EURUSD - Hitting new lows

EURUSD continued to hit new lows last week. Before the official release of the NFP, the price had already dropped below the 1.0900 support. Bulls pushed the price back to retest the round number level, but the corrective movement finished fast, because of the values of the US labor market indicators. The NFP was released at a value of 271K, the Unemployment Rate dropped to 5.0%, while the Hourly Average Earnings increased by 0.4%. These created a better context for the Fed to hike rates next month.

I have seen that the EURUSD’s price action respects round number levels. The price hit a new low very close to 1.0700 after the NFP release from last Friday. Now the price bounced back. Bulls might want to push it back to 1.0800. While a break above this level is expected to send the price to 1.0850, another bounce down would signal a drop below 1.0800, targeting 1.0700.

AUDUSD - Descending Channel

The price action of AUDUSD has been respecting a down channel for the past month. When the price hit the down trend line bounced back down. The drop, triggered by the fundamental data coming from both Australia and US, stopped only on the lower line of the channel. The price found a local support at 0.7022.

From the opening of today’s session the Australian dollar managed to gain back some ground, retesting the resistance, ex support, from 0.7065. This up move looks more like a Flag price pattern. If the pattern will be confirmed by a break below the lower line, I will be expecting a drop towards 0.7000. On the other hand, a break above the current resistance level could actually signal a rally towards 0.7100.

USDJPY - Waiting for a dip

The price of USDJPY has rallied again. It broke above the upper line of the range, I told you about in my previous analysis and is now very close to reaching the full target from 124.00. The new up trend drawn on the chart may end up being an up channel.

The price has reached the rejection line of this possible ascending channel. Though currently there are no strong bearish signals, I am expecting for a pullback an retest of 123.00 before continuing towards the next round number level and full target of the range. A break below 123.00 could signal that bears are pushing the price towards the next local support from 122.00.

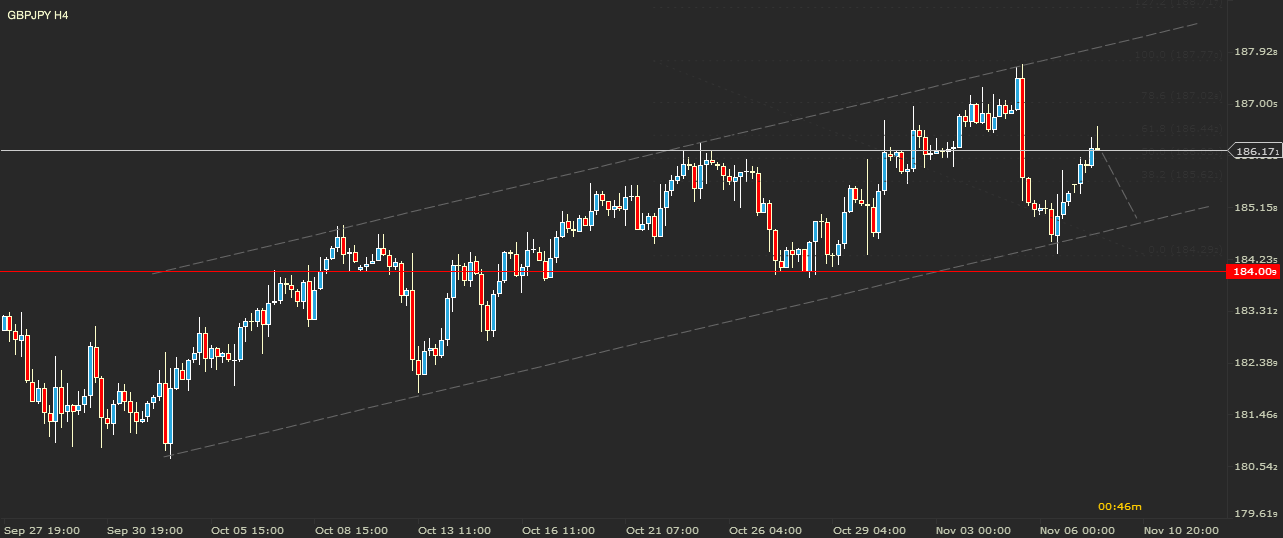

GBPJPY - A different view

I have the feeling that the view on GBPJPY will soon change. Let us look at the current price action of this currency pair. The price has drawn an uptrend and on the 6th of November it bounced back up again from the trend line. The rally brought it back to 186.50. This level is a 61.8 retrace out of the entire drop.

On a 4 hour chart a Shooting Star candlestick pattern seems to be drawn. If it will be confirmed, I would expect it to signal a drop in the price which would target the area between the main trend line and the round number level of 185.00. A close on this time frame above the current resistance, 186.50, would signal a possible rally towards the upper side of the channel.

Risk Warning: Financial Derivative Instruments are complex instruments and leveraged products that involve a high level of risk which can result in high losses, including the risk of losing the entire capital invested by the Client. Such instruments might not be suitable for all Clients. The Client should not engage in transactions with such Financial Instruments unless he/she understands and accepts the risks involved by trading Financial Instruments, taking into account his/her investment objectives and level of experience. Forex Rally warns that the information published on this website shall not be considered as a recommendation to buy/sell/keep a certain financial instrument and that past performance of Financial Instruments is not a reliable indicator of future performances.

Recommended Content

Editors’ Picks

AUD/USD failed just ahead of the 200-day SMA

Finally, AUD/USD managed to break above the 0.6500 barrier on Wednesday, extending the weekly recovery, although its advance faltered just ahead of the 0.6530 region, where the key 200-day SMA sits.

EUR/USD met some decent resistance above 1.0700

EUR/USD remained unable to gather extra upside traction and surpass the 1.0700 hurdle in a convincing fashion on Wednesday, instead giving away part of the weekly gains against the backdrop of a decent bounce in the Dollar.

Gold keeps consolidating ahead of US first-tier figures

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Bitcoin price could be primed for correction as bearish activity grows near $66K area

Bitcoin (BTC) price managed to maintain a northbound trajectory after the April 20 halving, despite bold assertions by analysts that the event would be a “sell the news” situation. However, after four days of strength, the tables could be turning as a dark cloud now hovers above BTC price.

Bank of Japan's predicament: The BOJ is trapped

In this special edition of TradeGATEHub Live Trading, we're joined by guest speaker Tavi @TaviCosta, who shares his insights on the Bank of Japan's current predicament, stating, 'The BOJ is Trapped.'