EURUSD - Correcting

Last week I was expecting for the price of EURUSD to continue the up move towards 1.13. The price hit 1.1300 and continued to rise until it hit the channel rejection line.This area proved to be a strong resistance zone. The EURUSD bounced back down towards 1.1200.

I am expecting this corrective move to continue. The confirmation of the drop would come to a close, with a four hour time frame,below 1.1160. In this situation, EURUSD might retest the support area from 1.1050. On the other hand another break above 1.1300 might trigger a rally towards 1.1400.

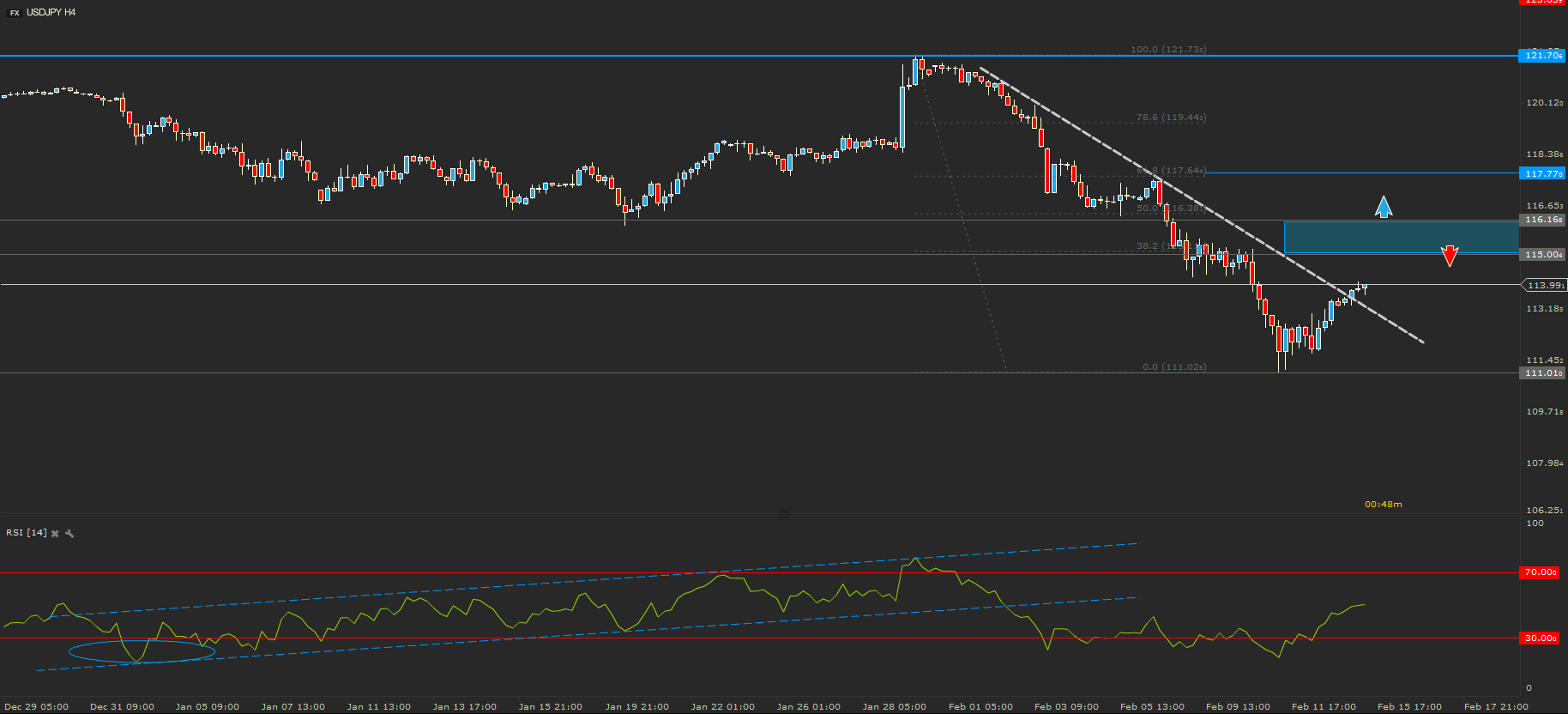

USDJPY - The greenback is recovering

USDJPY fell from 121.73 all the way to 111.01. After reaching this low the dollar started gaining and now is heading towards the resistance area of 115.00. The broken trend line is a strong bullish signal.

I am expecting for the up move to continue and enter the area between 115 and 116. Considering this to be a strong resistance, the price might bounce back down towards 113 or even lower towards 111.00. A break above 116.00 would be a strong bullish signal.

