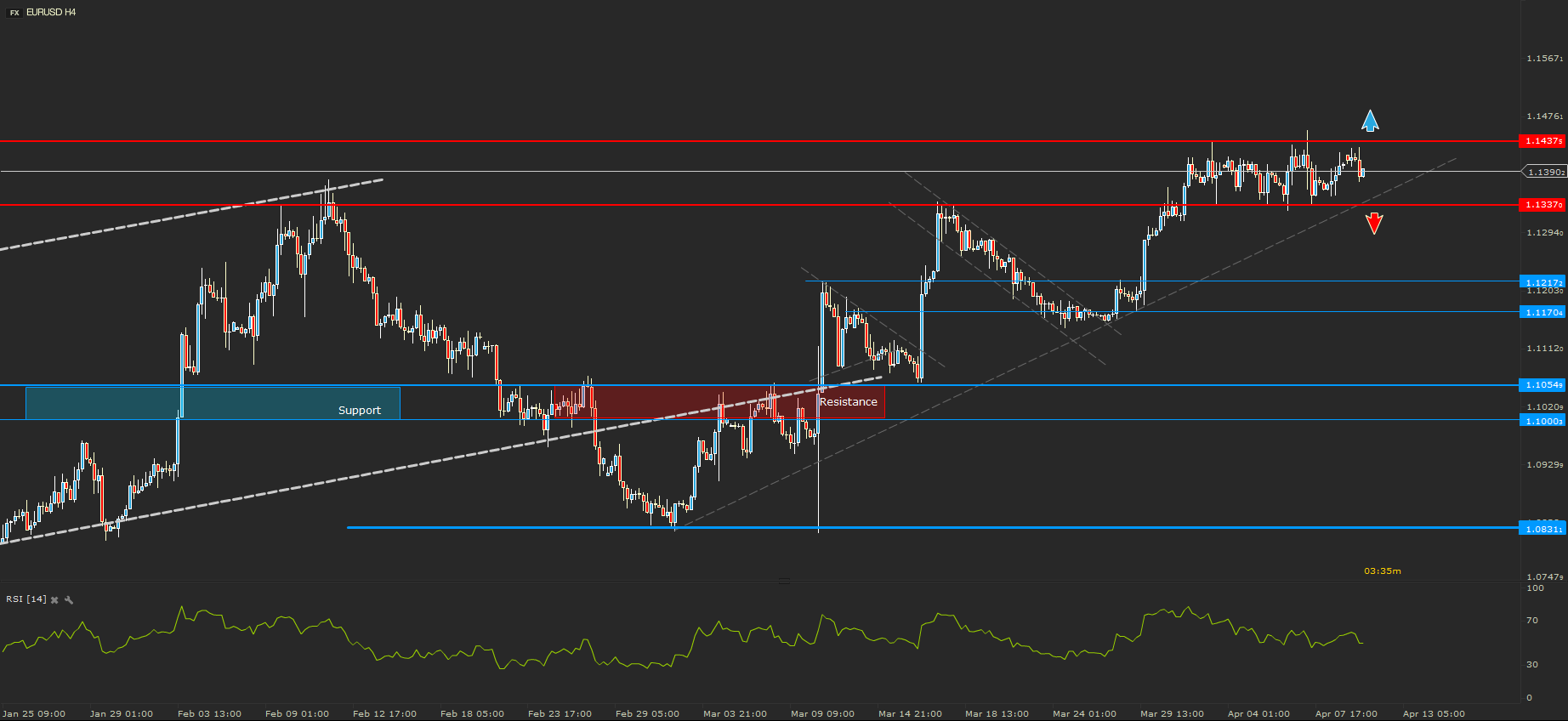

EURUSD – In a Holiday

The EURUSD sat in a 100 pips range from last weeks to now.The latest economic releases did not have any impact on the price action of this currency pair.

With the pressure accumulated, I would expect for the price to break the resistance from 1.1437 and rally towards 1.1500. I would go with this side because of both technical analysis and fundamental reasons. I would still keep an eye over a break below the support line from 1.1337.

