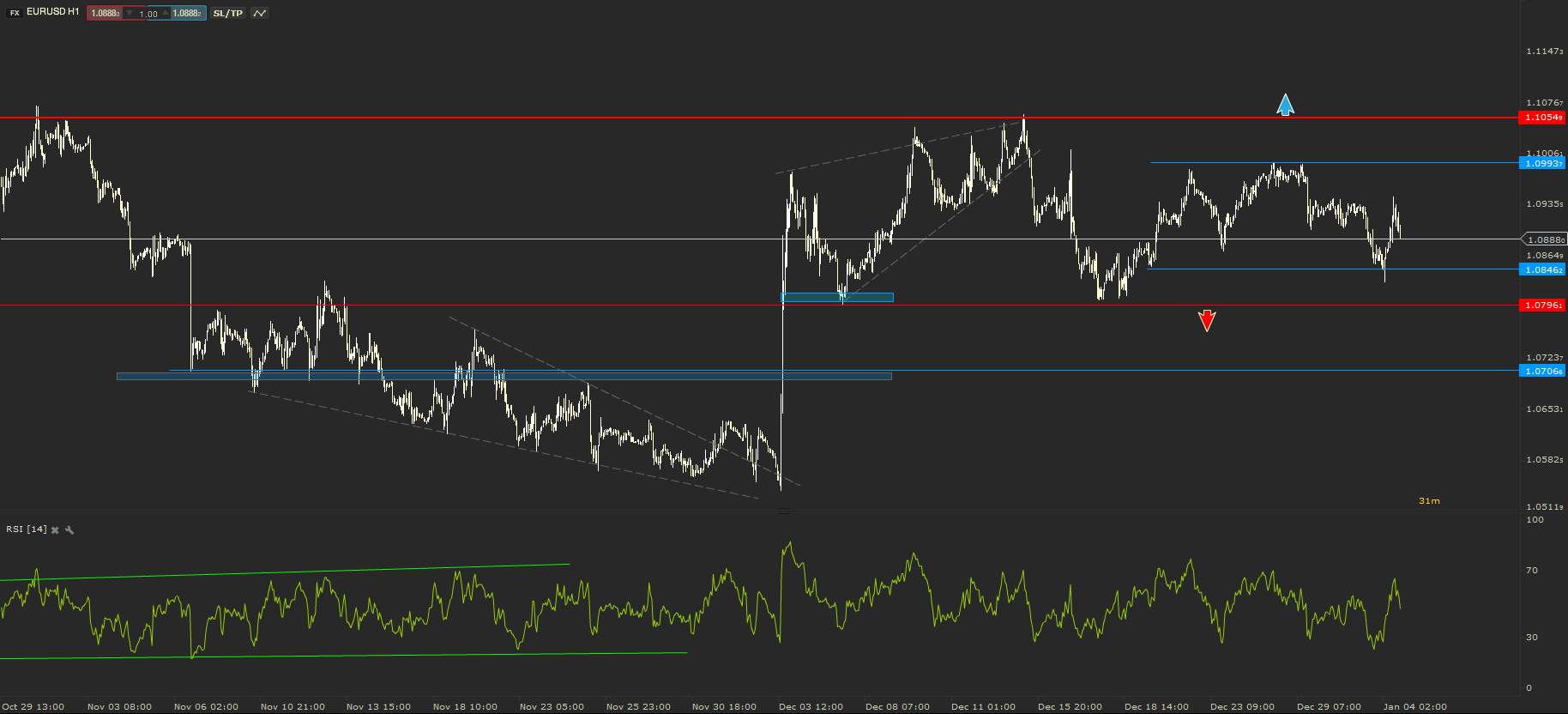

EURUSD - Back in its Comfort Zone

A new year has begun, but the EURUSD is stilltrading in the comfort of December’s range. The side move is limited by the15th of December high of 1.1055 and the 7th of December low of 1.0796. After itbroke above the Fibonacci, set in the past analysis, the price of the mosttraded currency pairs rallied to retest 1.1000.

The 250 pips range may continue to sit strongduring the first half of January. I expect volumes and volatility to startpicking up in the second half of this month. A confirmed break below theintermediate support from 1.0846 would signal a drop back towards the keysupport of the range, while a confirmed break above the round number level(1.1000) would signal another rally towards the key resistance of the range.

