Daily Forecast - 09 December 2014

EURUSD

EURUSD resistance at 1.2345/50 is key again today & bear in mind our shorts need a stop above 1.2375. However just be aware that a break higher is more likely today. If seen we can then use 1.2330/25 as support & look for a move towards 1.2380 for profit taking. A high for the day expected here so try shorts with stops above 1.2410.

Failure to get back above 1.2325/30 keeps the market in a bear trend to target 1.2295/90. It may be worth profit-taking on at least some of our shorts from the 1.2345 area here. However we are in a bear trend, so would not be a surprise to see the pair continue lower to 1.2275/71 and any further weakness is likely then to retest the 1.2251/45 level. A break below 1.2235 cannot be ruled out & should target 1.2205/00.

GBPUSD

GBPUSD has immediate support at 1.5635/30 so below here is helpful to our short positions and should target 1.5610/05. It could be worth profit-taking on at least some of our shorts from 1.5675 here but if we continue lower we could target 1.5570/65. Any further losses risk a retest of that 1.5540/35 level. Just be aware that a break below here this week targets 1.5505/00 in the longer term bear trend. If we continue lower we could then target 1.5465 and 1.5435/30.

Obviously the key level above is 1.5670/75 and could again hold a move higher today but our shorts do need a stop above 1.5700. A break above here is very positive and should initially target 1.5735/40. We could go on to reach 1.5765 for profit taking on remaining longs and perhaps even make it as far as 1.5785/90 for an excellent selling opportunity. Try shorts with a stop above 1.5830.

