Draghi disappointed our and the aggressive market expectations despite delivering a ‘menu’ of monetary easing measures.

The easing from the ECB included:

1. A 10bp deposit rate cut to -0.30% (the MRO rate was kept unchanged at 0.05%).

2. An extension of the QE programme by six months until the end of March 2017, but the ECB did not expand the monthly purchases of EUR60bn. (The purchases will continue until the ECB sees a sustainable adjustment in the path of inflation).

3. A decision to reinvest the principal payments on the securities purchased under the QE purchases as they mature, for as long as necessary.

4. An inclusion of bonds issue by regional and local governments located in the euro area.

5. A continuation of the fixed rate tender procedures with full allotment for as long as necessary.

Markets priced a 15bp deposit rate cut ahead of the meeting and most analysts also expected an expansion of the monthly purchases, hence the measures were not enough to fulfil expectations. We had also expected the ECB to reintroduce its old forward guidance on possibly lower policy rates, implying some probability of an additional cut could still be priced in, but this was not the case. The decision taken today was not unanimous, but based on a large majority. It remains unknown whether some ECB members had argued for more or less easing, but compared to Draghi’s previous very dovish comments, it could be that he had argued for more aggressive easing.

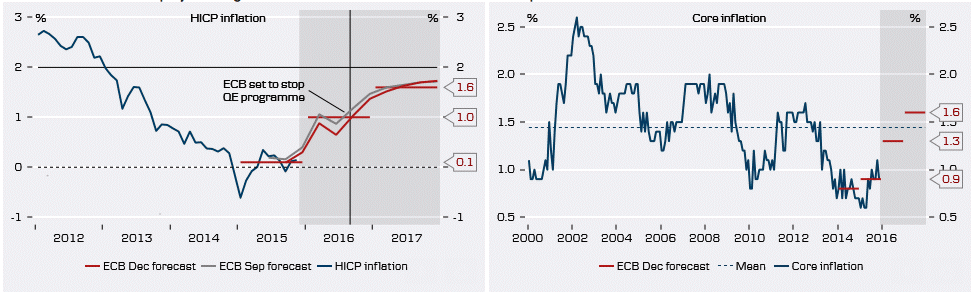

In terms of further easing, Draghi declined to answer whether the ECB had reached the lower bound on policy rates. Draghi only said that the ECB is ready and willing to use all prevailing tools. Moreover, he argued that the ECB was confident the decisions are adequate to reach the goal of inflation below, but close to 2% in the medium-term. The ECB revised its HICP inflation forecast slightly lower in 2016 and 2017 and only lowered its core inflation forecast for 2016 to 1.3% from 1.4% and kept it unchanged at 1.6% in 2017.

Draghi expressed optimism about the outlook for GDP growth, and the ECB’s projections for activity were revised slightly higher. Added to this, Draghi argued that the ECB’s easing measures supported the recovery, saying that QE had been quite effective, credit had become much cheaper and its volumes had become much broader.

The less aggressive move from the ECB together with today’s communication indicates that the bar for more easing is quite high. Hence, although the ECB did not deliver the menu of easing we had looked for, we expect the easing today to mark the end of easing. In the near term, base effects should lift inflation above 1.0% as early as January and the latest economic survey indicators also point to a stronger recovery in 2016. Moreover, with the Fed set to start hiking in December, the downside to EUR/USD from relative rates should weigh on a 3M horizon.

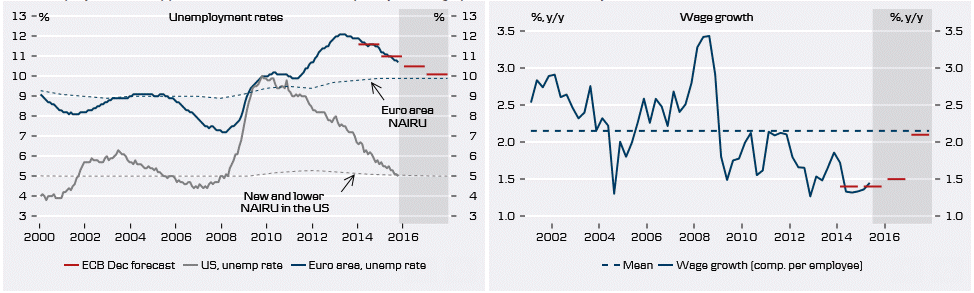

The risk to our expectation of the end of easing is that the ECB will eventually be forced to lower its core inflation forecast, which, in our view, is still too optimistic. Related to this, the ECB will be challenged by EUR appreciation pressure and the negative impact on inflation. That said, as the unemployment rate quickly approaches its structural level of 9.9%, wage pressure should return and ECB will not ease again.

