GBP/JPY – Potential for powerful surge towards 178.55/184.00

Strategy Summary – Stay long or buy at market for 178.55, 180.00 and then 184.00. Suggest a stop under either 169.35 or 167.80.

GBP/JPY is breaking through 173.95 to filter a topside break from a shallow two-month corrective channel. This follows another lower rejection in the 169.35/55 region. These downside failures continue to suggest that there is very significant longer-term upside scope and potential. Generally flat trade through 2014 to date, has stored up very significant energy levels to support this phase.

Just above 173.95 lies 175.35, the 2 July 2014 multi-year high. Clearance at 173.95/ 175.35 will confirm that a major new phase higher is under way. The first significant objective would be 178.55; this marks equality of the 169.35 to 173.95 cycle measured up from 173.95. A psychological barrier then rests at 180.00, ahead of 184.00, the key 50% retracement level of the major 241.10 to 116.85 decline (not shown).

Immediate support levels at 172.80 and 171.00 should now underpin any minor shortterms dips, while only clearance under the 167.80-169.55 region causes concern to the topside view.

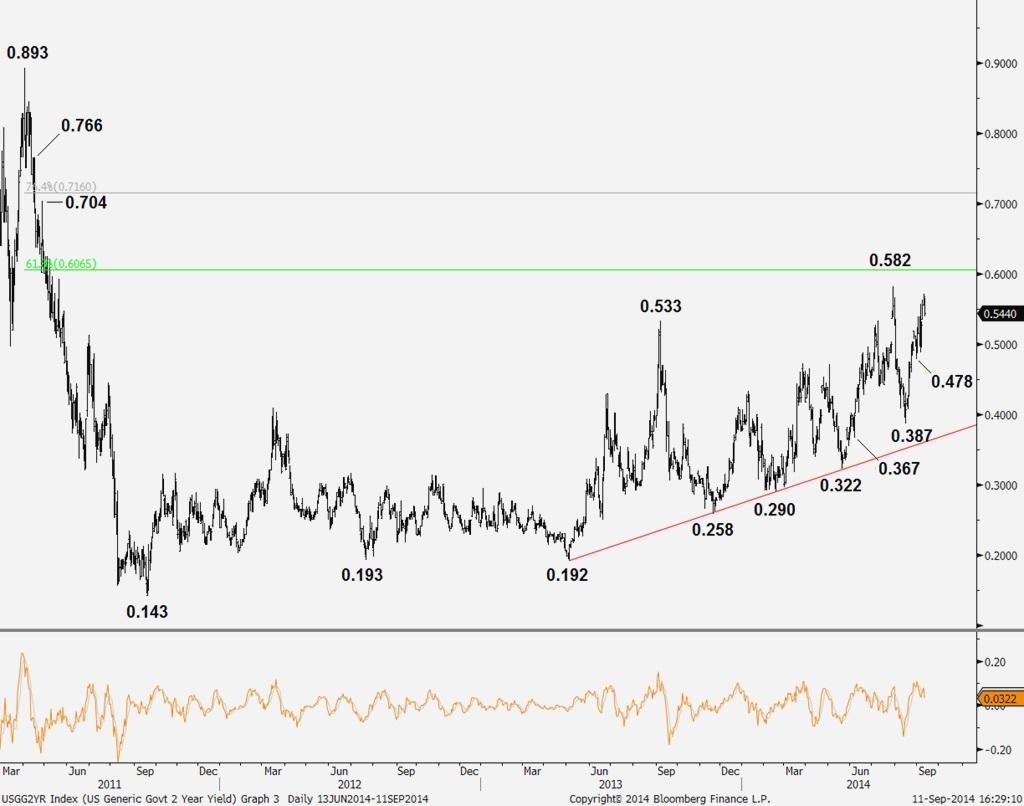

US 2Y yield – Recovery to continue after short-term consolidation

Strategy Summary – Look to buy yields into any corrective dips for a rally extension targeting 0.704/0.730 then 0.766. Place a protective stop below 0.478.

Yield bulls accelerated the recovery from 0.143 (20 September 2011 record low) to 0.582 (2014 peak – 30 July), before correcting to 0.387 (15 August low). Yield bulls have since resumed and given generally constructive daily/weekly/monthly studies; we await an eventual clearance of 0.582 exposing a cluster of Fibonacci levels between 0.599/0.625. This consists of 1x 0.192/0.533 off 0.258 at 0.599, 61.8% retrace of 0.893/0.143 fall at 0.606 and a 1.618 projection of 0.143/0.413 off 0.193 at 0.625.

Once 0.625 has been decisively cleared, a recovery extension would then be favoured towards 0.704/0.730 zone. This consists of 27 April 2011 lower high at 0.704, 76.4% of 0.893/0.143 fall at 0.716, 2x 0.143/0.413 off 0.192 at 0.727 and 1.382x 0.192/0.533 off 0.258 at 0.730. Further out, scope is seen to 0.766 (13-15 April 2011 highs), which guard 0.811 (1.618x 0.192/0.533 off 0.258).

Some daily studies are beginning to roll over, (which is indicative of a near-term correction), but this is seen as short term in nature and should be limited to 0.478 (29 August low). Only below there would caution yield bulls and re-open 0.387 (15 August low). Below ends the sequence of rising highs/lows and risks tests of a multi-tested 16- month rising trendline at 0.362 (near 6 June low at 0.367).

USD/TRY – Room for further advance towards 2.2590/2.2645

Strategy Summary – Buy upon any near-term corrective dips for a rally, extension towards the 2.2590-2.2645 region, then possibly 2.3195. Place a stop below 2.1625.

Since early April the USD/TRY has constructed a base above 2.0615 – the 14 May 2014 low and near a 50% of the entire 2013-14 (1.7455-2.3900) advance. The base was confirmed last month upon the break above the 2.1535 resistance. That prompted an initial advance to 2.1890 – close to a 38.2% of the 2.3900-2.0615 decline.

After some healthy consolidation, the market has resumed its advance and the broader chart structure remains highly positive. The rate has been holding well above the key, yearly and quarterly, moving averages. The MACD is in a bullish territory and exhibiting a fresh buy signal. All these conditions suggest a rally extension. Initially, look for a clearance of 2.2260, a 50% retracement of the January-May easing. Above the latter prompts a rise into the 2.2590-2.2645 region. This consists of the March highs, and a 61.8% retracement – both close to an approximate target of the four-month base. Above 2.2645 would open 2.3195/2.3900.

Look for the seven-week trendline support near 2.1625 to contain any dips. Only a break below the 2.1465 higher low concerns.

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.