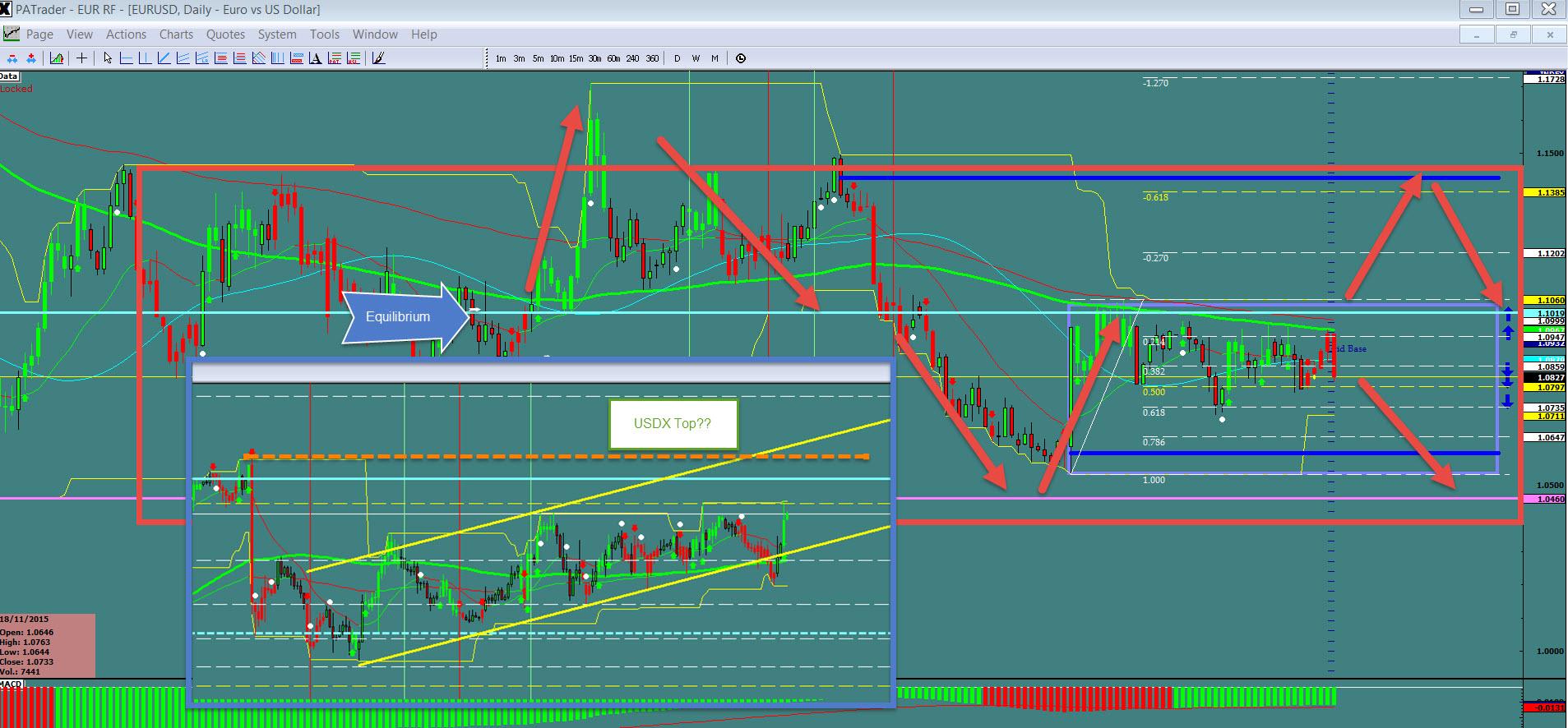

What ProAct Forex Target Traders See: We are currently sitting @ 1.0827 and ranging. I have posted the inset of the USDX which is potentially close to topping out so we are setting up for an interesting opportunity. If the USDX reacts to the downside at the top, we should see Euro strength up to 1.1202 and maybe higher. Short term of course you can see a potential move down to the 1.0500. The average daily true range (ATR) for the pair currently is 82 pips.

