Increasing uncertainty ahead

2014 was the year that UK economic growth finally got traction, with economic projections seeing regular upward revision and the speed with which the unemployment level tumbled forced the Bank of England to abandon its focus on the labour market in its forward guidance. But how sustainable is this growth and how much upside is left?Hikes being priced into Q4 2015

Any hike in the Bank of England base rate is now being priced further and further into 2015, with short sterling interest rate futures now pricing a first rate hike in the fourth quarter of the year, with the central bank cautious of hiking in the low inflation, low wage growth environment, with the additional threat of the weak Eurozone economy.

The UK’s productivity conundrum

The latest labour productivity data from the Office for National Statistics at the time of publication showed that UK labour productivity measured by output per hour was unchanged in the second quarter of 2014 compared with the previous quarter, and down 0.3 percent on the year, in line with a longer-running trend.Output per hour fell by 0.1 percent in the second quarter in service industries, and grew by 0.7 percent in the production industries.

Whole economy unit labour costs increased slightly in the second quarter but have fallen a little over the last year with a similar picture in manufacturing unit wage costs.

The ONS reported that extensive revisions to measures of economic output (and to a lesser extent to measures of labour input) have significantly revised the productivity record prior to the downturn, and especially over 2008-12. However, the ONS stressed that these revisions do not materially dispel the 'productivity conundrum': in Q2 2014 output per hour was some 16 percent lower than would have been the case had the pre-downturn trend continued.

This weakness in productivity per hour is a growing concern for 2015 growth prospects. As the UK labour market trends towards “full employment†around the 5 percent mark, the economy is going to have to see an increase in productivity to bolster GDP growth rather than relying in improving employment rates from their depths-of-recession levels.

In addition, despite the pickup in the headline measures of economic growth, the UK economy is still struggling to transmit that broader growth into wage hikes – ultimately linked to productivity gains.

UK chancellor George Osborne has recently been quick to highlight the return to real wage growth in the UK economy. But real wages (nominal wages less CPI inflation) have only showed by recent returns to positive growth, supported by short to medium-term transient low inflation levels.

Putting increased pressure on the need for improvements in UK productivity is the unlikelihood of any significant recovery in demand for UK exports from the Eurozone.

What deficit?

A further source of growing concern is Chancellor George Osborne’s increasing ambivalence towards the size of the UK current account deficit – something he seized upon as a key component of his “long term economic plan†when taking over as Chancellor of the Exchequer. The latest data from the Office for National Statistics (the statistical office established by Osborne) shows that the UK’s current account deficit widened to GBP27 billion in the third quarter of 2014, up from a revised GBP24.5 billion in the second quarter. The latest data shows that the UK deficit has soared to a record 6 percent of GDP at current market prices._20150112093344.png)

In addition, the UK has gone from running a GBP15bn surplus on foreign direct investment in 2011 to now being in deficit – pushing the deficit on the primary income account to GBP12.6 billion from GBP8.2 billion in the third quarter.

General Election uncertainty

The biggest uncertainty on the horizon for the UK is the General Election on 7 May. Under the first past the post (FPTP) system, all 650 seats of the House of Commons will be up for grabs, with the individual in each individual constituency that takes the most votes winning the seat.The current coalition government is a rarity in UK electoral history and the first coalition since the Second World War. It is composed of the centre-right Conservative Party and the Liberal Democrats (founded in 1988 with an amalgamation of Liberal Party and the Social Democratic Party with a broadly centre-left position).

_20150112093434.png)

The forthcoming general election is perhaps the most narrowly contested in living memory. Although the Conservative Party has crept into the lead in some recent polling, due to the FPTP system, Labour remain favourites to win sufficient seats to form a government. However, it is equally likely that we could see a hung parliament, with neither the Conservatives nor the LibDems garnering sufficient seats to form a majority and leading to another coalition or a second election in 2015.

The UK has a liberalised political betting market and as such the bookmakers have historically been among the most accurate forecasters of elections in the UK and abroad. Ladbroke’s currently have the Labour and Conservative parties neck and neck at 10/11 to take the most seats, with the odds-on favourite for the electoral outcome is one of no overall majority (5/2). A Labour majority post-election government is at 4/1, tied with a Conservative/Liberal Democrat coalition government. William Hill has a Con/Lib Dem coalition edging out into the lead at 7/2 compared with a Labour majority at 4/1.

_20150112093529.png)

While it is theoretically possible that in the event of no party able to command a ruling majority by itself then the Conservative Party could go into coalition with Ukip, it is more likely that Ukip will instead influence the policy decisions taken by the major parties. Though Ukip have been polling ahead of the Lib Dems for the popular vote for the last 12 months, under FPTP it is unlikely they’ll win more seats than the traditional third party. A big question leading into the general election is how many votes Ukip will take from traditional Labour voters – while Ukip were originally seen as the home of disaffected Conservative voters, they have recently shown that they can challenge Labour in their traditional heartlands, recently coming close to causing an upset in the Heywood and Middleton by-election.