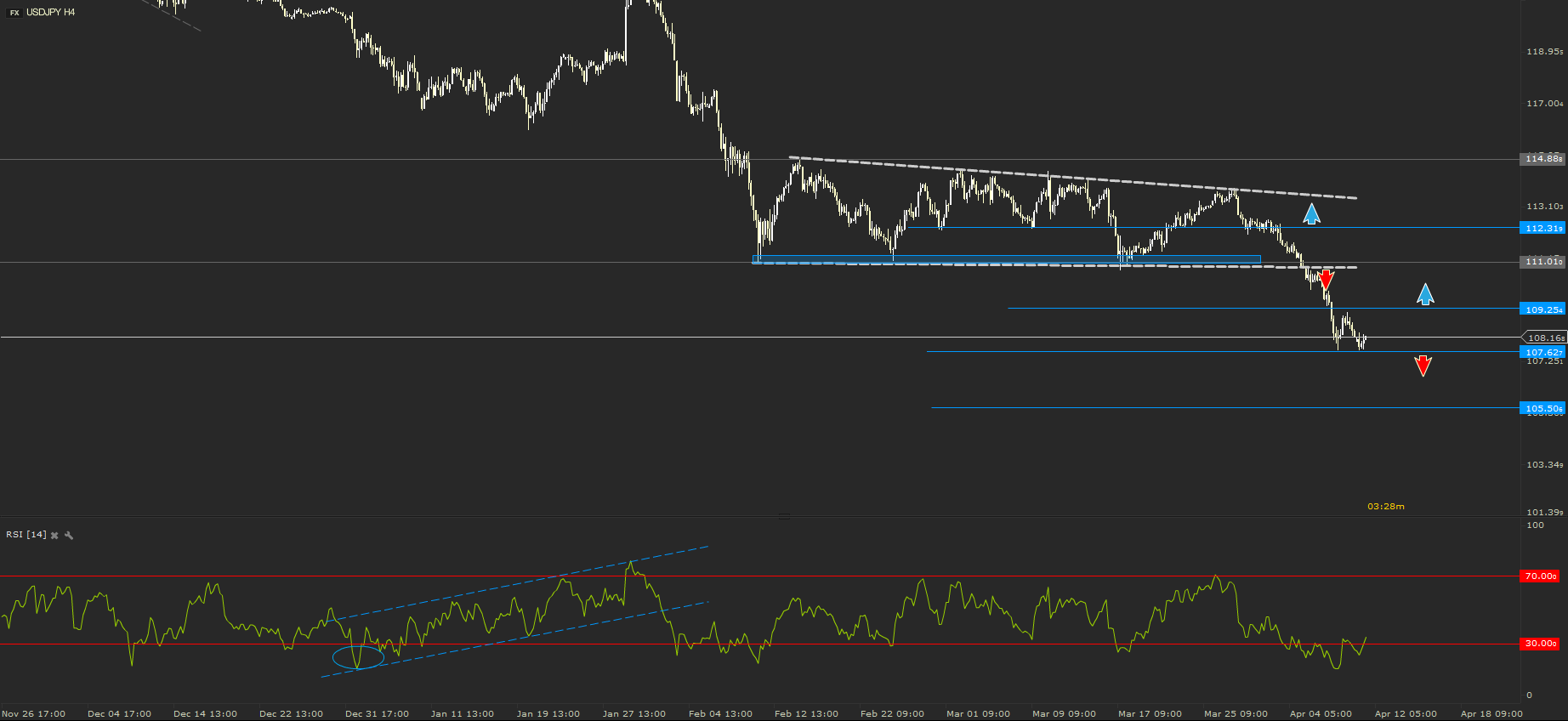

USDJPY – Finally Out

The USDJPY is finally out of the range. As Technical Analysis was pointing last week, the price broke the lower line of the range a dropped all the way to 107.62, where it found a local support.

A short term range seems to be in place. A break below the 107.62 support would signal a continuation of the drop towards the next key support from 105.50. On the other hand, a rally above 109.25 would signal a corrective move towards 111.00.