————————————————————————--

$USDJPY

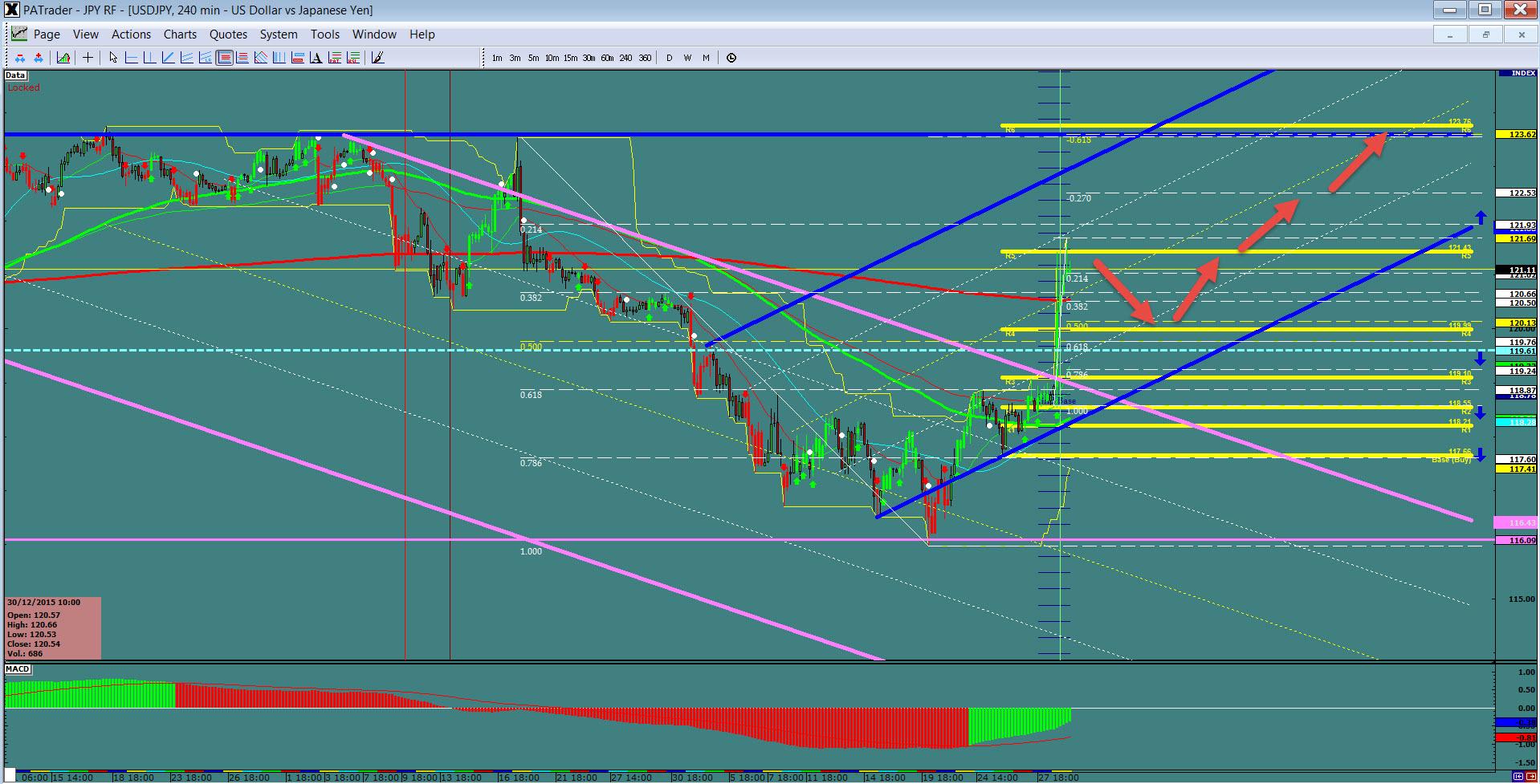

What ProAct Forex Target Traders See: We are currently @ 121.11 and a nice reaction from the BOJ. We are looking for a pullback to the R4/0.500 Fibo and then a bounce to 122.53 with a further target @ 123.62. The average daily true range (ATR) for the pair currently is 112 pips.

——————————————————————————–

$GBPUSD

What ProAct Forex Target Traders See: Sterling is currently @ 1.4241 and while currently still in a range, is most likely in a 5th wave down. We are looking for a continuation to the S5 @ 1.43370 and then a continuation to the S6 area @ 1.3804-38. The average daily true range (ATR) for the pair currently is 133 pips.

——————————————————————————–

$AUDUSD – A great smooth currency for Newbie’s!

What ProAct Forex Target Traders See: Aussie is @ 0.7068 and still in a large range. A couple of different scenarios: 1: Bullish: a move to the square up @ 0.7267 area) and 2: Bearish: A break down to the support @ 0.6816. The average daily true range (ATR) for the pair currently is 94 pips.

ProAct Traders™ (hereafter, PAT) assumes no responsibility for errors, inaccuracies, or omissions, nor does it warrant the accuracy or completeness of the information in the materials that comprised the text, graphics or other items contained in the ProAct Charts as a result of computer or power failures or interruptions in the electronic delivery systems via the Internet. PAT shall not be liable for any special, indirect, incidental or consequential damages including without limitation losses, lost revenue, or lost profits that may result from these materials.

Foreign Currency Trading carries a level of risk / reward that may not be suitable for all considering participation in the market known as Forex. The Forex is a "zero sum" market and its end effect is that there are an equal number of winners and losers. Consequently, the possibility exists that you could sustain an eventual loss of some or all of you initial investment. Therefore, you should never invest money that you cannot afford to lose. Before deciding to trade the Forex, you should become thoroughly educated in how the market works, have a sound money management plan and then carefully consider your investment objectives, level of experience, and risk appetite. If you have any doubts, seek advice from an independent financial advisor.

Recommended Content

Editors’ Picks

EUR/USD rises toward 1.0700 after Germany and EU PMI data

EUR/USD gains traction and rises toward 1.0700 in the European session on Monday. HCOB Composite PMI data from Germany and the Eurozone came in better than expected, providing a boost to the Euro. Focus shifts US PMI readings.

GBP/USD holds above 1.2350 after UK PMIs

GBP/USD clings to modest daily gains above 1.2350 in the European session on Tuesday. The data from the UK showed that the private sector continued to grow at an accelerating pace in April, helping Pound Sterling gather strength.

Gold price flirts with $2,300 amid receding safe-haven demand, reduced Fed rate cut bets

Gold price (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark heading into the European session.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.