What ProAct Forex Target Traders See: We are currently sitting @ 1.2178. Looking to see what reaction we get at the 2.618 Fibo @ 1.2109. A break down here would set up a nice move to the S6 @ 1.1993. The average daily true range (ATR) for the pair currently is 97 pips.

————————————————————————--

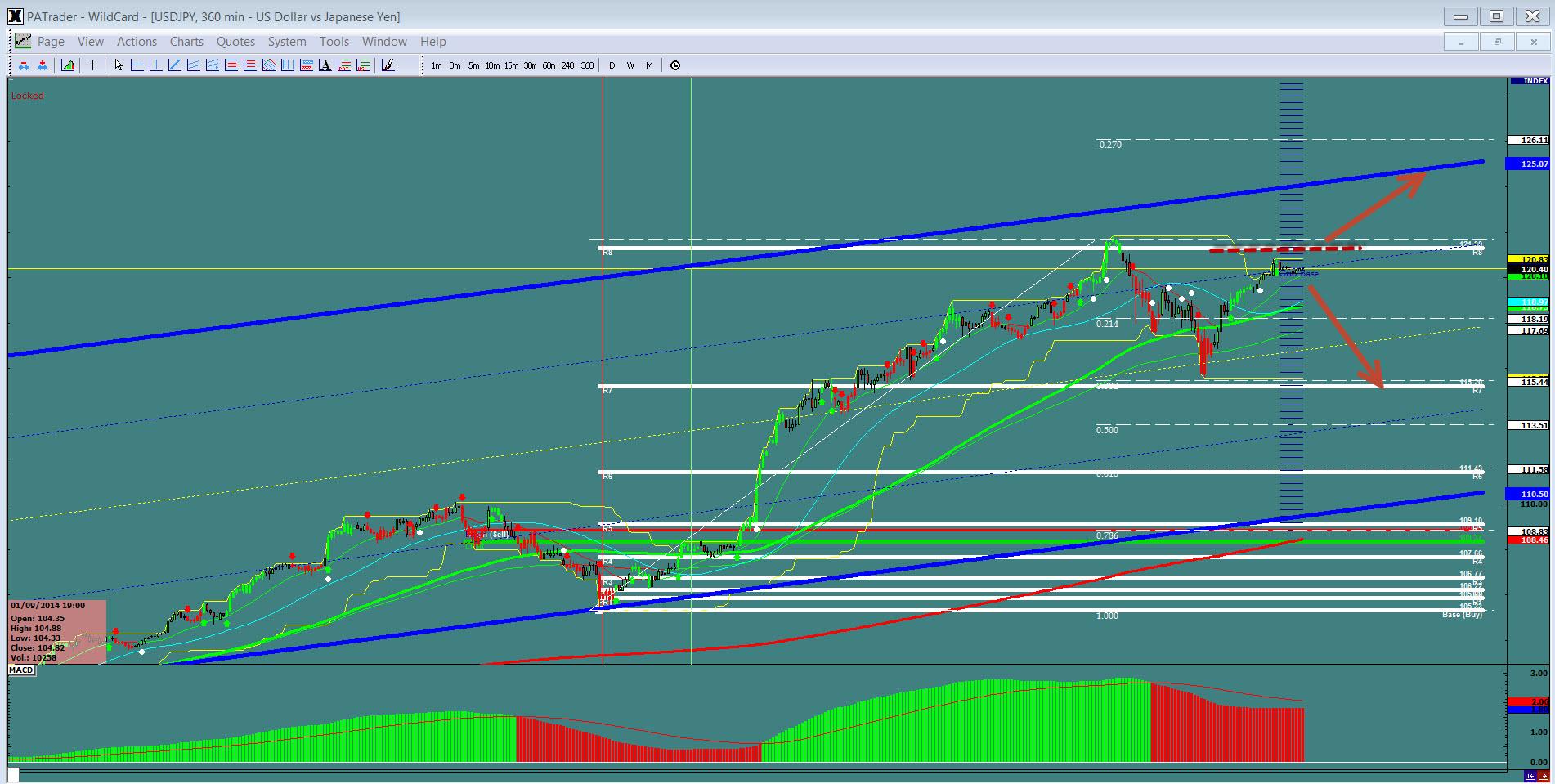

$USDJPY

What ProAct Forex Target Traders See: We are currently @ 120.40. A couple of different scenarios: 1: bullish: A move above 121.50 would signal a continuation to the trend line top around 125.00 . 2: Bearish : A break down here make this an head and shoulders pattern that would set up a move back to the 0.382 Fibo @ 115.44. The average daily true range (ATR) for the pair currently is 150 pips.

——————————————————————————–

$GBPUSD

What ProAct Forex Target Traders See: Cable is currently sitting @ 1.5553 after breaking the rectangle which is bearish. We are looking for the1.618 fibo @ 1.5293. The average daily true range (ATR) for the pair is 106 pips.

——————————————————————————–

$AUDUSD – A great smooth currency for Newbie’s!

What ProAct Forex Target Traders See: Aussie is @ 0.8073 in a channel. If we take out the day chart support @ 0.8073, look to the S7 @ 0.7806. A bounce here, look to correct back to the 0.8263 level. The average daily true range (ATR) for the pair currently is 80 pips.

Recommended Content

Editors’ Picks

EUR/USD fluctuates near 1.0700 after US data

EUR/USD stays in a consolidation phase at around 1.0700 in the American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold stays in consolidation above $2,300

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.