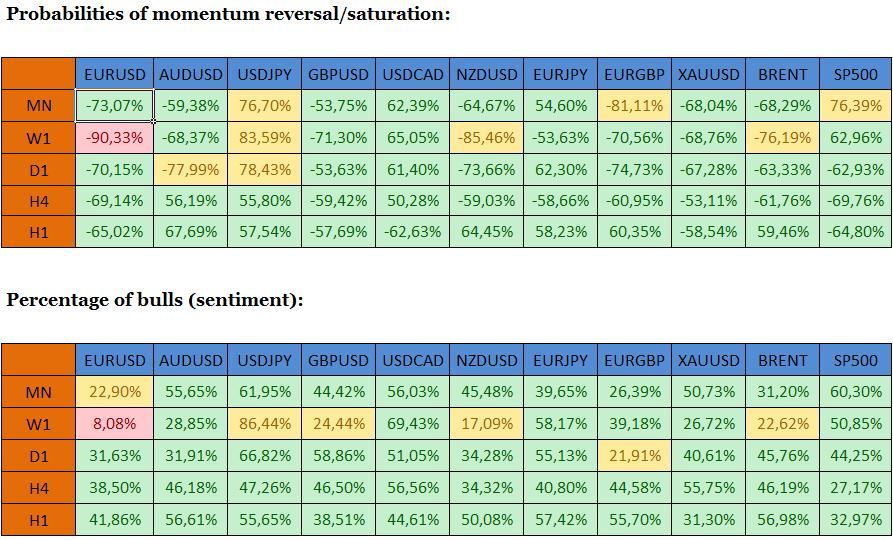

BETA - Propareos levels (areas where probabilities of price action reversal or saturation reach 90%; valid till 09:00 GMT):

EURUSD: 1.2805 -1.2820 on the upside, 1.2605-1.2620 on the downside.

AUDUSD: 0.8855-0.8870 on the upside, 0.8665-0.8680 on the downside.

USDJPY: 109.75-109.90 on the upside, 108.15-108.30 on the downside.

GBPUSD: 1.6380-1.6395 on the upside, 1.6165-1.6180 on the downside.

USDCAD: 1.1180-1.1195 on the upside, 1.1015-1.1030 on the downside.

NZDUSD: 0.8045-0.8060 on the upside, 0.7710 – 0.7725 on the downside.

EURJPY: 139.40-139.55 on the upside, 138.00-138.15 on the downside.

EURGBP: 0.7835-0.7850 on the upside, 0.7760-0.7775 on the downside.

XAUUSD: 1230.00-1240.00 on the upside, 1190.00-2000.00 on the downside.

BRENT: 98.00-99.00 on the upside, 94.00-95.00 on the downside.

SP500: 2010.00-2020.00 on the upside, 1935.00-1945.00 on the downside.

Warning! Propareos levels do not take into account fundamental developments. Their validity is reduced on days when the NFP is released and when Central Banks change their interest rate.

Recommended Content

Editors’ Picks

EUR/USD stays weak near 1.0650 ahead of Eurozone PMI data

EUR/USD remains on the back foot near 1.0650 in European trading on Tuesday. Resurgent US Dollar demand amid a cautious risk tone weighs on the pair. Investors stay wary ahead of the preliminary Eurozone and US business PMI data.

GBP/USD: Flat lines around mid-1.2300s, bearish potential seems intact

GBP/USD holds steady on Tuesday amid subdued USD demand, albeit lacks bullish conviction. The divergent Fed-BoE policy expectations turn out to be a key factor acting as a headwind. The technical setup suggests that the path of least resistance for the pair is to the downside.

Gold could see a rebound before resuming the correction

Gold price sees a fresh leg down in Asia on Tuesday even as risk flows dissipate. Receding fears over Middle East escalation offset subdued US Dollar and Treasury bond yields. Gold remains heavily oversold on the 4H chart, rebound appears in the offing.

PENDLE price soars 10% after Arthur Hayes’ optimism on Pendle derivative exchange

Pendle price is among the top performers in the cryptocurrency market today, posting double-digit gains. Its peers in the altcoin space are not as forthcoming even as the market enjoys bullish sentiment inspired by Bitcoin price.

After Monday's relief rally, attention shifts to earnings and policy fronts

With the easing of tensions in the Middle East, safe-haven demand reversed course; global stock markets experienced a modicum of relief. Indeed, in a classic relief rally fashion, Monday saw a rebound in the S&P 500, snapping a six-day losing streak.