Daily Forecast - 14 April 2015

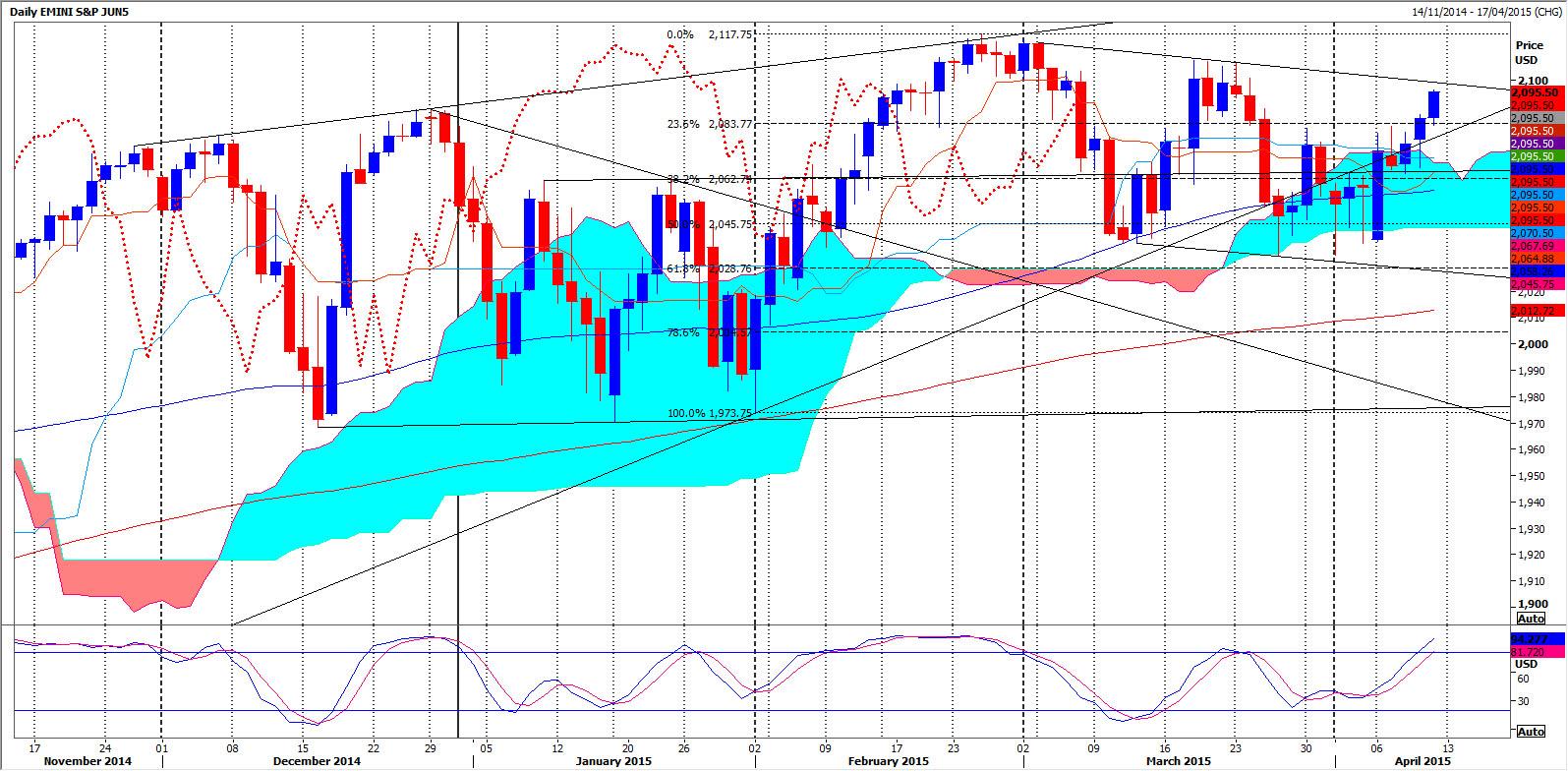

S&P June contract

Emini S&P holding good support & our buying opportunity at 2085/84 triggers a recovery to 2092/93 for at least some profit taking on longs. If we continue higher look for strong resistance at the upper trend line of the 6 week channel at 2099/01. Again sell with stops on a move above 2106. However a break & close above here keeps the short term outlook positive & targets 2107/08. If we continue higher look for 2114 & a retest of the all time high at 2117.75.

First support at 2085/84 of course but longs need stops below 2081. Be ready to go with a break lower to target next support at 2078/77. Try longs with stops below 2073. Just be aware that a break & close below 2077 is more negative in to the end of the week & targets 2070 then excellent support at 2063/62 for a buying opportunity.

