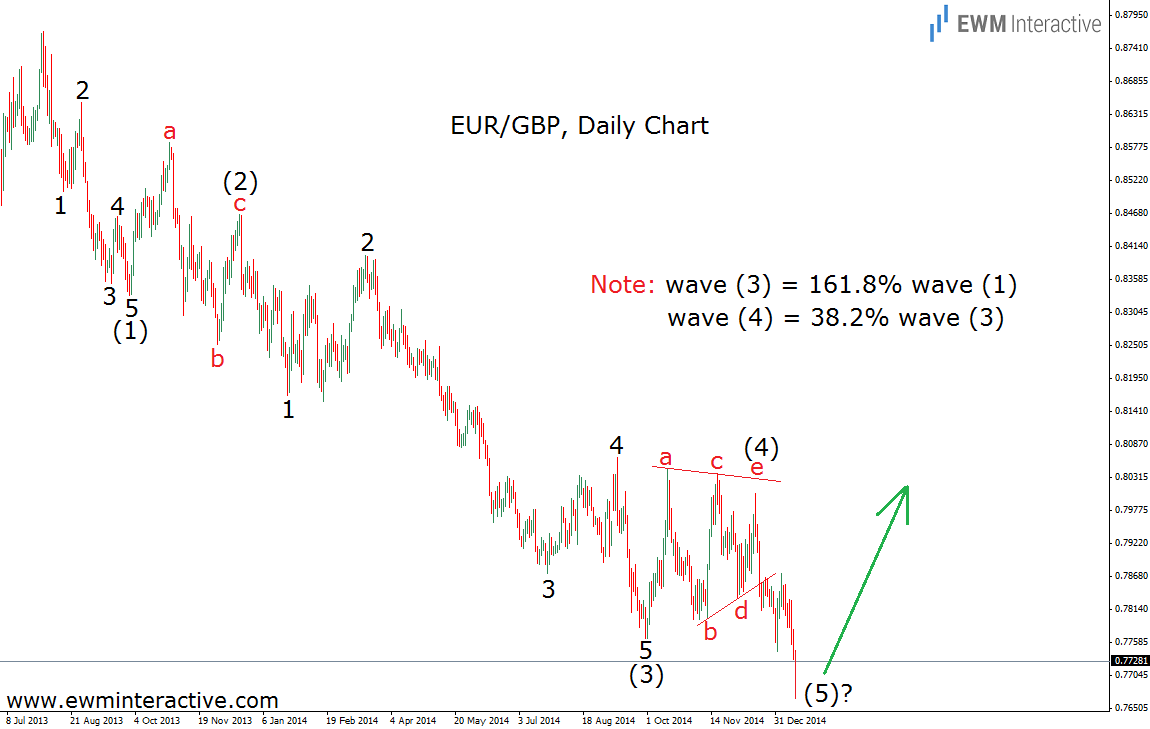

The EUR GBP exchange rate went below 0.77 today, which is its lowest level since March 2008. To many this may be a reason to get more and more bearish on the pair with each pip to the downside. However, the Elliott Wave Principle signals a “proceed with caution” sign, because it could be time at least for a temporary recovery soon. The chart below shows one of the clearest impulses in terms of wave structure and Fibonacci ratios. See for yourself.

As visible, the whole decline that started from 0.8770 could easily be counted as a five-wave sequence, where wave (5) is still in progress. The structure of waves (1) and (3) is also very clear. Wave (3) is extended to exactly 161.8% the length of wave (1). Wave (4) retraces 38.2% of wave (3). There are two reasons we believe the bears may be running out of power. First, according to the theory, every impulse is followed be a correction in the opposite direction. So regardless of how the bigger picture would look like if we examine it, this five-wave decline here suggests we should expect a reversal, once wave (5) is over. And second, wave (4) is a triangle. No matter where you see this pattern, it precedes the final move of the larger sequence. In this case, the wave (4) triangle precedes wave (5). Now, wave (5) does not seem finished yet. It could take the form of a regular impulse or an ending diagonal. In both scenarios, EUR GBP could visit the territory of 0.75, but not much lower.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.