What ProAct Forex Target Traders See: We are currently sitting @ 1.1135 and could be finishing a 4th wave (although no a-b-c is seen yet). Short term of course you can see a potential move down to the 1.0993 before the bounce. Either way we are looking to continue to the R6 @ 1.1338 with a continuation to the 1.270 Fibo @ 1.1476. The average daily true range (ATR) for the pair currently is 101 pips.

————————————————————————--

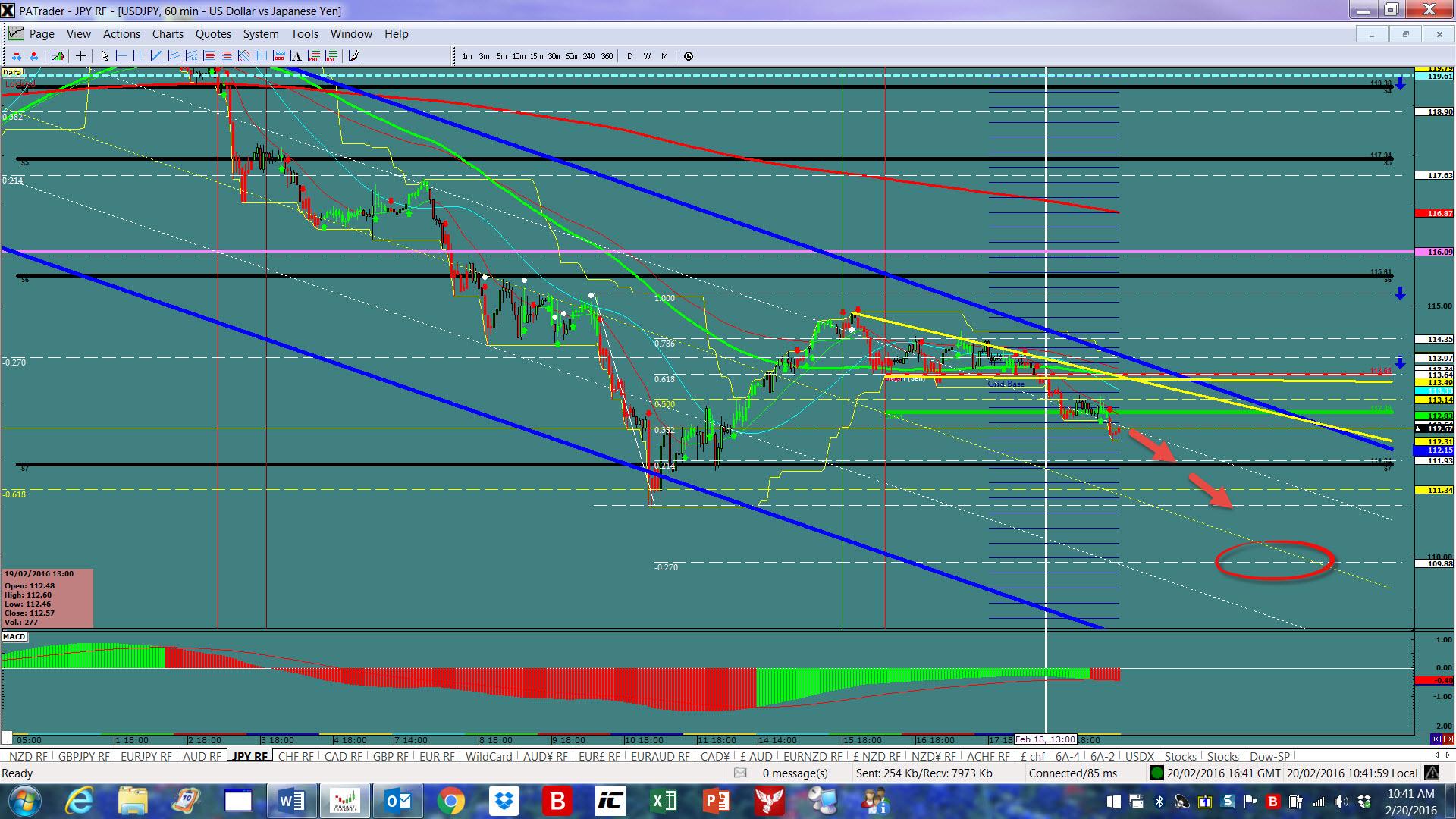

$USDJPY

What ProAct Forex Target Traders See: We are currently @ 112.57. We are looking for a move to the S7 again @ 111.93 and then the Fibo @ 109.88. Watch for an inverse head & shoulder pattern. The average daily true range (ATR) for the pair currently is 141 pips.

