What ProAct Forex Target Traders See: We are currently sitting @ 1.0590. We are looking for a break of the support and then a move to the S6 support @ 1.0462 with an overall target of 1.0378. The average daily true range (ATR) for the pair currently is 76 pips.

————————————————————————--

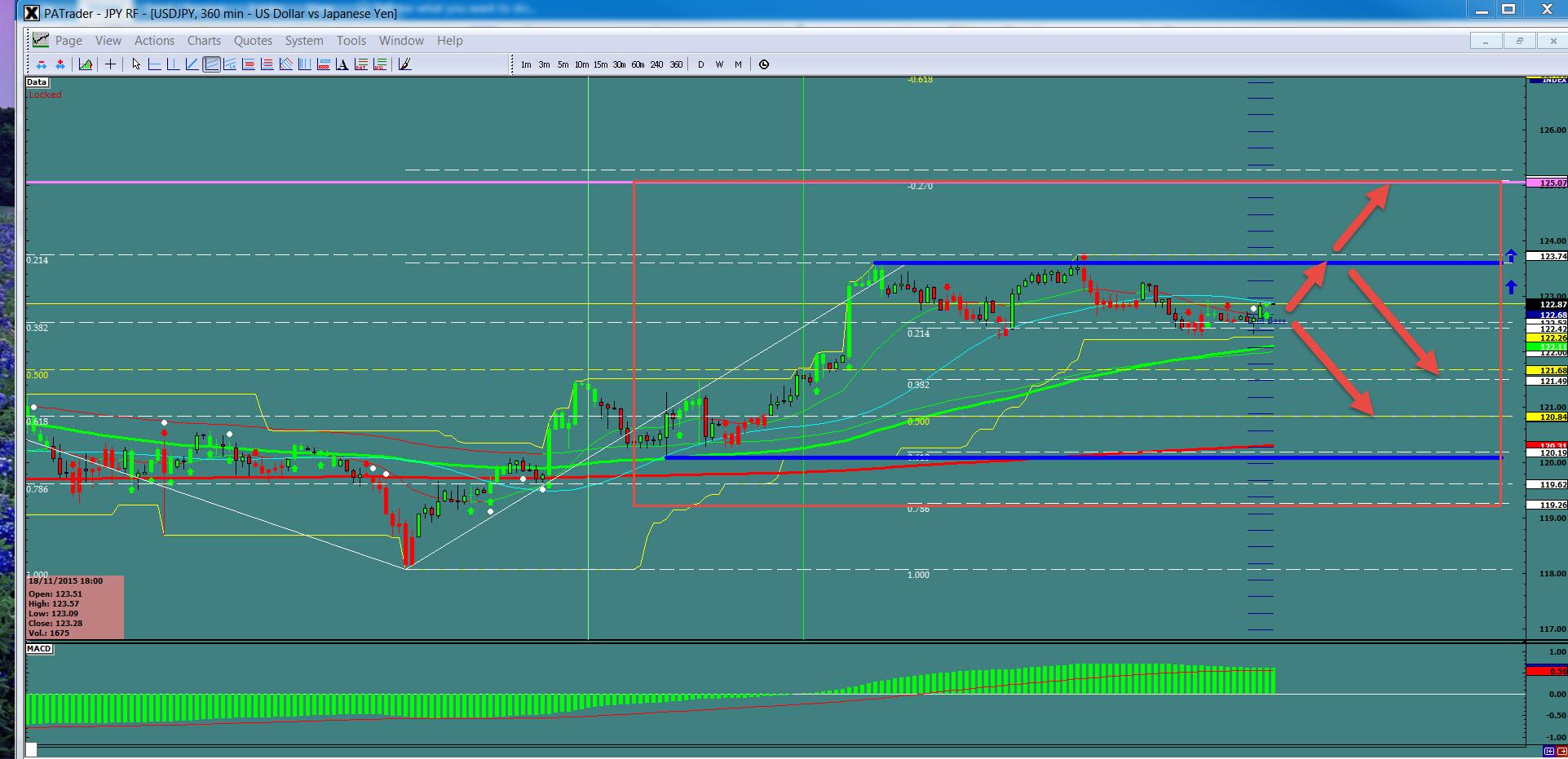

$USDJPY

What ProAct Forex Target Traders See: We are currently @ 122.86 in a sideways move AGAIN. We are WAITING for direction! A couple of different scenarios: 1: Bullish: a move to the upper day chart top @ 125.07 area) and 2: Bearish: A break down to the 0.500 Fibo support @ 120.84. The average daily true range (ATR) for the pair currently is 52 pips.

——————————————————————————–

$GBPUSD

What ProAct Forex Target Traders See: Sterling is currently @ 1.5033. We said last week “We are looking for a move to the support @ 1.5028”. A continuation here targets the 1.4905 with a continuation to the 11.4869 support. The average daily true range (ATR) for the pair currently is 72 pips.

——————————————————————————–

$AUDUSD – A great smooth currency for Newbie’s!

What ProAct Forex Target Traders See: Aussie is @ 0.7130 in a large box. A couple of different scenarios: 1: Bullish: a move to the upper range @ 0.7686 area) and 2: Bearish: A break down to the support @ 0.7013. The average daily true range (ATR) for the pair currently is 61 pips.

ProAct Traders™ (hereafter, PAT) assumes no responsibility for errors, inaccuracies, or omissions, nor does it warrant the accuracy or completeness of the information in the materials that comprised the text, graphics or other items contained in the ProAct Charts as a result of computer or power failures or interruptions in the electronic delivery systems via the Internet. PAT shall not be liable for any special, indirect, incidental or consequential damages including without limitation losses, lost revenue, or lost profits that may result from these materials.

Foreign Currency Trading carries a level of risk / reward that may not be suitable for all considering participation in the market known as Forex. The Forex is a "zero sum" market and its end effect is that there are an equal number of winners and losers. Consequently, the possibility exists that you could sustain an eventual loss of some or all of you initial investment. Therefore, you should never invest money that you cannot afford to lose. Before deciding to trade the Forex, you should become thoroughly educated in how the market works, have a sound money management plan and then carefully consider your investment objectives, level of experience, and risk appetite. If you have any doubts, seek advice from an independent financial advisor.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.