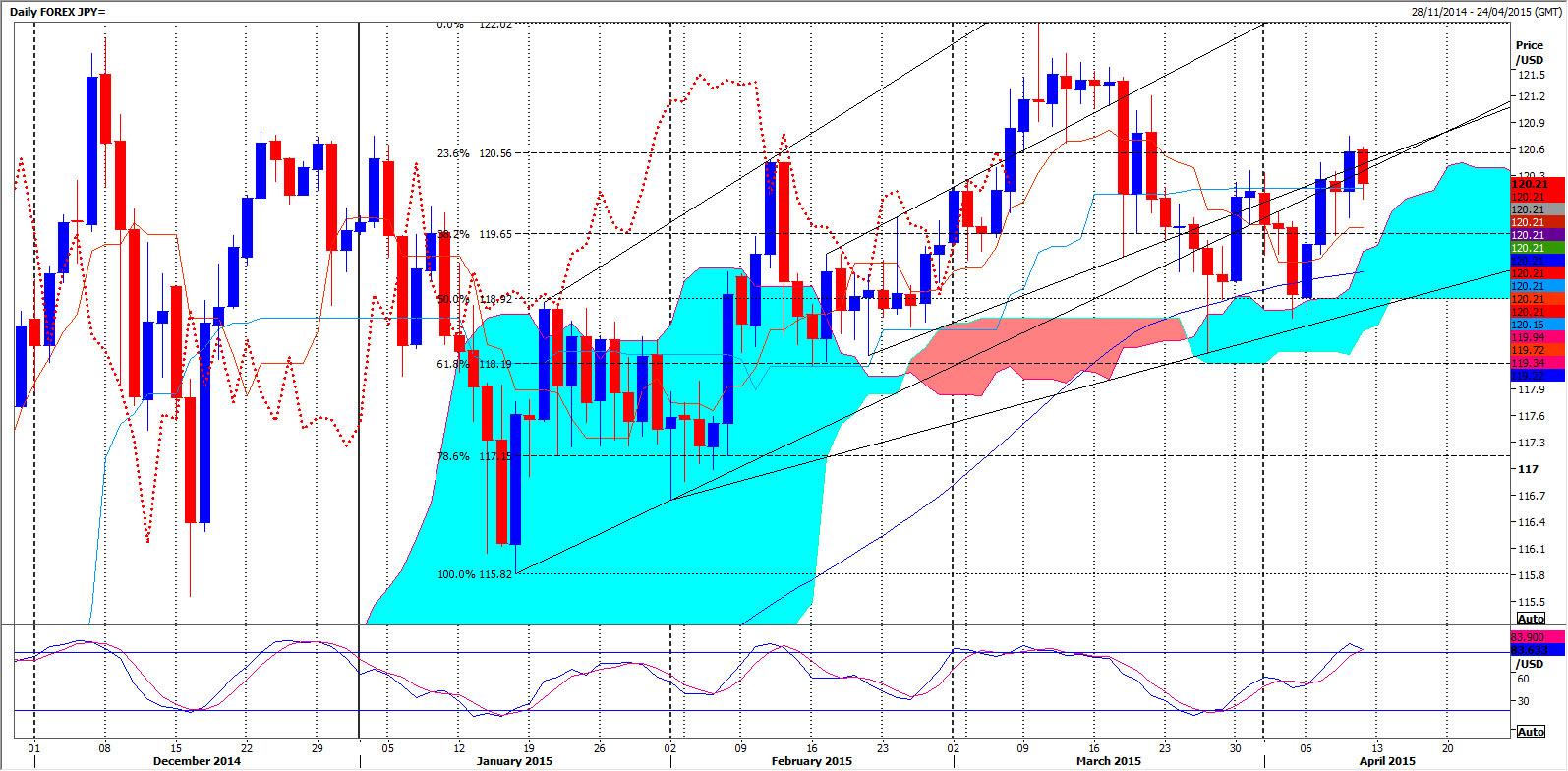

USDJPY Spot

USDJPY support at 119.80/119.75 is key to direction. We could recover from here again today to 120.00/05 & perhaps as far as resistance at 120.20/25 for profit taking on remaining longs. If we continue higher look for resistance at 120.45/55. We can try shorts here with stops above 120.70. Be ready to go with a break above yesterday's high at 120.84 however as this is more positive & targets 121.10/20. If we continue higher today we can reach towards 121.50/60.

Failure to hold above support at 119.80/119.75 keeps the market under pressure & longs need stops below 119.60. Be ready to go with a break lower to target 119.55/50, perhaps as far as strong support at 119.25/20. Buy with stops on a move below 119.00.