Fixed income market reaction

With the extensive deposit cut expectations (15bp now, 25bp in total priced before the meeting) the post-meeting disappointment was centered in the front, leading to a complete re-pricing of the front-end, with an increase of up to 15bp in the Eonia forward curve it almost flat until mid 2017. Correspondingly, the 2y German yield has increased 14bp. With the outlook for a deposit rates kept at -30bp going forward, Eonia and 3m Euribor should settle around -24bp and -14bp respectively. Going forward, the front-end should be very anchored, with ECB on hold.

Further out, yields on longer maturities mirrored the movements in the front, taking 10y Germany to 0.64%. We think the sell off is too early to fade with our constructive macro outlook, the prospect of the Fed hiking in two week’s time and a very subdued term risk premium still being in the curve.

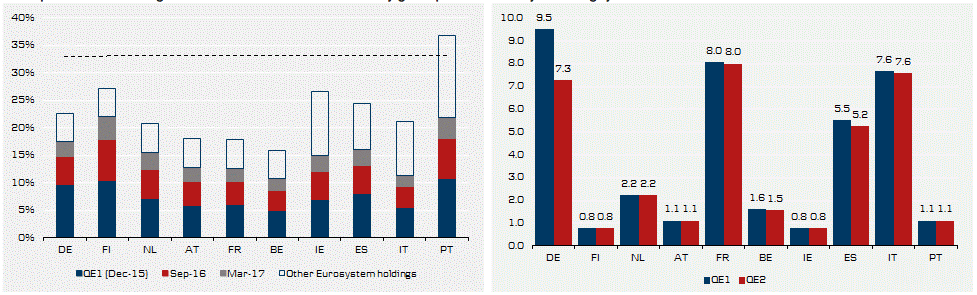

For the periphery, the disappointment over the QE programme changes caused significant volatility, with the Italy-Germany spread traded in a 20bp range compared to pre-announcement. That said, the spread quickly came under 100bp and still stands below the level before the October ECB meeting. Interestingly, the inclusion of regional and local governments in the QE universe is almost only an issue for German purchases, as EUR241bn out of EUR301bn in the eligible universe is in Germany. Hence, fear of scarcity in Bunds purchases should be less going forward. The reinvestment of matured QE purchases should from a market perspective not have any effect, as it was widely expected after recent comments from Praet and fully in line with lessons from US and UK QE programmes.

FX market reaction

In light of the high expectations and heavy short EUR positioning going into the ECB meeting, the initial jump in EUR/USD towards the 1.09 mark seems ‘fair’. The small rate cut, the lack of any forward guidance, and the fact that no two-tiered deposit rate system was introduced (this could have opened up the probability space for rates on the downside) should be supportive of EUR crosses near term. That said, our short-term financial model suggests that we are seeing an overshooting in the cross at present putting EUR/USD ‘fair’ at 1.07. Notably, as a good deal of short EUR bets should have been covered in today’s rally, risks should be on the downside short term. Indeed, a key driver of downside in the cross near term remains the Fed: a first hike now seems more or less a done deal provided payrolls do not plunge tomorrow. While the FOMC ‘dots’ may be revised in a more dovish direction in December, we still project a more aggressive Fed in 2016 than what is currently priced in, and thus see EUR/USD under pressure from this side in 1-3M. A rebound in EUR/USD in 6-12M is still on our agenda though.

EUR/SEK bounced on the ECB announcement, trading back above the 9.20 psychological floor. Short term, EUR/SEK should bounce further given that the latest move lower in EUR/SEK has been driven by aggressive ECB expectations. Still, the trading range for EUR/SEK has moved lower to 9.10-9.50 and the market is likely to test the Riksbank’s willingness to maintain a weak SEK. EUR/NOK has also bounced on the ECB disappointment. However, an important near-term driver for NOK could be the OPEC meeting tomorrow, but we expect oil prices to be little changed on this. Expect recent EUR/DKK downside pressure to stall following ECB disappointment. Should significant downward pressure re-emerge, we expect Danmark’s Nationalbank (DN) to cap EUR/DKK downside around 7.4500 using FX intervention.

ECB did not fulfil the aggressive market expectations - higher short-end EUR rates

PSPP purchases of EUR govies - far from the 33% limit Monthly govie purchases likely to be sligtly lower under QE2

Regional and local government bonds mainly issued in Germany

ECB's updated projections

ECB lowered its inflation projection again ECB's core inflation forecast remains too optimistic

The unemployment rate approaches the structural level quickly The wage pressure will eventually return, but not until 2017

Source: Bloomberg, ECB, Eurostat, Danske Bank Markets

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.