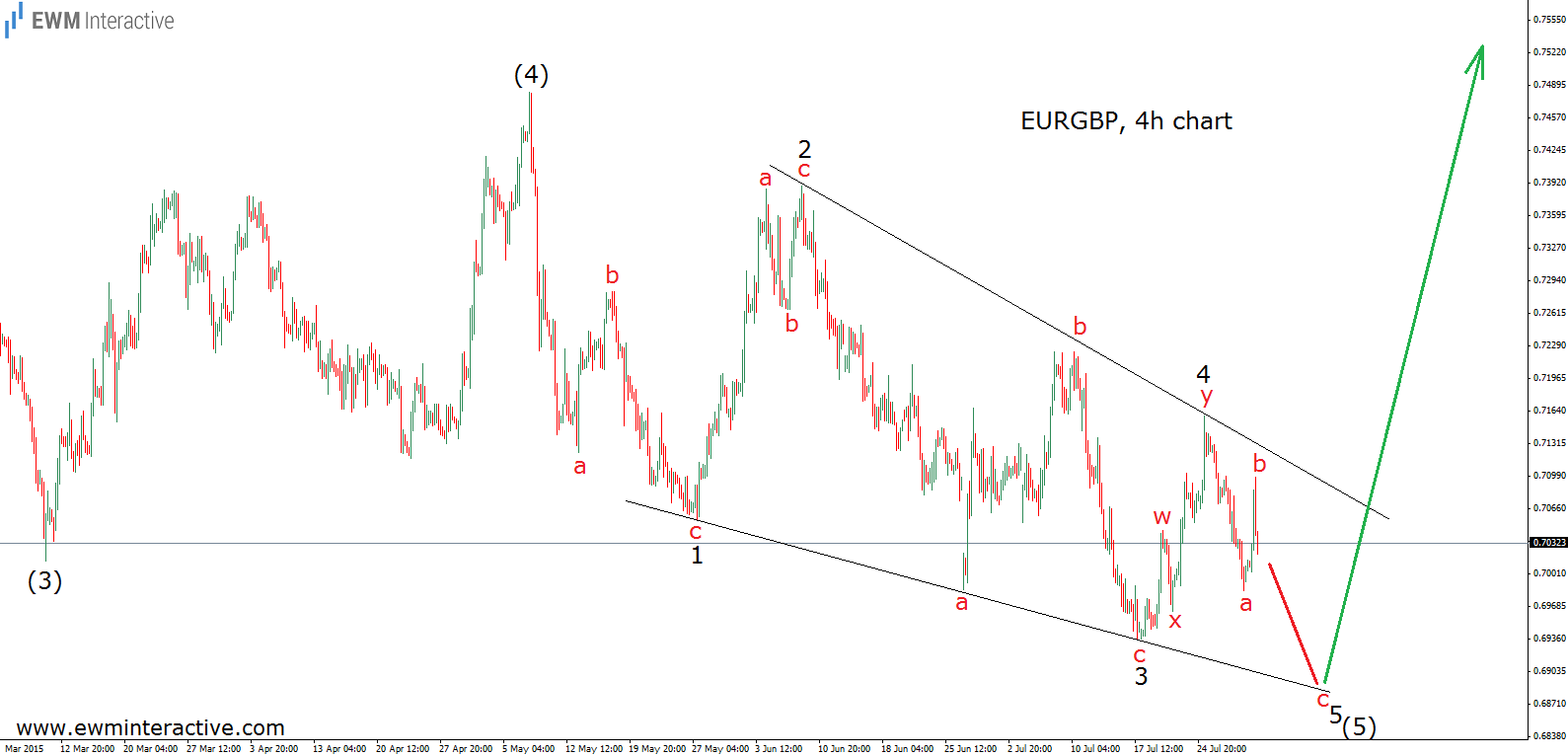

The Elliott Wave Principle is famous for its ability to help traders and investors identify price extremes and predict reversals. Two months ago, on August 2nd, we applied it to the 4-hour chart of EURGBP. In an article, called “EURGBP Trying To Find The Bottom”, it warned us that a bullish reversal might occur soon. You can see how the forecast was looking like on the chart below.

As visible, we thought there is an ending diagonal developing in wave (5), whose wave 5 was still under construction. That is why we said that “EURGBP should make one last bottom near 0.69 and reverse to the upside.” The updated chart shows how things went from then on.

