Forecast for 8th March 2013

XAU Spot Gold

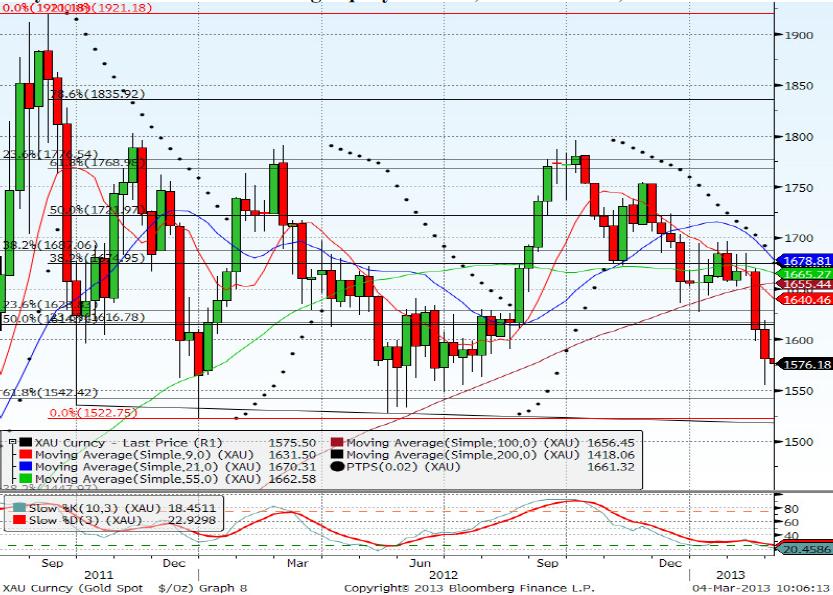

Spot Gold holding support at 1569/67 & 1587/88 resistance.

Below 1579 we could now test support at 1569/67 again today & a break below 1565 could signal a retest of February lows at 1555.

We will need to hold above 1579/80 for another test of 1587/88 resistance. This could hold the top of the market again today but if we start to push higher look for 1595 with 1605/09 the target above.

The contents of our reports are intended to be understood by professional users who are fully aware of the inherent risks in Forex, Futures, Options, Stocks and Bonds trading. INFORMATION PROVIDED WITHIN THIS MATERIAL SHOULD NOT BE CONSTRUED AS ADVICE AND IS PROVIDED FOR INFORMATION AND EDUCATION PURPOSES ONLY.

Recommended Content

Editors’ Picks

EUR/USD rises toward 1.0700 after Germany PMI data

EUR/USD gains traction and rises toward 1.0700 in the early European session on Monday. HCOB Composite PMI in Germany improved to 50.5 in April from 47.7 in March, providing a boost to the Euro. Focus shifts Eurozone and US PMI readings.

GBP/USD eases below 1.2350, UK PMIs eyed

GBP/USD is dropping below 1.2350 in the European session, as the US Dollar sees fresh buying interest on tepid risk sentiment. The further downside in the pair could remain capped, as traders await the UK PMI reports for fresh trading impetus.

Gold price flirts with $2,300 amid receding safe-haven demand, reduced Fed rate cut bets

Gold price (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark heading into the European session.

PENDLE price soars 10% after Arthur Hayes’ optimism on Pendle derivative exchange

Pendle is among the top performers in the cryptocurrency market today, posting double-digit gains. Its peers in the altcoin space are not as forthcoming even as the market enjoys bullish sentiment inspired by Bitcoin price.

Focus on April PMIs today

In the euro area, focus today will be on the euro area PMIs for April. The previous months' PMIs have shown a return of the two-speed economy with the service sector in expansionary territory and manufacturing sector stuck in contraction.