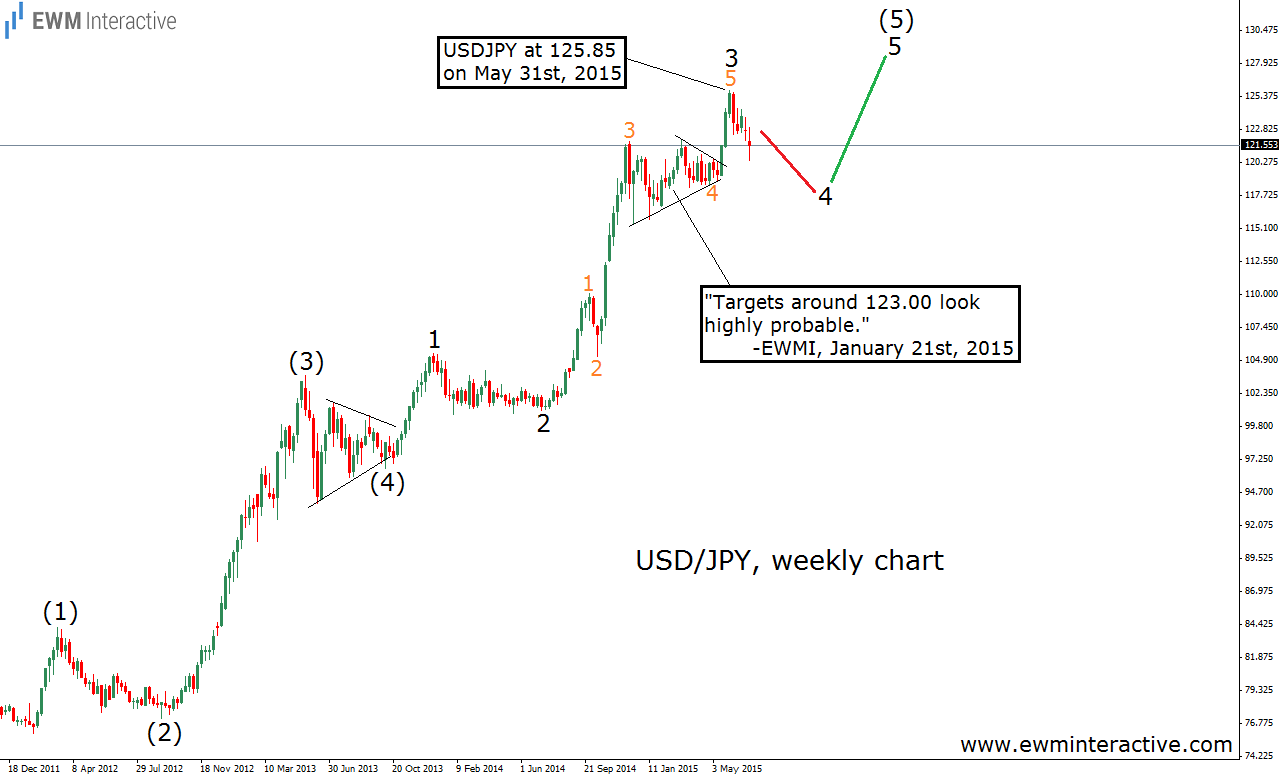

“USDJPY might lose another 400-500 pips in wave 4 of (5), before wave 5 of (5) to the upside begins. You might want to wait a while, before buying this dip.” This is an excerpt from “USDJPY Right On Track In 2015″, which we published on July 9th, 2015, when USDJPY was trading near 121.50. In other words, we were expecting the pair to visit the area between 117.50 and 116.50. The chart below shows how the forecast looked like back then.

Soon as the article was published, the pair rose to 125.28. However, the top 125.85 was never touched. Instead, USDJPY started falling as expected. On August 24th, the “Black Monday”, the dollar plunged to as low as 116.15 against the Japanese yen. This is 35 pips beyond our second target. Not bad at all. The Elliott Wave Principle proved its value once again. An updated chart is given below.

By the way, note where the recent sell-off in wave 4 of (5) ended – precisely at the 38.2% Fibonacci retracement level. It turns out the market is mathematically organized, even in the panics, huh?

From now on, USDJPY should continue higher in the face of the anticipated wave 5 of (5). Naturally, the bulls are supposed to take the pair above the previous high of 125.85, unless a truncation occurs.

Trading financial instruments entails a great degree of uncertainty and a variety of risks. EMW Interactive’s materials and market analysis are provided for educational purposes only. As such, their main purpose is to illustrate how the Elliott Wave Principle can be applied to predict movements in the financial markets. As a perfectly accurate method for technical analysis does not exist, the Elliott Wave Principle is also not flawless. As a result, the company does not take any responsibility for the potential losses our end-user might incur. Simply, any decision to trade or invest, based on the information from this website, is at your own risk.

Recommended Content

Editors’ Picks

EUR/USD holds gains near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.