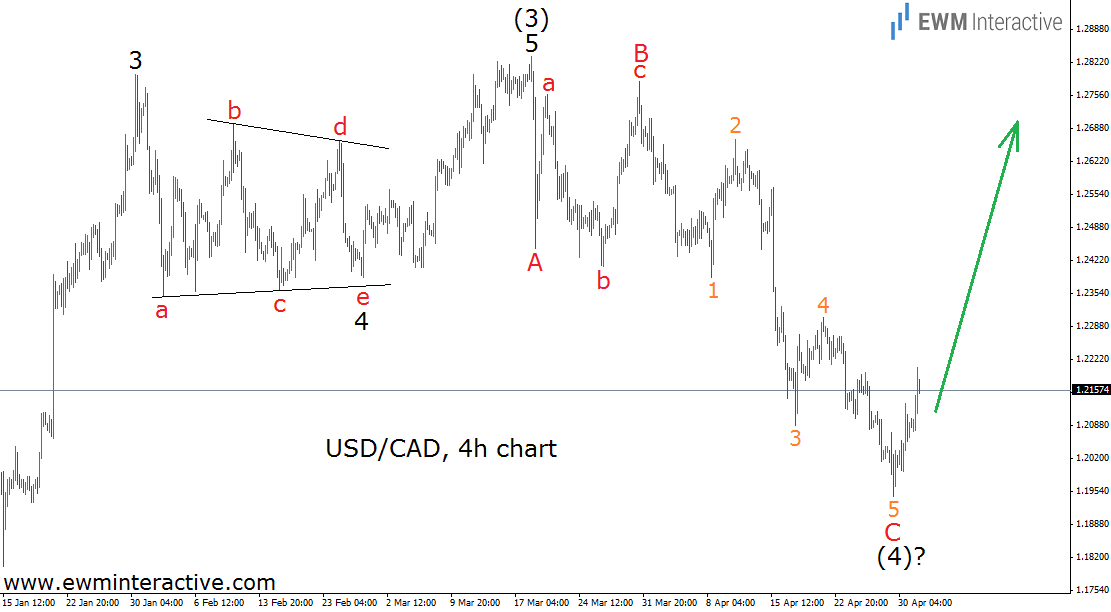

April was not the best of months for the bulls on USDCAD. Not only the March top of 1.2835 remained untouched, but the pair fell much lower to 1.1945 last week. What to expect from now on? Should the buyers abandon ship? Well, the Elliott Wave Principle suggests things are not that bad, because the larger uptrend is still in progress. However, it has to be looked at from the proper angle. The weekly chart of USDCAD can help.

According to the theory, trends move in five-wave sequences, called impulses. As you can see, the impulse in USDCAD is not complete yet. It appears to be in wave (4) of III, which means wave (5) to the north should begin soon. In addition, fourth waves tend to retrace around the 38.2% Fibonacci level of the third wave. This is exactly where the bulls on USDCAD decided to wake up and form that nicely-looking hammer weekly candle you see on the chart. But let’s go deeper into the wave structure to gain a more precise outlook.

In order to be qualified as a correction, the decline from 1.2835 to 1.1945 has to consist of three waves. And it does. USDCAD has drawn an A-B-C zig-zag, where wave B is an expanding flat correction. That is why we can prepare for a significant recovery in the near future. However, this three-wave decline might turn out to be just wave (A) of a wave (4) triangle. Nevertheless, the bears are not supposed to test 1.1945 again any time soon.

Recommended Content

Editors’ Picks

AUD/USD holds hot Australian CPI-led gains above 0.6500

AUD/USD consolidates hot Australian CPI data-led strong gains above 0.6500 in early Europe on Wednesday. The Australian CPI rose 1% in QoQ in Q1 against the 0.8% forecast, providing extra legs to the Australian Dollar upside.

USD/JPY sticks to 34-year high near 154.90 as intervention risks loom

USD/JPY is sitting at a multi-decade high of 154.88 reached on Tuesday. Traders refrain from placing fresh bets on the pair as Japan's FX intervention risks loom. Broad US Dollar weakness also caps the upside in the major. US Durable Goods data are next on tap.

Gold price struggles to lure buyers amid positive risk tone, reduced Fed rate cut bets

Gold price lacks follow-through buying and is influenced by a combination of diverging forces. Easing geopolitical tensions continue to undermine demand for the safe-haven precious metal. Tuesday’s dismal US PMIs weigh on the USD and lend support ahead of the key US macro data.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday. Most people expect the stablecoin to be backed by gold, considering BRICS nations have been accumulating large holdings of the commodity.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Fed might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.