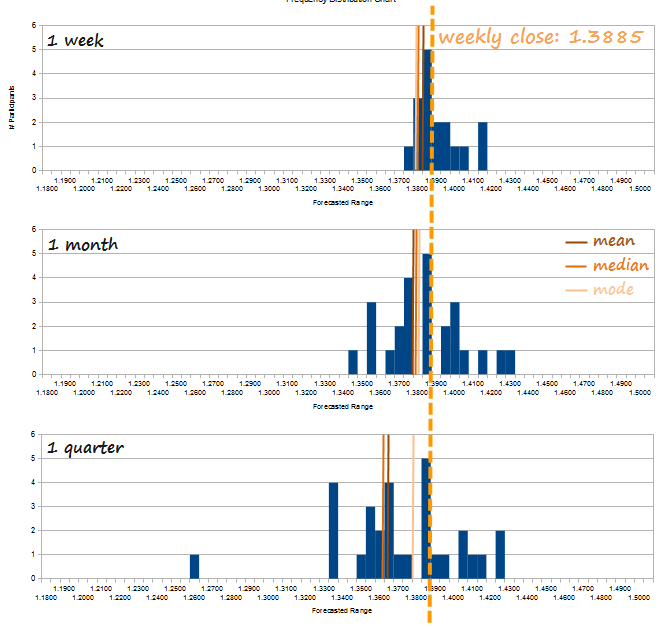

When asking for the typical outcome of the latest release of the sentiment poll, one would be given the central tendency measures (the mean, the median and the mode) which, when smoothed into a new average becomes 1.3850, a figure a few pips shy of Friday's close at 1.3885. Put into historical context: the week before the poll was printing 1.3637 as the “average of averages”, which represents indeed a substantial rise. It seems like the poll, as an aggregate, is mimicking price for a second test of the the 1.3939 top from 5 weeks ago.

What about the mid and longer-term views? These also saw a proportional increase in the averages to the price action. Poll participants are currently forecasting a EUR/USD around 1.38 in one month time and 1.36 in three months in the future. When was the last time we heard from those figures under 1.33? It was September 2013. Remarkable is the ascending movement across all time horizons but the piece of data that stands out this week is the mode which was registered among participating analysts: at 1.3800, its the highest print so far.

All indicator parameters are showing a “business as usual” type of activity. The price ranges among the lowest and highest forecast values across the 3 time horizons are at normal levels. As such we see five hundred pips in the 1-week forecast, and one thousand and two thousand pips for the 1-month and 1-quarter prognosis respectively.

The ratio between bulls and bears increased a little across all time horizons but it is not showing extreme sentiment neither.

On the technical front most of the central tendency numbers are below this week's pivot point (1.3829), an offsetting signal but not strong enough to scare the bulls.

What does it mean for traders? In the 1-month and 1-quarter predictions, the mean and the median are below the mode. This is a typical condition of a chronical negative skewness. The fact that a 200 pip rally staged from Monday to Friday in the EUR/USD exchange rate hasn't really changed the trader's opinions to an extreme, shows that participants are in a “let's wait and see” mode.

If we could witness upward migrations in the EUR/USD forecasts with weekly performances under 0.5%, what will an above-average weekly performance like we just had of 1.32% lead to in the weeks to come? The G20, IMF, and World Bank meetings and their announcements this week are probably going to result in more volatility. It will be interesting to see how the poll reacts to it post holiday.

Note: The Weekly Sentiment Report provides a breakdown of the data published in the Currencies Forecast Poll through the use of descriptive statistics. The Currencies Forecast Poll is published every Friday at 17:00 Central European Time by FXStreet and aggregates the forecasted values from individuals and companies that were reported from Wednesday to Friday of the same week.The data represents what direction members feel the market will be in the next week, one month and three months.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold climbs above $2,340 following earlier drop

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.