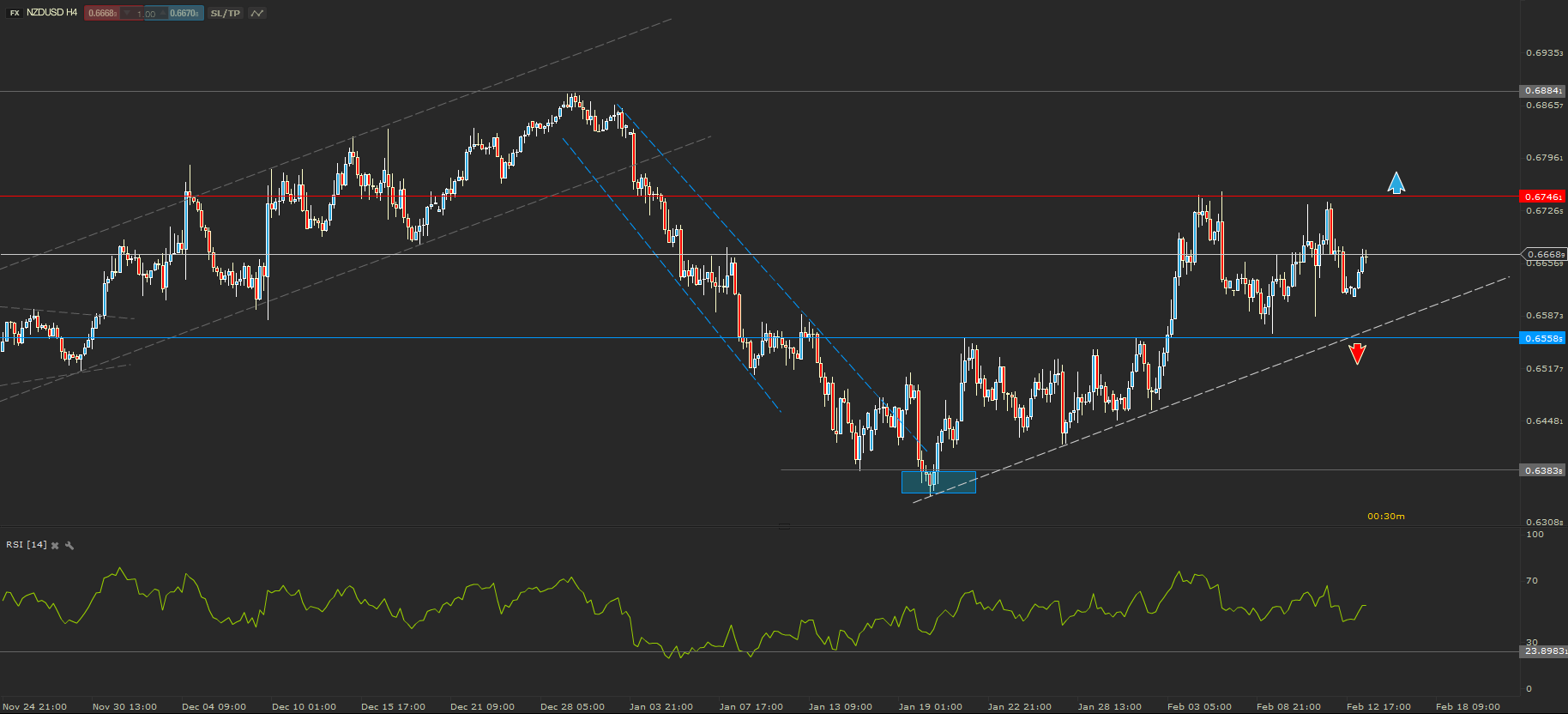

NZDUSD - Sideways Move

The price of NZDUSD has started an uptrend in the second part of January. Even though the trend seems to be up,the resistance from 0.6746 managed to keep the price below.

The latest price action shows a sideways move, looking like a triangle. A break above the current resistance level would confirm the uptrend and would signal a continuation of the move towards 0.6900.On the other hand a break below the support of 0.6558, would signal that bears are taking control and price might continue to fall towards 0.6383.

Risk Warning: Financial Derivative Instruments are complex instruments and leveraged products that involve a high level of risk which can result in high losses, including the risk of losing the entire capital invested by the Client. Such instruments might not be suitable for all Clients. The Client should not engage in transactions with such Financial Instruments unless he/she understands and accepts the risks involved by trading Financial Instruments, taking into account his/her investment objectives and level of experience. Forex Rally warns that the information published on this website shall not be considered as a recommendation to buy/sell/keep a certain financial instrument and that past performance of Financial Instruments is not a reliable indicator of future performances.

Recommended Content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD mired near 1.0730 after choppy Thursday market session

EUR/USD whipsawed somewhat on Thursday, and the pair is heading into Friday's early session near 1.0730 after a back-and-forth session and complicated US data that vexed rate cut hopes.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: Slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.