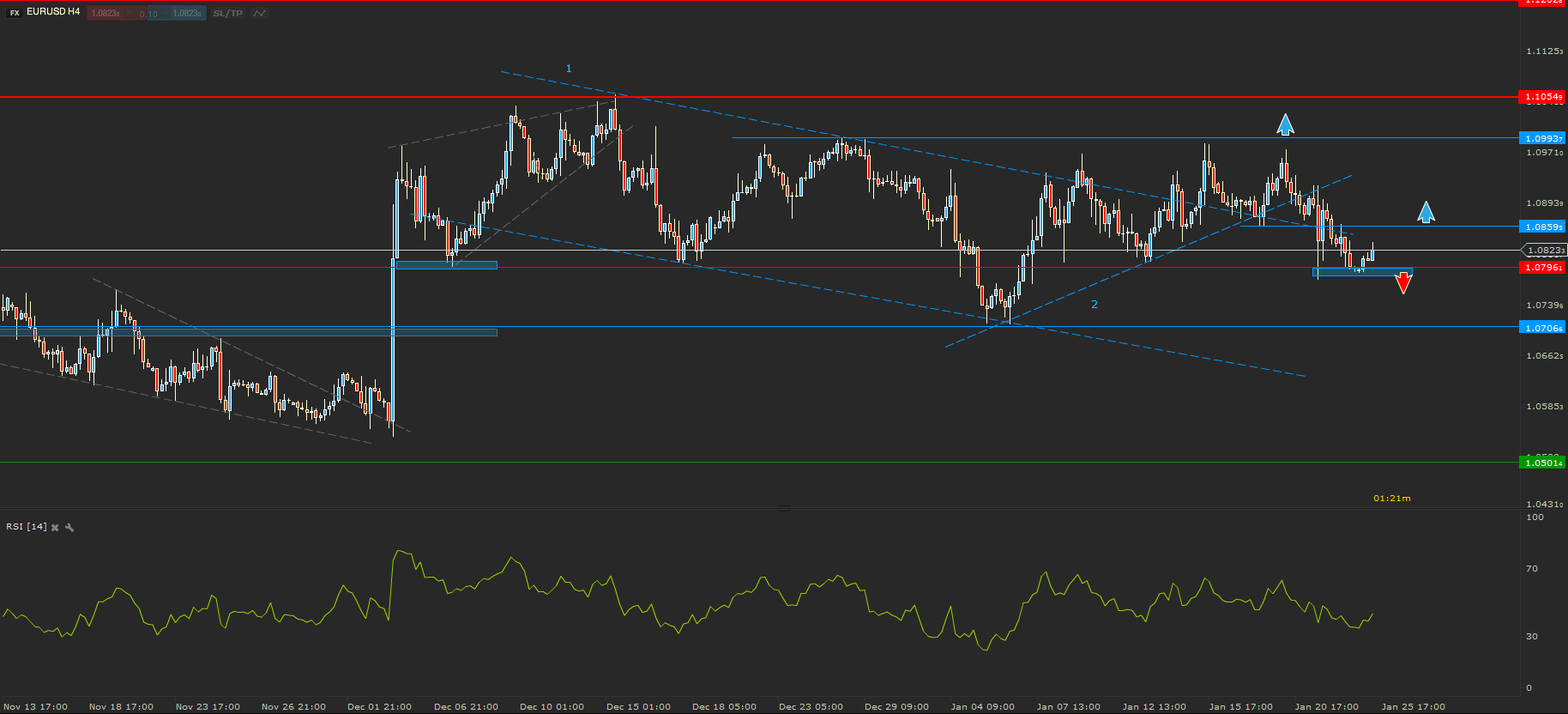

EURUSD - Wandering around 1.0800

Bears proved to be once again stronger than bulls. The price of EURUSD bounced third time from the trend lined (marked with 2 on my chart), but it did not manage to break above 1.1000. The resistance proved to be stronger than buyers expected.The price dropped below 1.0900 and only found support at 1.0800.

Currently EURUSD is wandering around this support level. 1.0800 was tested before, but it still is strong enough. A break and close below this support, on a 4 hour chart would signal adrop move towards 1.0700. On the other hand a break and close above 1.0860 would be a strong bullish signal. An up move could send the price back towards 1.1000.

