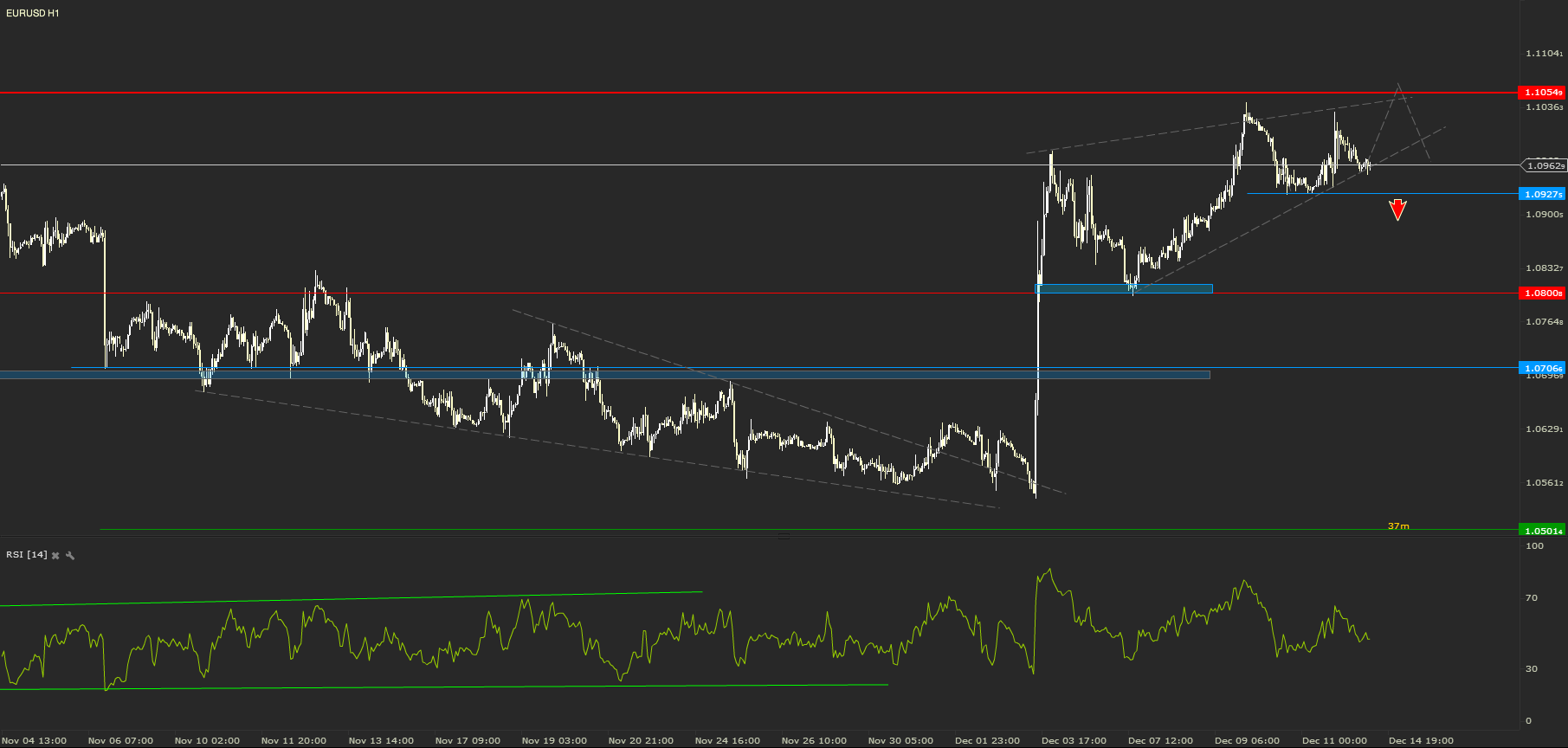

EURUSD - 2 Days beforethe Federal Reserve Meeting

Last week the fiber’sprice action gave some pretty clear signals of what the price might do. Asexpected EURUSD jumped from 1.0800 all the way above 1.1000. It did not hit thenext resistance from 1.1050 and in the second part of the week it has beentrading in an 100 pips range between 1.0930 and 1.1030.

I am expecting for thisbeginning of the week for the bears to try once more to break above 1.1054.They have the biggest chance before Wednesday, when the Federal Reserve isexpected to announce a new rate hike. If so, the price could plunge back to1.0800 or even 1.0700. If the Fed will not deliver what they are expected to,then we might witness another move of 400 pips up.

USDJPY - CorrectiveMovement

Last week I emphasizedthe one month range in which the USDJPY was trading. My expectations were forthe price to break above the upper limit. It did the opposite, triggering thealternative scenario. After the confirmed break below 122.24, the price droppedbelow 121.00, hitting a low at 120.60.

Currently is trading around121.30. The down move looks like a Falling Wedge. Combining the price patternwith the positive divergence from the 14 periods RSI, will give us a prettystrong bullish signal. I would still wait for a proper break above 122.24before considering trusting the bulls. On the other hand I would consider abreak below 120.00, to be a strong bearish signal.

NZDUSD - Still tradingup

The price of kiwidropped last week and retested the support from 0.6600. Even though it brokebelow, it did not confirm the breakout with a close on the 240 minute chart.Right after the false break the price rallied and retested the resistance from0.6785.

A break above theresistance could trigger another rally for the New Zealand dollar, which wouldget the price to the next important resistance from 0.6860. But considering thefollowing events, the dollar might just win against all its counterparts by theend of the week. This bearish scenario for the kiwi would be confirmed by abreak and close under the current support from 0.6600.

USDCHF - All bullishsignals

When the USD lostagainst other currencies across the board, it also lost 400 pips against theSwiss franc. The drop in USDCHF got the price of the pair all the way to0.9800. On this round number level, it is also found the 61.8 Fibonacciretrace. The support held the price for the moment, but the pressure mightcontinue from bears.

Signals are turningbearish on the last part of the down move. The prize drew a Falling Wedge and apositive divergence on the 14 periods RSI. There could become very strongsignals of the price will break and close on an H4 time frame above 0.9900. Inthis scenario a rally could get the price back to parity.

Risk Warning: Financial Derivative Instruments are complex instruments and leveraged products that involve a high level of risk which can result in high losses, including the risk of losing the entire capital invested by the Client. Such instruments might not be suitable for all Clients. The Client should not engage in transactions with such Financial Instruments unless he/she understands and accepts the risks involved by trading Financial Instruments, taking into account his/her investment objectives and level of experience. Forex Rally warns that the information published on this website shall not be considered as a recommendation to buy/sell/keep a certain financial instrument and that past performance of Financial Instruments is not a reliable indicator of future performances.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0650 after US data

EUR/USD retreats from session highs but manages to hold above 1.0650 in the early American session. Upbeat macroeconomic data releases from the US helps the US Dollar find a foothold and limits the pair's upside.

GBP/USD retreats toward 1.2450 on modest USD rebound

GBP/USD edges lower in the second half of the day and trades at around 1.2450. Better-than-expected Jobless Claims and Philadelphia Fed Manufacturing Index data from the US provides a support to the USD and forces the pair to stay on the back foot.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.