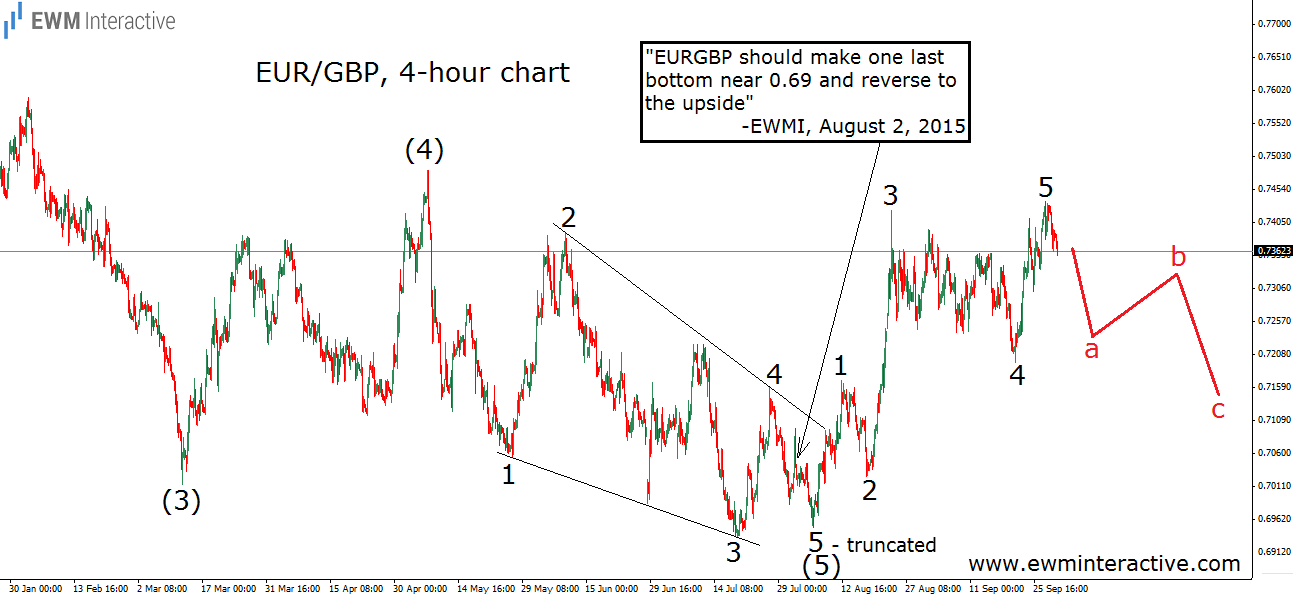

It turned out the bulls were even more impatient than expected. EURGBP fell to 0.6950, which happened to be the level, where the bears finally gave up. Wave 5 of (5) did not make a new low, which allows us to call it a truncation. The pair then started rising. On September 29th, it reached as high as 0.7436.

What to expect in EURGBP from now on? As the chart depicts, the rally from 0.6950 to 0.7436 could easily be counted as a five-wave impulse. According to the theory, every impulse is followed by a three-wave correction in the opposite direction. So, we suspect the euro is going to weaken against the sterling in the near term. A pull-back to 0.7200 should not be excluded as a possibility.

Trading financial instruments entails a great degree of uncertainty and a variety of risks. EMW Interactive’s materials and market analysis are provided for educational purposes only. As such, their main purpose is to illustrate how the Elliott Wave Principle can be applied to predict movements in the financial markets. As a perfectly accurate method for technical analysis does not exist, the Elliott Wave Principle is also not flawless. As a result, the company does not take any responsibility for the potential losses our end-user might incur. Simply, any decision to trade or invest, based on the information from this website, is at your own risk.

Recommended Content

Editors’ Picks

AUD/USD hovers around 0.6500 amid light trading, ahead of US GDP

AUD/USD is trading close to 0.6500 in Asian trading on Thursday, lacking a clear directional impetus amid an Anzac Day holiday in Australia. Meanwhile, traders stay cautious due ti risk-aversion and ahead of the key US Q1 GDP release.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price treads water near $2,320, awaits US GDP data

Gold price recovers losses but keeps its range near $2,320 early Thursday. Renewed weakness in the US Dollar and the US Treasury yields allow Gold buyers to breathe a sigh of relief. Gold price stays vulnerable amid Middle East de-escalation, awaiting US Q1 GDP data.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta Platforms Earnings: META sinks 10% on lower Q2 revenue guidance Premium

This must be "opposites" week. While Doppelganger Tesla rode horrible misses on Tuesday to a double-digit rally, Meta Platforms produced impressive beats above Wall Street consensus after the close on Wednesday, only to watch the share price collapse by nearly 10%.