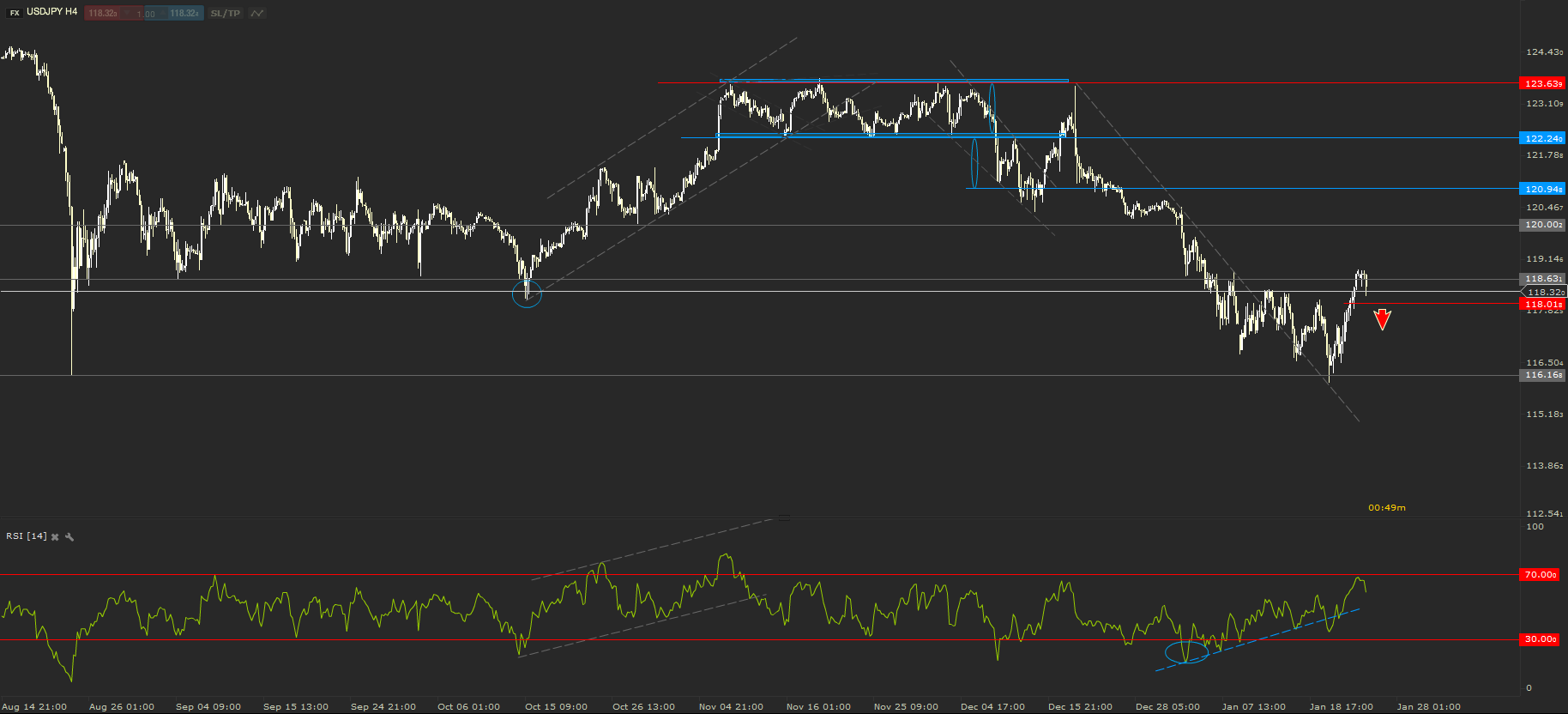

USDJPY – Bullish move confirmed

For the past 2 weeks I was highlighting the positive divergence drawn on the 14 periods RSI. The signal became a very strong last week, when the price hit the key level support and the divergence got even more significant. USDJPY jumped more than 200 pips in the second part of last week, hitting the resistance from 118.60.

I am expecting the resistance to be strong enough to reject the price. If the price will break below 118.00 I am expecting it to continue the down move towards 117.00 or even back to the key level support from 116.16.

