Abenomics and the yen trajectory

After seemingly trying in vain to weaken the yen, the Bank of Japan finally started to see some long-awaited downside in the yen, falling 17.1 percent in six months.Following the re-election of Shinzo Abe’ in a snap election, the trajectory of the yen and the policies of “Abenomics†remain closely tied

Yen weakness, inflation, but no growth

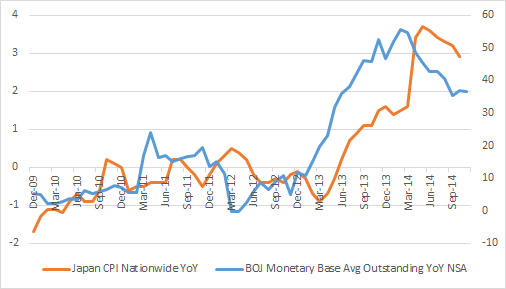

The Bank of Japan may have achieved its objectives in term of a weaker yen and resultant imported inflation, but consumer spending and economic growth remain weak. Expect to see a continuation of aggressive monetary expansion in 2015 as Abe and BoJ governor Haruhiko Kuroda try to transmit monetary policy to the wider economy.

The hunt for Japanese growth

Despite the aggressive policies being pursued by Japanese prime minister Shinzo Abe, the Japanese economy has struggled to show any significant recovery. But after being re-elected after a snap election, the yen outlook and Abenomics are inextricably linked.The three arrows of Abenomics

Shinzo Abe’s “Abenomics†programme consists of three arrows targeted at fighting Japanese disinflation pressures and the two decades of economic stagnation experienced by Japan. Unlike the UK and the US, where monetary and fiscal policy have diverged, at least in stated policy objective terms with monetary expansion being joined by fiscal constraint, Abe has pursued both fiscal and monetary expansion.The first of his three arrows has been aimed at the monetary base, printing between JPY60-70 trillion yen (later upped to its current JPY80 trillion)in an effort to force generate some inflationary pressures. Though not explicitly targeted, the hope has been that the measures would result in a weaker yen and increased domestic price levels.

Unlike the US and the UK and to a much smaller degree Europe, Japan has not pursued fiscal reduction policies. Instead it has ushered in large-scale government spending programmes in an effort to stimulate aggregate demand, running up the world’s biggest debt burden in the process.

The third arrow of Abenomics is a less straightforward task than simply bashing the yen down and the government spending more money to try and get the population to follow suit. Instead, his plans for widespread regulatory reforms have been a tougher task to implement – among the targets has been Japan’s historically rigid labour markets in an attempt to make hiring and firing a less legally arduous process.

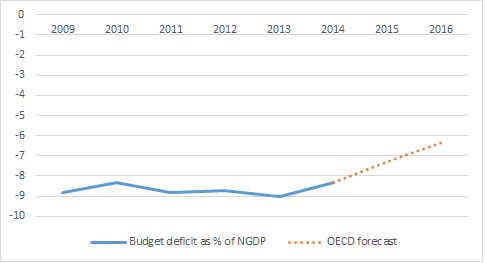

Japanese deficit

The Japanese government is running one of the highest deficits in the world as a percentage of nominal GDP and has accumulated the highest government debt.

Effectiveness of Abenomics

In the first of these three arrows Abe has finally found a degree of success. For three + years of trashing Japan’s currency, the Bank of Japan has been blighted by haven demand for yen given the turmoil in both the US and Europe, with expansionary policies failing to gain traction. However the yen finally started to listen to the BoJ’s commands in the second half of this year, declining 17.1 percent against the dollar, breaking to a high of JPY121.46 after five years of struggling to break JPY105 or even into triple figures. And with it Abe finally managed to get his long-desired uptick in inflation, through the BoJ’s 2 percent target range.Following Abe’s snap election victory in December, the Japanese prime minister has an increased mandate to push through further, more aggressive stimulus policies with the aid of BoJ governor Haruhiko Kuroda. In 2015 we will see further aggressive monetary expansion policies form the BoJ.

Against a backdrop of the normalisation of US Federal Reserve monetary policy and the anticipated move into a tightening phase, the USD/JPY rate is primed to be pushed higher, with a JPY125 target not out of the question going into the second quarter of 2015.

In terms of the economic picture, Japan is seeing plenty of upside thanks to a number of factors including the changes in asset allocation for the Japanese Government Investment Fund, the postponement of the planned VAT rate hike and cuts to corporation tax. In addition, the restarting of Japanese nuclear power plants in 2015, as well as a proposed package of reforms to encourage Female participation in the labour market are expected to improve the fundamental outlook.

Technical analysis

_20141224152610.png)

2014 began quietly for the USD/JPY pair after it added nearly 2500 pips in 2013. For the first half of the year, the pair was confined to a tight 400 pips range, until it finally exploded to advance over 2000 pips in the six months from July. It was a mixture of dollar strength and continued stimulus from the BOJ that pushed the pair to a 7-year high at JPY121.84.

On a monthly basis the technical picture shows 6 months of steady gains to December that points out to close with a doji. RSI stands at historical highs of JPY82 and is beginning to look exhausted, while momentum reached a lower high around currently JPY121 level and lost upward steam. The price in the meantime, stands more than 1200 pips away from its 200 SMA.

All of this suggests a top may have come into place, but by no means is a sign of a reversal. The most market players can expect if the top is confirmed, is a consolidative stage that can extend into the first months of 2015. But it the price manages to breach the JPY122.00 level, the rally can extend with not much in the middle up to JPY124.13, June 2007 high while if this last is finally taken, speculators will likely put their eyes on the JPY130.00 figure

To the downside, the risk of a stronger correction will come with a break below this December low at JPY115.55 that may lead to a downward extension towards JPY112.30, where the pair still has an unfilled gap following late October surprise stimulus announced by the BOJ. If somehow the price reaches that level, which has limited possibilities from a fundamental point of view, the next movement will be determinative for the long term trend, as a bounce from there should revive demand and see price advancing again towards JPY120.00, while a break below will signal a steady decline that can extend down to JPY105.00 over the following months.

Recommended Content

Editors’ Picks

EUR/USD holds gains near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.