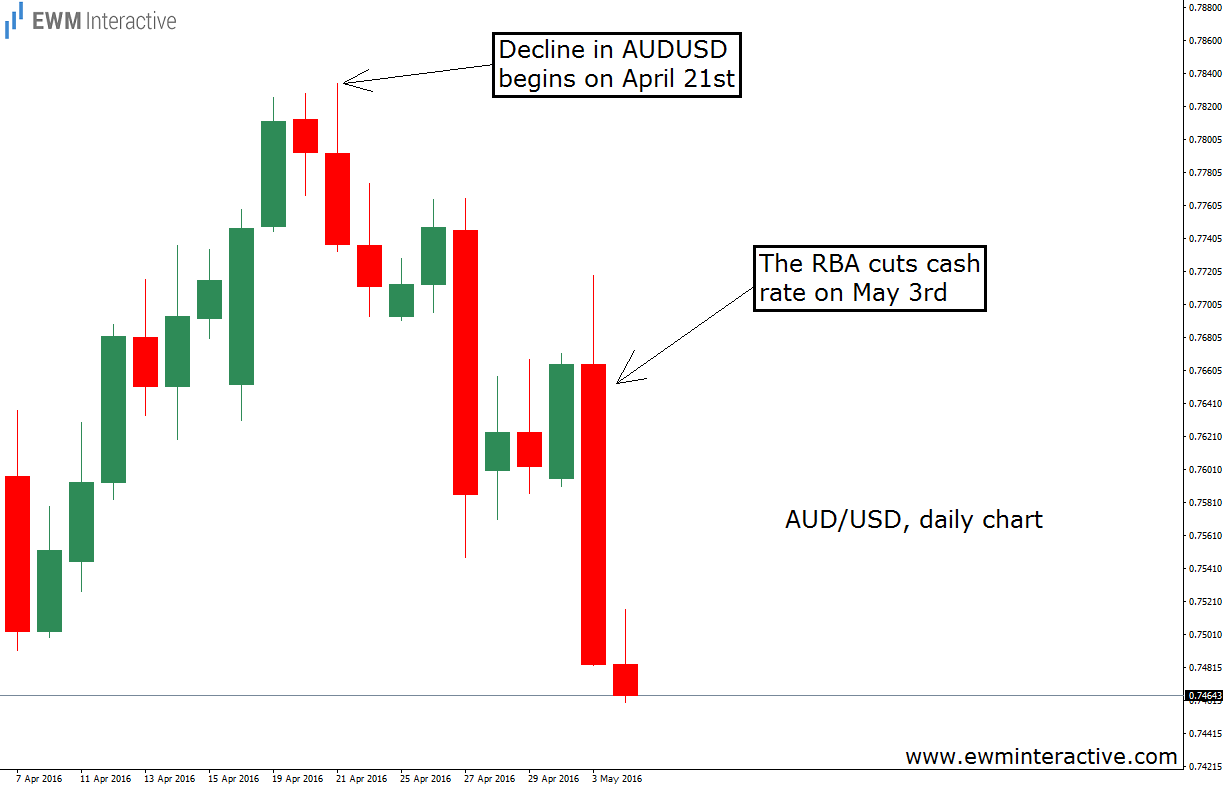

AUDUSD was flying above 0.7830 just two weeks ago. On April 21st the pair rose to 0.7834 and everything was looking as if sky was the limit for the bulls. Today, May 4th, AUDUSD plunged to 0.7460 so far. According to the majority of experts, the obvious explanation for the current weakness is the surprising decision the Reserve Bank of Australia took on Tuesday, May 3rd, to cut its cash rate by 25 basis points to 1.75%. It makes sense until you take a look at the charts of AUDUSD, which clearly show that the Australian dollar began declining against the U.S. counterpart on April 21st, not on May 3rd.

So it turns out the market is ahead of the news once again. The Reserve Bank of Australia does not change the trend. It simply follows it. The question is how can you be ahead of the news as well, instead of waiting for someone to surprisingly decide something?

The next chart shows the forecast our premium clients received before the markets opened on Monday, April 25th, 9 days before the cash rate cut by the RBA.(some of the marks have been removed for this article)

The method we use to stay ahead of the news is called the Elliott Wave Principle. On April 25th, it warned us not to “buy the dip”, because the weakness in AUDUSD was supposed to extend much lower. In addition, the relative strength index was showing a strong bearish divergence, which further supported the negative outlook. We shared with our premium clients our opinion that “short positions are preferable as long as the invalidation level at 0.7835 holds, while first targets … around 0.7500 are plausible.” The updated chart of AUDUSD below shows how things went.

Fortunately, 0.7835 was never threatened. Instead, the exchange rate began declining and, on May 3rd, the day the Reserve Bank of Australia announced its surprising decision, the target at 0.7500 has been reached and exceeded.

In order to be successful in the market, traders need an accurate forecasting method. The Elliott Wave principle is the one we use an trust, because it not only tells us what the market is most likely to do, but also provides a specific price levels to serve as a map, which allows us to know it if we are wrong. What more does a trader need?

Trading financial instruments entails a great degree of uncertainty and a variety of risks. EMW Interactive’s materials and market analysis are provided for educational purposes only. As such, their main purpose is to illustrate how the Elliott Wave Principle can be applied to predict movements in the financial markets. As a perfectly accurate method for technical analysis does not exist, the Elliott Wave Principle is also not flawless. As a result, the company does not take any responsibility for the potential losses our end-user might incur. Simply, any decision to trade or invest, based on the information from this website, is at your own risk.

Recommended Content

Editors’ Picks

AUD/USD jumps above 0.6500 after hot Australian CPI data

AUD/USD extended gains and recaptured 0.6500 in Asian trading, following the release of hotter-than-expected Australian inflation data. The Australian CPI rose 1% in QoQ in Q1 against 0.8% forecast, providing extra legs to the Australian Dollar upside.

USD/JPY hangs near 34-year high at 154.88 as intervention risks loom

USD/JPY is sitting at a multi-decade high of 154.88 reached on Tuesday. Traders refrain from placing fresh bets on the pair as Japan's FX intervention risks loom. Broad US Dollar weakness also caps the upside in the major. US Durable Goods data are next on tap.

Gold price cautious despite weaker US Dollar and falling US yields

Gold retreats modestly after failing to sustain gains despite fall in US Treasury yields, weaker US Dollar. XAU/USD struggles to capitalize following release of weaker-than-expected S&P Global PMIs, fueling speculation about potential Fed rate cuts.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday. Most people expect the stablecoin to be backed by gold, considering BRICS nations have been accumulating large holdings of the commodity.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Fed might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.