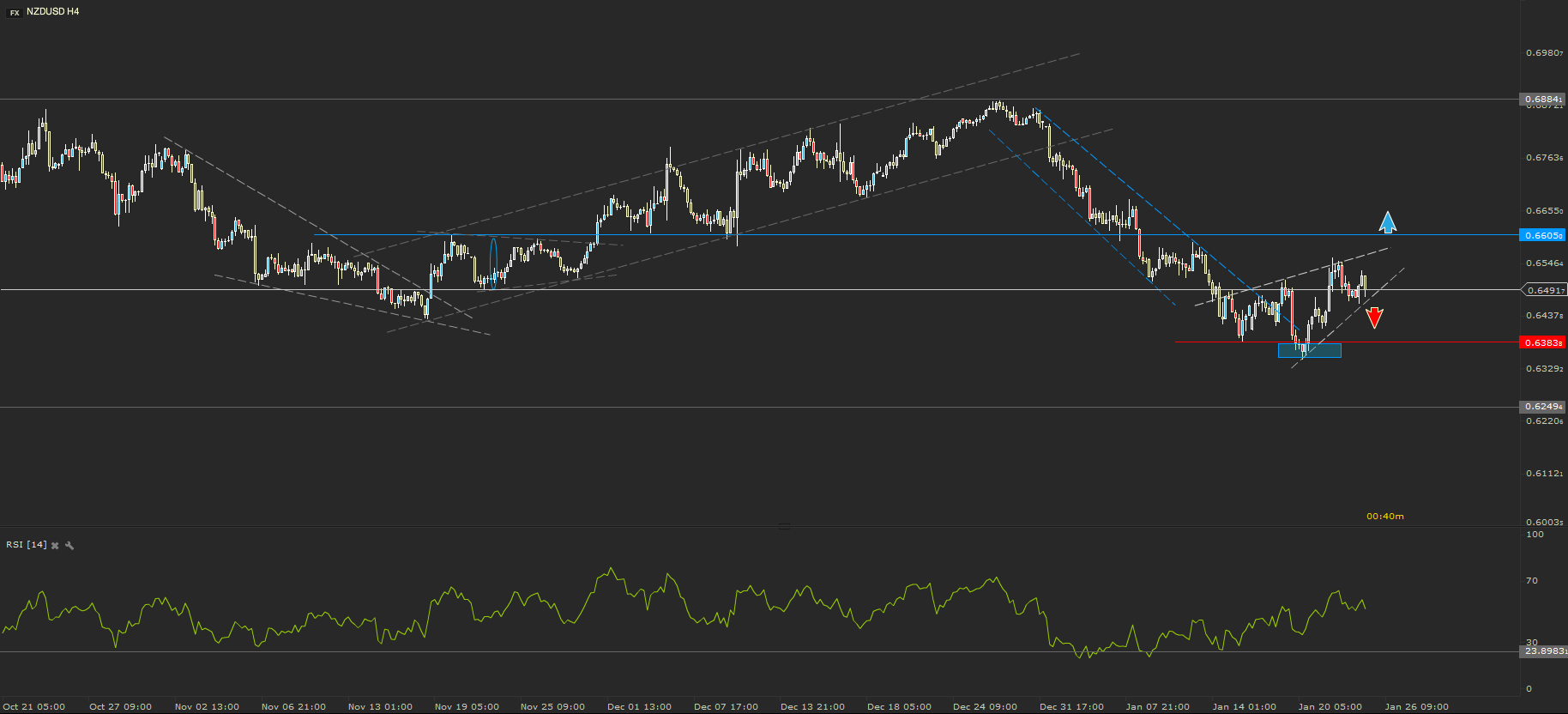

NZDUSD – Rising Wedge

I was expecting NZDUSD to continue the fall after a close below 0.63833, but it did not happen. After the close of a four hour candle below this support level the NZD started a strong comeback and managed to rally all the way above 0.6500.

The up move has drawn a Rising Wedge. This price pattern usually shows a continuation of the downtrend. If the lower line of the Wedge will be broken, I am expecting for the price to aim for the support level mentioned earlier. On the other hand, if the NZD will continue to gain against the greenback, I will be expecting for the up move to find a resistance at 0.6600

Risk Warning: Financial Derivative Instruments are complex instruments and leveraged products that involve a high level of risk which can result in high losses, including the risk of losing the entire capital invested by the Client. Such instruments might not be suitable for all Clients. The Client should not engage in transactions with such Financial Instruments unless he/she understands and accepts the risks involved by trading Financial Instruments, taking into account his/her investment objectives and level of experience. Forex Rally warns that the information published on this website shall not be considered as a recommendation to buy/sell/keep a certain financial instrument and that past performance of Financial Instruments is not a reliable indicator of future performances.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.