Daily Forecast - 23 January 2015

GBPUSD

GBPUSD outlook remains negative today after the breakout to the downside. Further losses target 1.4935 before support at 1.4870/60. If we continue lower look for a test of 2013 lows & good support at 1.4829/12.

Any recovery is a selling opportunity with immediate resistance at 1.5035/40 but above here look for a selling opportunity at 1.5080/85 with stops above 1.1515.

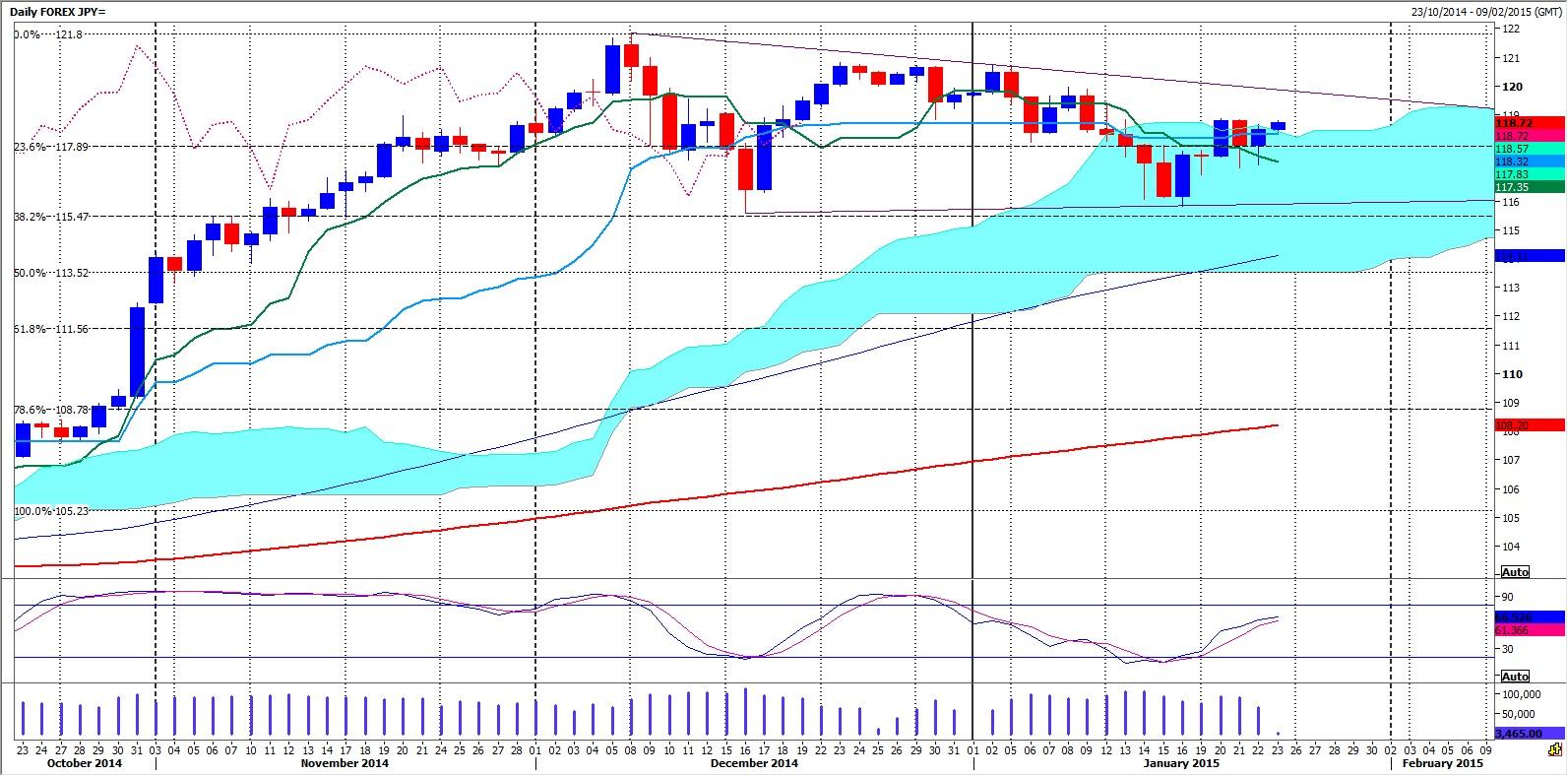

USDJPY

USDJPY is testing strong resistance at 118.70/80 for a selling opportunity with stops above 118.95. A break above 118.80 today however is very positive & should target 119.30, perhaps as far as 119.60/65. If we continue higher in to next week look for 119.88/96.

Failure to beat strong resistance at 118.70/80 should trigger a move lower towards 118.55/50 then support at 118.25/15. It should be worth covering shorts here with a low for the day possible but any longs need a stop below 117.90. There is good support at 117.70, so should be worth trying longs here with a stop below 117.45.

EURUSD

EURUSD breaking 1.1316 in the longer term bear trend targets 1.1270/60 then very strong support at 1.1210. The pair has already dropped from 1.2108 to 1.1316 in just 3 weeks with 8 out of 9 months of losses. 1.1220/10 is the best chance of a short term bottom we have seen for a long time & it may be wise to cover shorts here. There is a good chance of a bounce from here but longs need wide stops below 1.1180.

Immediate resistance at 1.1390/95 but if we can push above here look for a selling opportunity at 1.1440, with stops above 1.1460.

AUDUSD

AUDUSD outlook remains negative so be ready to go with a break lower again today to target strong support at 7945/40. Buy with stops on a move below 7915. However a break below here sees 7940/45 act as strong resistance for a move towards 7850/45, 7800 & perhaps as far as 7787 in to next week.

Any recovery is a selling opportunity with immediate resistance at 8055/60. Try shorts with stops above 8080. A break higher however meets the next resistance at 8105/10. Try shorts with stops above 8135.

The contents of our reports are intended to be understood by professional users who are fully aware of the inherent risks in Forex, Futures, Options, Stocks and Bonds trading. INFORMATION PROVIDED WITHIN THIS MATERIAL SHOULD NOT BE CONSTRUED AS ADVICE AND IS PROVIDED FOR INFORMATION AND EDUCATION PURPOSES ONLY.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated below 1.0700. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 as USD rebounds

GBP/USD declined below 1.2500 and erased the majority of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold drops below $2,320 as US yields shoot higher

Gold lost its traction and turned negative on the day below $2,320 in the American session on Thursday. The benchmark 10-year US Treasury bond yield is up more than 1% on the day above 4.7% after US GDP report, weighing on XAU/USD.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.