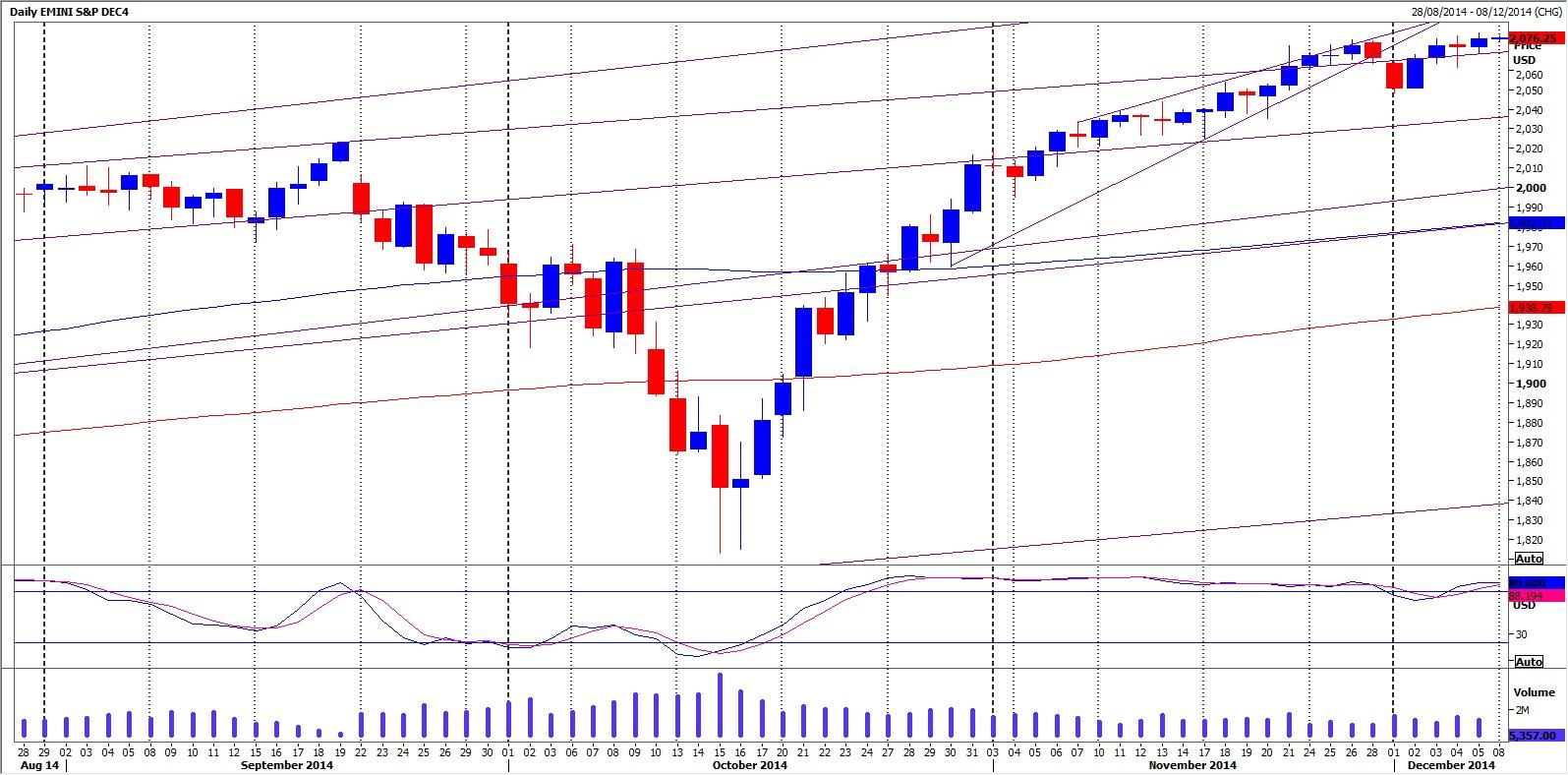

S&P December contract

Emini S&P broke lower eventually to try longs at 2056/55 expecting a bounce from here, but with stops below 2049. This trade also worked perfectly as we bottomed at 2054 to hit 2063. Be ready to go with a break below 2052 today to target December lows at 2049. If this does not hold the downside look for a short term buying opportunity at 2042/41 & a good chance of a low for the day. Longs need stops below 2035.

Holding support at 2056/55 is more positive & can target 2067/70. We should struggle here & a high for the day possible but be ready to go with a break higher to target 2075 then the all time high at 2079. Obviously this is the important level for the week but even in overbought conditions we could see a break higher to 2083 & possibly as far as 2086/87. If we continue higher this week look for 2092 then 2098/99.

USDCAD

USDCAD holding above 1.1466/1475 & hit our next target of 1.1495 perfectly. We topped exactly here in fact but could continue higher today towards 1.1558 then 1.1639 & perhaps as far as 1.1759 this week.

Immediate support at 1.1475/65 of course but below here risks a slide to 1.1425/20 for an excellent buying opportunity & a low for the day. Try longs with stops below 1.1395.