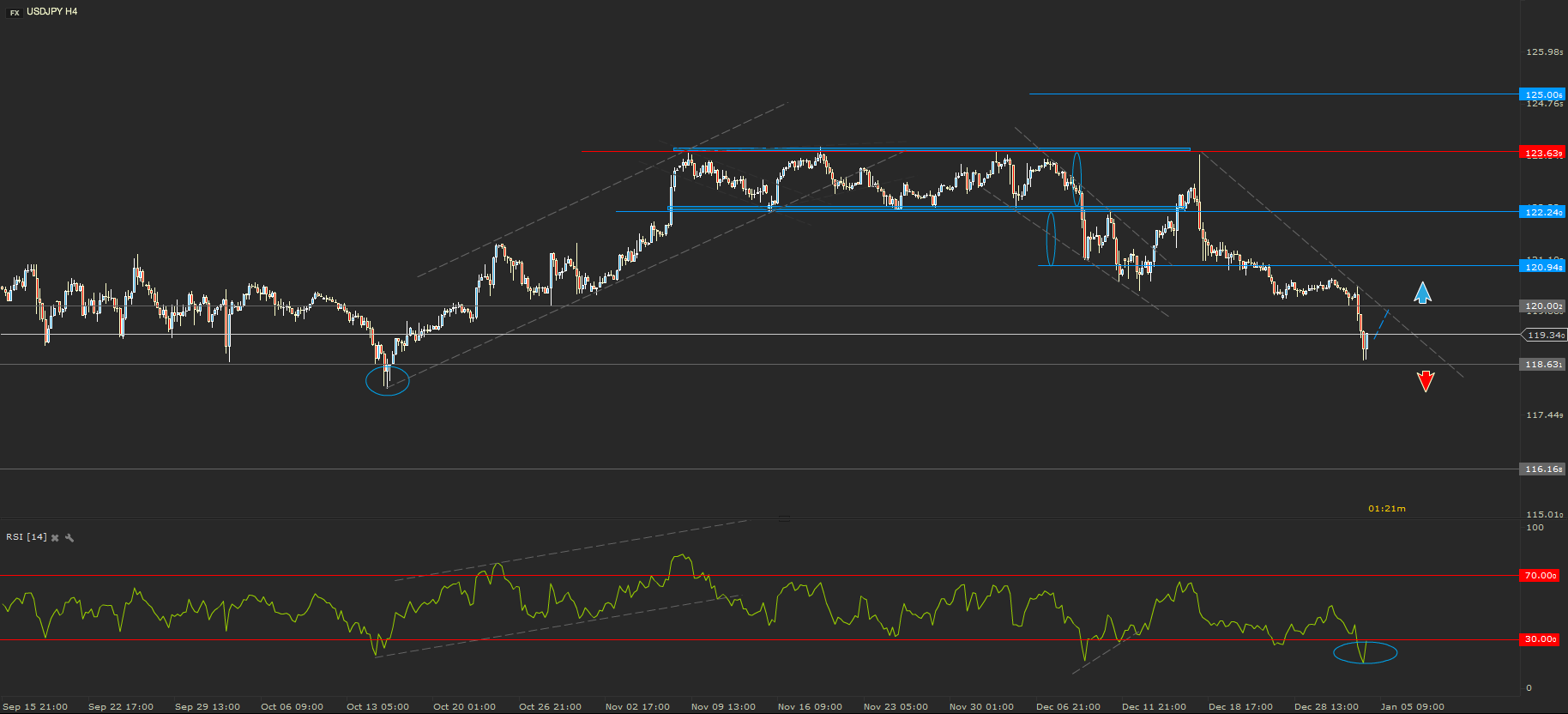

USDJPY - Retesting the Key Support

The New Year’s Eve found the USDJPY almosttouching 120.00. The first day of trading from 2016 pushed the Japanese yen higher.The price of the currency pair dropped below 120.00 and went straight to thekey level support from 118.63.

I am currently expecting for the price to retestor even to make a false break above 120.00. The main move is still sideways onthe daily chart. A considerable break above the round number level accompaniedby a close could signal the possibility of the price to move higher towards thenext resistance from 121.00. If the price will break this week below 118.63 Iwould consider this signal to be a strong bearish one.