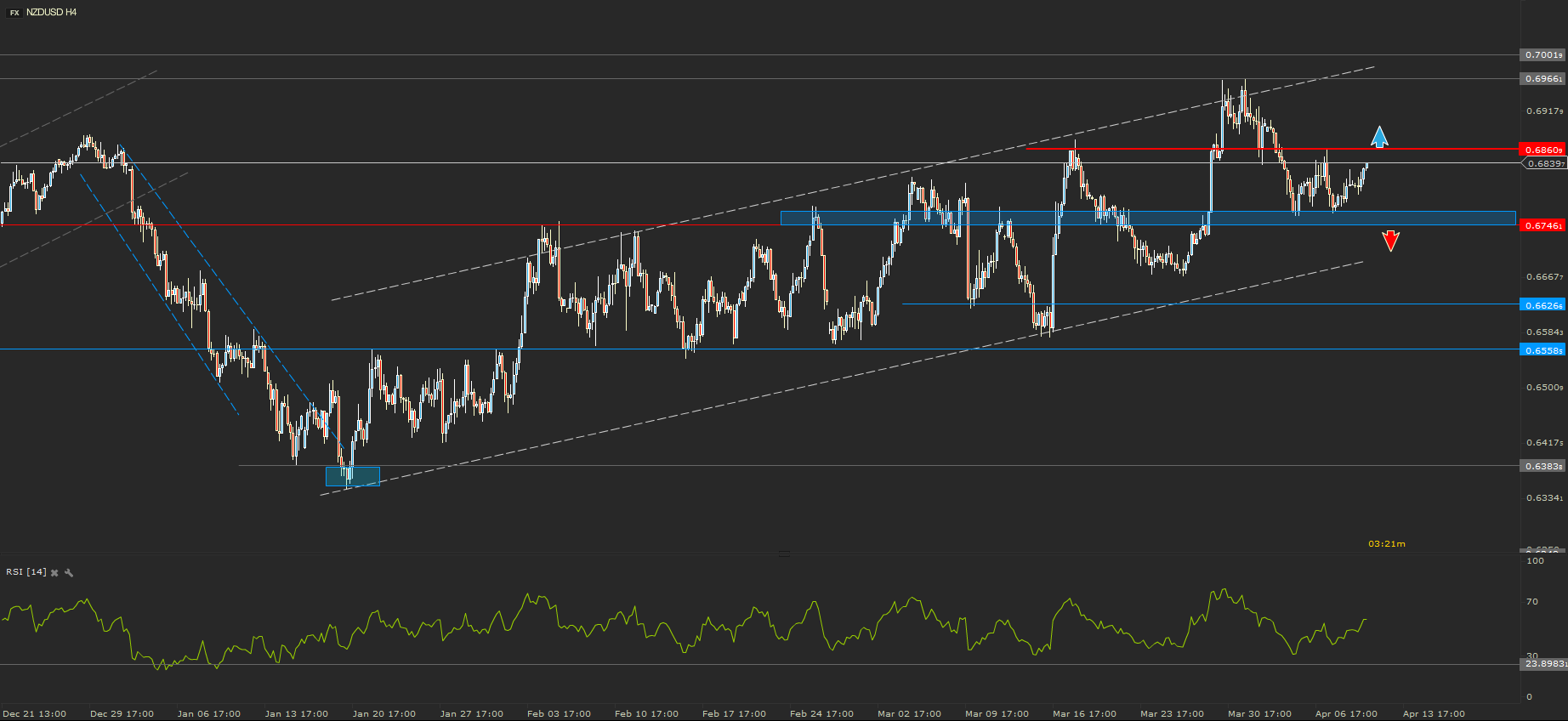

NZDUSD – Back toTrend Line

The NZDUSD price broke below 0.6821, the local support, and headed towards the next support, 06746, which happens to be close to the uptrend’s line. For the moment a Double Bottom pattern seems to be emerging from the last price action.

A break above the current resistance, 0.6860, would signal a comeback o the kiwi towards previous highs, or even rally higher towards next round number level, 0.7000. A bearish signal will come with a break below current support area.

Risk Warning: Financial Derivative Instruments are complex instruments and leveraged products that involve a high level of risk which can result in high losses, including the risk of losing the entire capital invested by the Client. Such instruments might not be suitable for all Clients. The Client should not engage in transactions with such Financial Instruments unless he/she understands and accepts the risks involved by trading Financial Instruments, taking into account his/her investment objectives and level of experience. Forex Rally warns that the information published on this website shall not be considered as a recommendation to buy/sell/keep a certain financial instrument and that past performance of Financial Instruments is not a reliable indicator of future performances.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0650 after US data

EUR/USD retreats from session highs but manages to hold above 1.0650 in the early American session. Upbeat macroeconomic data releases from the US helps the US Dollar find a foothold and limits the pair's upside.

GBP/USD retreats toward 1.2450 on modest USD rebound

GBP/USD edges lower in the second half of the day and trades at around 1.2450. Better-than-expected Jobless Claims and Philadelphia Fed Manufacturing Index data from the US provides a support to the USD and forces the pair to stay on the back foot.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.