EURUSD – Pennant Price Pattern

Last week the price of EURUSD has tried to break the resistance are from 1.1000 several times. On Thursday, when the volatility was at its highest point EURUSD bounced once more from the resistance area, retested the support from 1.0830. During the ECB’s press conference the price bounced from 1.0830 and had an incredible rally, hitting a high at 1.1217.

Currently the price of EURUSD has drawn a Pennant. In most of the cases, this patterns signals a continuation of the previous move. In this situation a break above the upper line of the price pattern would signal another rally, most probably above the current highs,targeting the next important resistance from 1.1400. On the other hand, a drop below 1.1000 would be a strong bearish signal. In this second scenario I will be expecting the Euro to lose against the greenback at least 100 more pips.

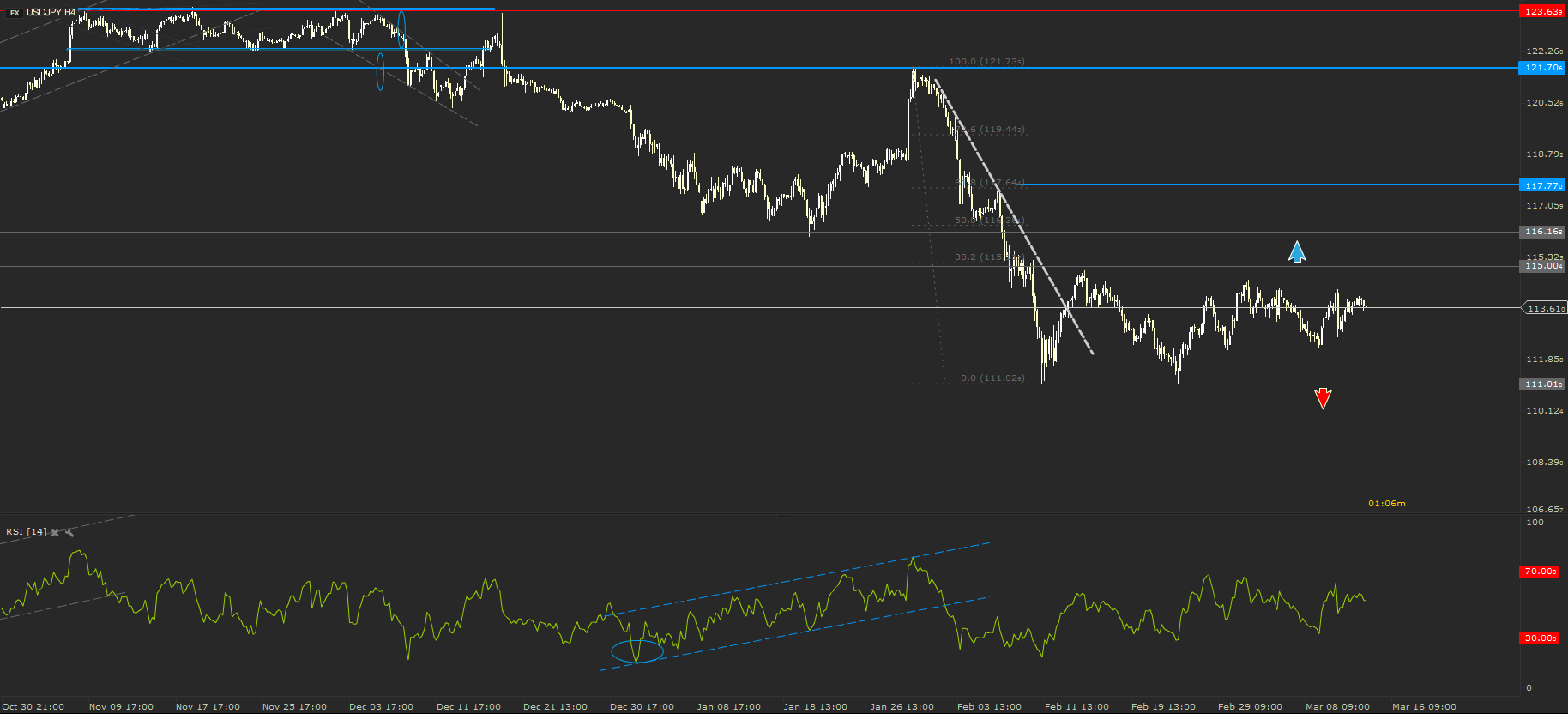

USDJPY – Continues Sideways

Seems like investors doesn’t really care about USDJPY this month. Half of March already gone and the price of this currency pair did not exit the range with the limits set in February between 115.00 (resistance) and 111.00 (support.)

I am keeping an eye on this pair for a breakout. My favorite scenario in this situation would a break below the support.

NZDUSD – Stronger Bearish Signals

Last week I was expecting the NZDUSD to be rejected once more from 0.6746 support area. Expectations met, the price got back to the resistance to bounce back towards the support. In the first half of last week the support was broken and the price fell to the trend line. In the second part of the week, the price got back to retest the resistance area (ex-support 0.6746).

This week started with a plunge of the kiwi. NZDUSD currently trading below 0.6700. I am expecting the price to retest the trend line and maybe to break it. I would consider a close on a four hour time frame under the trend line, a strong bearish signal. In this scenario I will be expecting the price to get back to the key level support from 0.6558.I would believe in a comeback of the NZD only if the price will break again above 0.6750.

Risk Warning: Financial Derivative Instruments are complex instruments and leveraged products that involve a high level of risk which can result in high losses, including the risk of losing the entire capital invested by the Client. Such instruments might not be suitable for all Clients. The Client should not engage in transactions with such Financial Instruments unless he/she understands and accepts the risks involved by trading Financial Instruments, taking into account his/her investment objectives and level of experience. Forex Rally warns that the information published on this website shall not be considered as a recommendation to buy/sell/keep a certain financial instrument and that past performance of Financial Instruments is not a reliable indicator of future performances.

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 after German IFO data

EUR/USD stays in a consolidation phase at around 1.0700 in the European session on Wednesday. Upbeat IFO sentiment data from Germany helps the Euro hold its ground as market focus shifts to US Durable Goods Orders data.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold price flat lines above $2,300 mark, looks to US macro data for fresh impetus

Gold price (XAU/USD) struggles to capitalize on the previous day's bounce from over a two-week low – levels just below the $2,300 mark – and oscillates in a narrow range heading into the European session on Wednesday.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin (WLD) price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.