——————————————————————————–

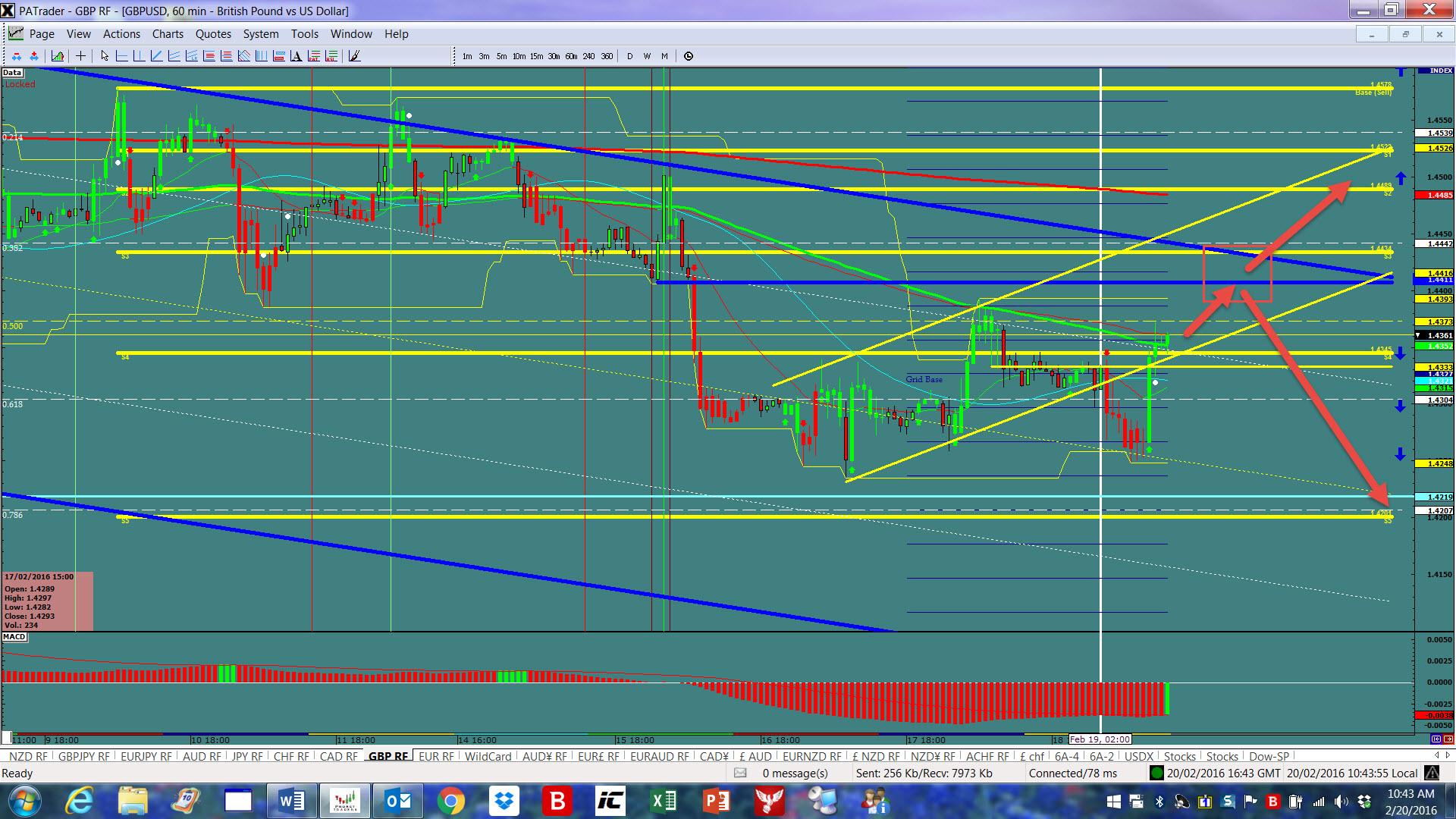

$GBPUSD

What ProAct Forex Target Traders See: Cable is currently @ 1.4361 back in the up channel after a quick breakout. We are looking for a move to the square up @ 1.4411 and a POSSIBLE move down to 1.4200 or a breakout to the1.4500. The average daily true range (ATR) for the pair currently is 134 pips.

——————————————————————————–

$AUDUSD – A great smooth currency for Newbie’s!

What ProAct Forex Target Traders See: Aussie is @ 0.7145 (9 pips from this time last week) and in a wedge in a large range. A couple of different scenarios: 1: Bullish: a move to the range top @ 0.7400 area and 2: Bearish: A break down to the Fibo support @ 0.6816. The average daily true range (ATR) for the pair currently is 86 pips.

ProAct Traders™ (hereafter, PAT) assumes no responsibility for errors, inaccuracies, or omissions, nor does it warrant the accuracy or completeness of the information in the materials that comprised the text, graphics or other items contained in the ProAct Charts as a result of computer or power failures or interruptions in the electronic delivery systems via the Internet. PAT shall not be liable for any special, indirect, incidental or consequential damages including without limitation losses, lost revenue, or lost profits that may result from these materials.

Foreign Currency Trading carries a level of risk / reward that may not be suitable for all considering participation in the market known as Forex. The Forex is a "zero sum" market and its end effect is that there are an equal number of winners and losers. Consequently, the possibility exists that you could sustain an eventual loss of some or all of you initial investment. Therefore, you should never invest money that you cannot afford to lose. Before deciding to trade the Forex, you should become thoroughly educated in how the market works, have a sound money management plan and then carefully consider your investment objectives, level of experience, and risk appetite. If you have any doubts, seek advice from an independent financial advisor.

Recommended Content

Editors’ Picks

AUD/USD hovers around 0.6500 amid light trading, ahead of US GDP

AUD/USD is trading close to 0.6500 in Asian trading on Thursday, lacking a clear directional impetus amid an Anzac Day holiday in Australia. Meanwhile, traders stay cautious due ti risk-aversion and ahead of the key US Q1 GDP release.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.