EURUSD – Is it an ABC Correction?

Last week the price has infirmed the Flag price pattern, by breaking above 1.1337. Bulls couldn’t get the price back up to the previous resistance (1.1437). The rally stopped around 1.1400 and fell all the way to the next local support from 1.1217.

The current corrective move seems to be an ABC pattern. This might mean that the price might come back on an up move, targeting a new high above 1.1465. From my point of view, such a scenario could be confirmed by another break above 1.1340. On the other hand, a break below the current support from 1.1217 could trigger drop towards 1.1050, or even lower to 1.1000.

USDJPY – Back Above111.00

USDJPY has broken the local resistance, as said in my alternative scenario from last week. After the break, the USD rallied against the Japanese yen, went over 111.00 and almost hit 112.00. Currently it has retreated to retest 111.00.

Looking on a four hour time frame, a big Descending Wedge was formed and the price broke outside. This could be a strong bullish signal. Another rally could start with a break above 112.00. This time the rally could get the price all the way back towards 114.50.

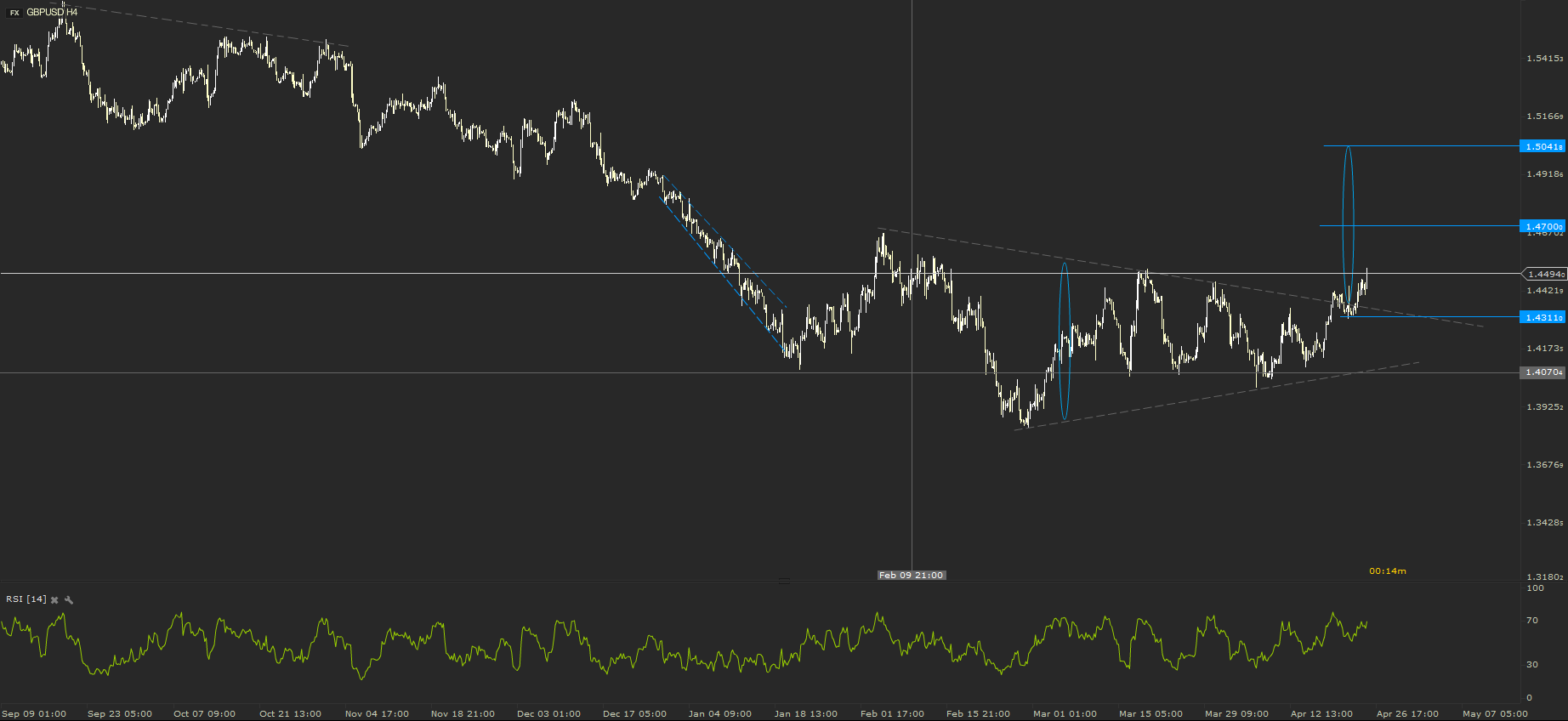

GBPUSD – Out of the Triangle

The price of GBPUSD has stood in a Triangle price pattern from the beginning of February all the way to last week, when it broke the upper line. For the moment it seems to have found a resistance at 1.4500,but might not resist enough bulls’ pressure.

A break above the current round number resistance could be another strong bullish signal. A future rally could get the price all the way to the half of the full target of the triangle. I would consider changing my view only if the price would come back towards the local support from 1.4311.

Risk Warning: Financial Derivative Instruments are complex instruments and leveraged products that involve a high level of risk which can result in high losses, including the risk of losing the entire capital invested by the Client. Such instruments might not be suitable for all Clients. The Client should not engage in transactions with such Financial Instruments unless he/she understands and accepts the risks involved by trading Financial Instruments, taking into account his/her investment objectives and level of experience. Forex Rally warns that the information published on this website shall not be considered as a recommendation to buy/sell/keep a certain financial instrument and that past performance of Financial Instruments is not a reliable indicator of future performances.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.