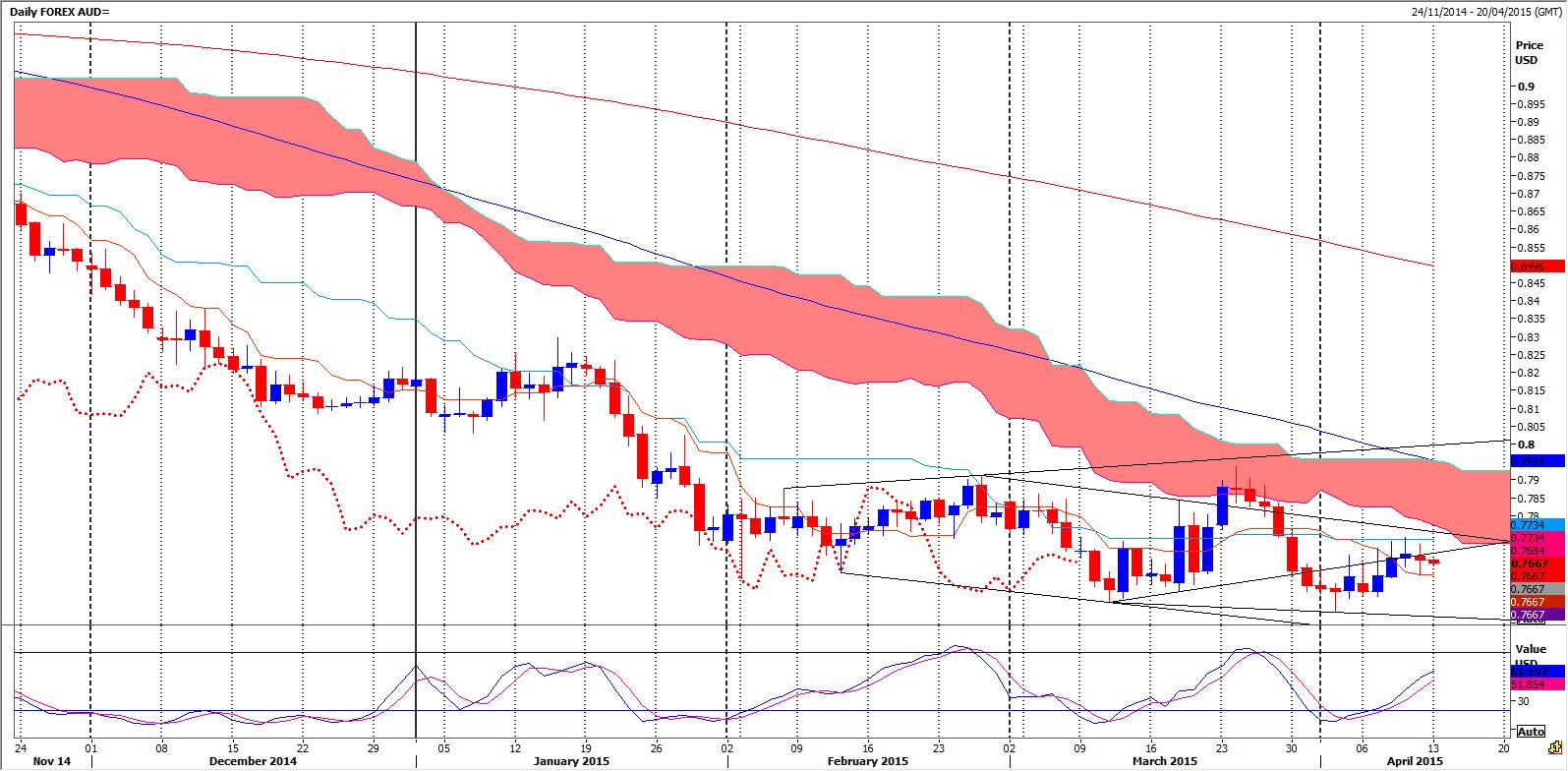

AUDUSD

AUDUSD first resistance at 7622/25 could hold a move higher but shorts need stops above 7645. A break higher however targets 7666 & we should struggle here but if we continue higher look for strong resistance at 7685/90. Try shorts with stops above 7710.

Failure to beat first resistance at 7622/25 should trigger a move lower to 7595. A bounce from here certainly possible on the first test at least. However the trend is of course negative so be ready to go with a break lower to target 7577 then 7558/50. Last week's low at 7530 is then important. Obviously a break below here is more negative & indicates the start of the next leg lower to target 7500 initially then 7440/35.

GBPUSD

GBPUSD must now hold above 1.4665/60 to maintain the recovery & target first resistance at 1.4715/20. Try shorts with stops above 1.4740. A break higher however then targets 1.4765/70 & if we continue higher look for a selling opportunity at 1.4810/15. Our shorts need stops above 1.4845.

First support at 1.4665/60 could hold the downside today but longs need stops below 1.4630. A break lower risks a slide to 1.4590/85 before a retest of yesterday's low at 1.4563. A bounce from here possible again, but a break lower kills all chance of a recovery & targets 1.4550/45 & perhaps as far as 1.4499/94. If we continue lower this week look for 1.4475 & 1.4430/25.

The contents of our reports are intended to be understood by professional users who are fully aware of the inherent risks in Forex, Futures, Options, Stocks and Bonds trading. INFORMATION PROVIDED WITHIN THIS MATERIAL SHOULD NOT BE CONSTRUED AS ADVICE AND IS PROVIDED FOR INFORMATION AND EDUCATION PURPOSES ONLY.

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.