_20150112093617.png)

The biggest market impact of the general election could come if the Conservatives win a majority. David Cameron’s party have promised a referendum on Britain’s membership of the EU by 2017 if they win the election. The prime minister has said that he intends to renegotiate the UK’s position with the EU and then campaign for the “Yes†camp to stay within the EU in the referendum. However, a Conservative win with the prospect of a referendum within 2 years of the election would significantly raise the stakes in terms of the UK’s power to renegotiate its position. Neither the Labour nor Liberal Democrat parties support a referendum on EU membership.

The move in the UK yield curve with 6 month yields pushing out above the 1 year Gilt reflects this uncertainty running into the second quarter of 2015, however, we anticipate that this kink will be ironed out should we see some resolution in the current UK political uncertainty.

Technical analysis

EUR/GBP

_20141224152405.png)

Sterling enjoyed the attention of investors early 2014, with market participants anticipating that the UK would probably be following the US in the path of tightening its monetary policy. But half way things turned around: economic data became weaker and the BoE less willing to change course. Nevertheless, the market believes that fundamentally, GBP is in better shape than the EUR, and the EUR/GBP cross reflects so.

Having started the year at GBP0.8298, the EUR/GBP cross points to close it a couple hundred pips above the year low 0f GBP0.7766 reached last September. For the long term, the picture is not as bearish as it may seem at a first glance, as the monthly chart shows indicators recovering from oversold readings, now closer to the their midlines. The same chart shows the relevance of the year low, as the area has contained the downside since March 2008, resulting however in lower highs as time went by. Still there is no a clear downward momentum that confirms the bearish continuation, albeit is clear that the EUR remains weaker than the GBP fundamentally, increasing the risk of a bearish breakout.

The GBP0.7750 price zone therefore holds the key, as a clear break below it should signal further declines with next big target around GBP0.7260, May 2005 monthly high. The GBP0.8050/0.8100 price zone is the other side of the coin as once above the picture will turn more bullish, pointing for an upward continuation up to GBP0.8300, a long term descendant trend line coming from December 2008.

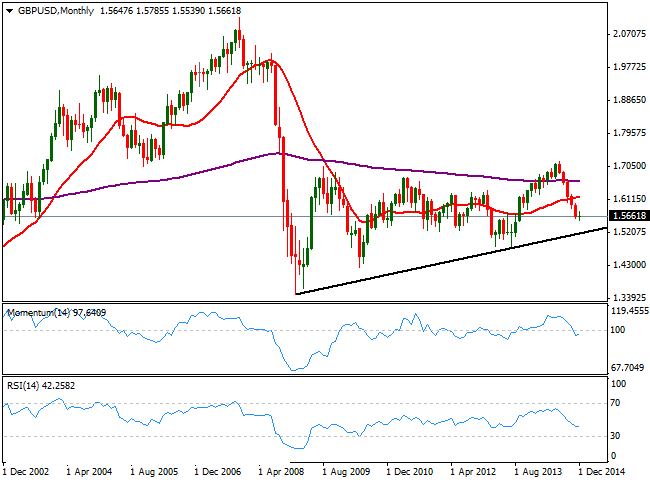

GBP/USD

Technically, the monthly chart shows that the price develops below its 20 SMA, and while indicators broke below their midlines last November. The limited range of December however, has left indicators directionless but below their midlines. The pair has closed in the red for six month in a row, and December doji alongside with indicators losing their downward potential, suggest the pair may correct higher in the first quarter of 2015. If the movement is a correction or a change in the dominant bearish trend is something yet to be confirmed.

A break below the year low should signal further declines ahead, eyeing a long term ascendant trend line coming from USD1.3501 January 2009 low, comes as the probable bearish target then around USD1.5200, whilst below this last there will be little room to maneuver to the upside. The breakout point to the upside stands at USD1.6000 well above the current level, and further above, the 38.2 percent retracement of the latest monthly decline stands at USD1.6165, almost 1000 pips above current level. It will take a recovery above this last to confirm a GBP comeback in the long term, back towards the USD1.7000 figure.

Recommended Content

Editors’ Picks

AUD/USD pressures as Fed officials hold firm on rate policy

The Australian Dollar is on the defensive against the US Dollar, as Friday’s Asian session commences. On Thursday, the antipodean clocked losses of 0.21% against its counterpart, driven by Fed officials emphasizing they’re in no rush to ease policy. The AUD/USD trades around 0.6419.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Runes likely to have massive support after BRC-20 and Ordinals frenzy

With all eyes peeled on the halving, Bitcoin is the center of attention in the market. The pioneer cryptocurrency has had three narratives this year already, starting with the spot BTC exchange-traded funds, the recent all-time high of $73,777, and now the halving.

Billowing clouds of apprehension

Thursday marked the fifth consecutive session of decline for US stocks as optimism regarding multiple interest rate cuts by the Federal Reserve waned. The downturn in sentiment can be attributed to robust economic data releases, prompting traders to adjust their expectations for multiple rate cuts this year.