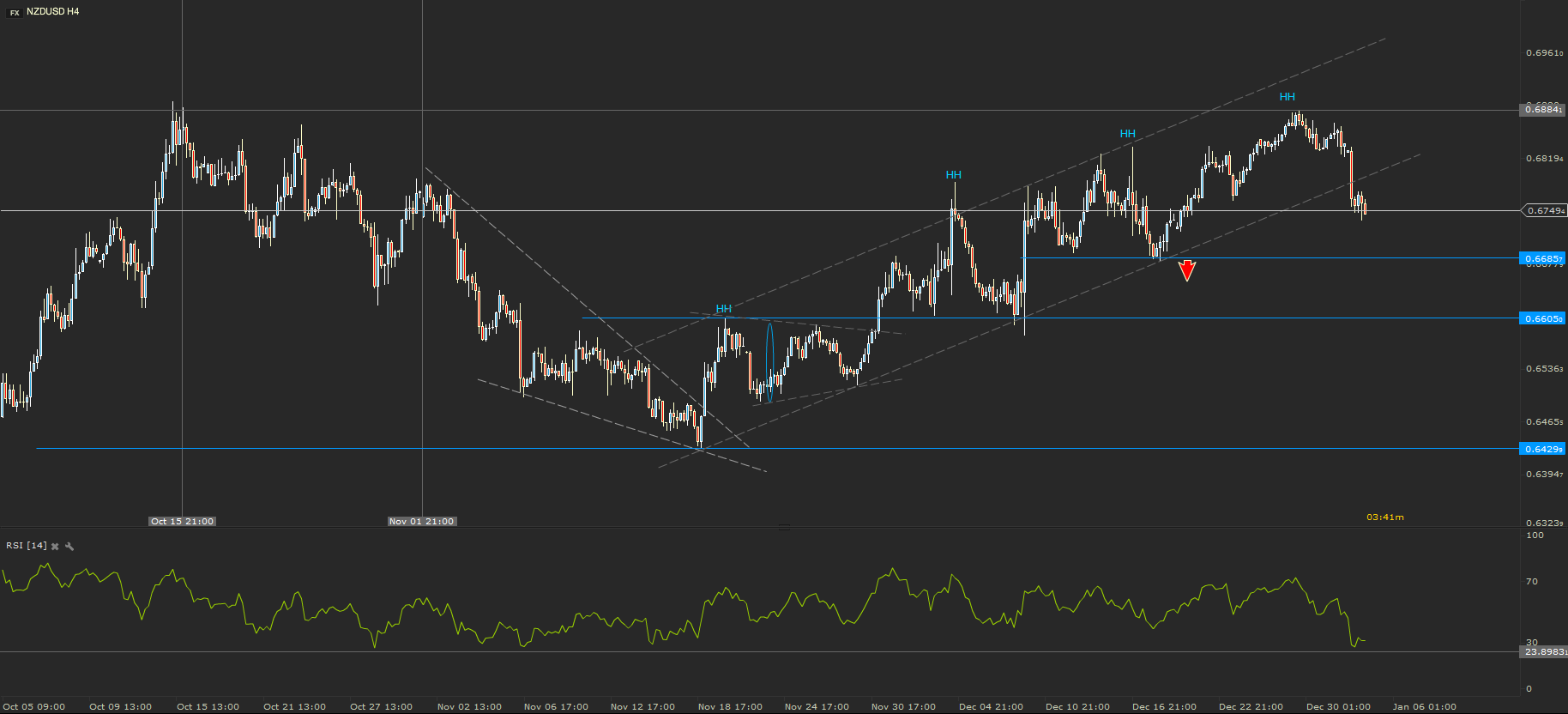

NZDUSD - The Uptrend Continues

The NZDUSD uptrend is still in place. The priceaction of this currency pair has drawn higher high and higher lows throughoutthe entire month of December. The last high has hit the key resistance levelfrom 0.6884. The price bounced back from the resistance and broke the maintrend line. This is considered to be a negative signal in this currentdirection.

Even though there is a negative signal showingthat the trend is weakening, I still believe that there is a good probabilityfor the price to rally again towards 0.6800 or even higher towards the mainresistance. I would consider a strong negative signal the break below thesupport from 0.6685.

Risk Warning: Financial Derivative Instruments are complex instruments and leveraged products that involve a high level of risk which can result in high losses, including the risk of losing the entire capital invested by the Client. Such instruments might not be suitable for all Clients. The Client should not engage in transactions with such Financial Instruments unless he/she understands and accepts the risks involved by trading Financial Instruments, taking into account his/her investment objectives and level of experience. Forex Rally warns that the information published on this website shall not be considered as a recommendation to buy/sell/keep a certain financial instrument and that past performance of Financial Instruments is not a reliable indicator of future performances.

Recommended Content

Editors’ Picks

EUR/USD: The first upside target is seen at the 1.0710–1.0715 region

The EUR/USD pair trades in positive territory for the fourth consecutive day near 1.0705 on Wednesday during the early European trading hours. The recovery of the major pair is bolstered by the downbeat US April PMI data, which weighs on the Greenback.

GBP/USD rises to near 1.2450 despite the bearish sentiment

GBP/USD has been on the rise for the second consecutive day, trading around 1.2450 in Asian trading on Wednesday. However, the pair is still below the pullback resistance at 1.2518, which coincides with the lower boundary of the descending triangle at 1.2510.

Gold price struggles to lure buyers amid positive risk tone, reduced Fed rate cut bets

Gold price lacks follow-through buying and is influenced by a combination of diverging forces. Easing geopolitical tensions continue to undermine demand for the safe-haven precious metal. Tuesday’s dismal US PMIs weigh on the USD and lend support ahead of the key US data.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday. Most people expect the stablecoin to be backed by gold, considering BRICS nations have been accumulating large holdings of the commodity.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.