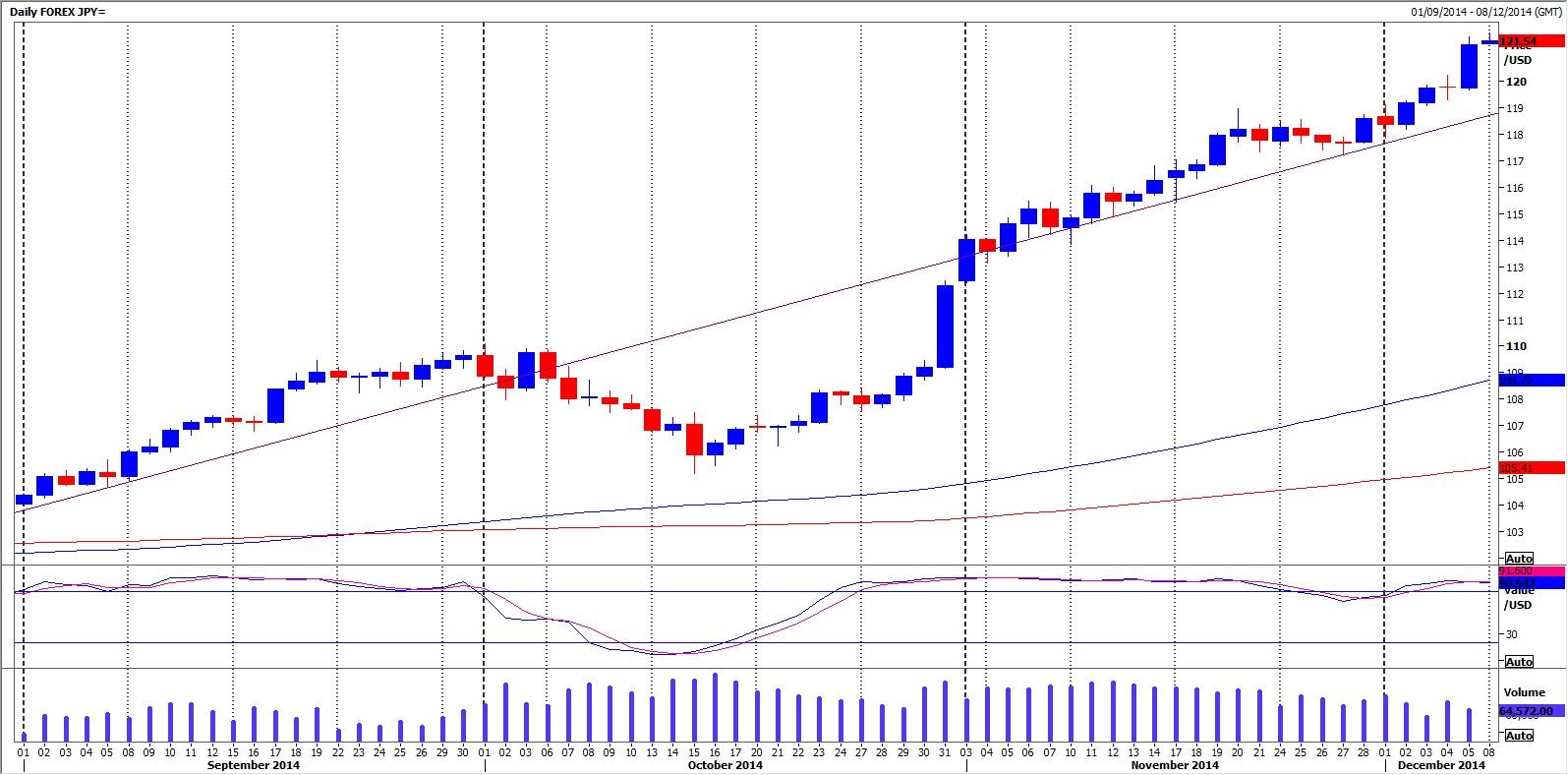

USDJPY

USDJPY has first resistance at 121.10 so it is probably worth profit-taking on our longs from 120.25/20 anywhere from here up to 121.10 for a potential 80 pip profit. However above 121.25 is more positive for today and may allow move towards 121.60/70 before yesterday's high at 121.84. Clearly there is no point in standing in front of this runaway train so be ready for a break higher to target 122.09/19. Any further gains this week target 122.44 then 123.00/09.

Our first support at 120.25/20 is obviously key to the downside again today & longs need stops below 120.00. Yesterday's price action was actually quite negative and when you bear in mind how severely overbought we are a break lower cannot be ruled out today. Be ready to jump into shorts on a break therefore and look for a downside target of 119.50/45. Exit all shorts and try longs here expecting a low for the day, but with stops below 119.25.

Dax December contract

Dax holding below 10,045/040 is more negative for today & risks a retest of support at 9970/9950. If however we continue lower today as looks likely, we could test strong support at 9890/80. Try longs with stops below 9850. However be ready to go with a break lower as this is a negative signal. We could quickly target 9785/80 then good support at 9745/40. A low for the day is certainly possible here but further losses target excellent support at 9710/9700. This is such good support that it could even mark the low for the week if we do experience a correction.

Immediate resistance at 2 day highs of 10093/099 then all time highs at 10,127 are now the key to direction of course. A break above here negates Thursdays negative price action to turn the outlook positive again and targets 10,160/170. Watch for a high for the day here but be ready to go with a break higher in the strong Bull trend to target 10,200 then 10,240/50.

The contents of our reports are intended to be understood by professional users who are fully aware of the inherent risks in Forex, Futures, Options, Stocks and Bonds trading. INFORMATION PROVIDED WITHIN THIS MATERIAL SHOULD NOT BE CONSTRUED AS ADVICE AND IS PROVIDED FOR INFORMATION AND EDUCATION PURPOSES ONLY.

Recommended Content

Editors’ Picks

EUR/USD clings to gains near 1.0700, awaits key US data

EUR/USD clings to gains near the 1.0700 level in early Europe on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price lacks firm intraday direction, holds steady above $2,300 ahead of US data

Gold price remains confined in a narrow band for the second straight day on Thursday. Reduced Fed rate cut bets and a positive risk tone cap the upside for the commodity. Traders now await key US macro data before positioning for the near-term trajectory.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta takes a guidance slide amidst the battle between yields and earnings

Meta's disappointing outlook cast doubt on whether the market's enthusiasm for artificial intelligence. Investors now brace for significant macroeconomic challenges ahead, particularly with the release of first-quarter gross domestic product (GDP) data on Thursday.