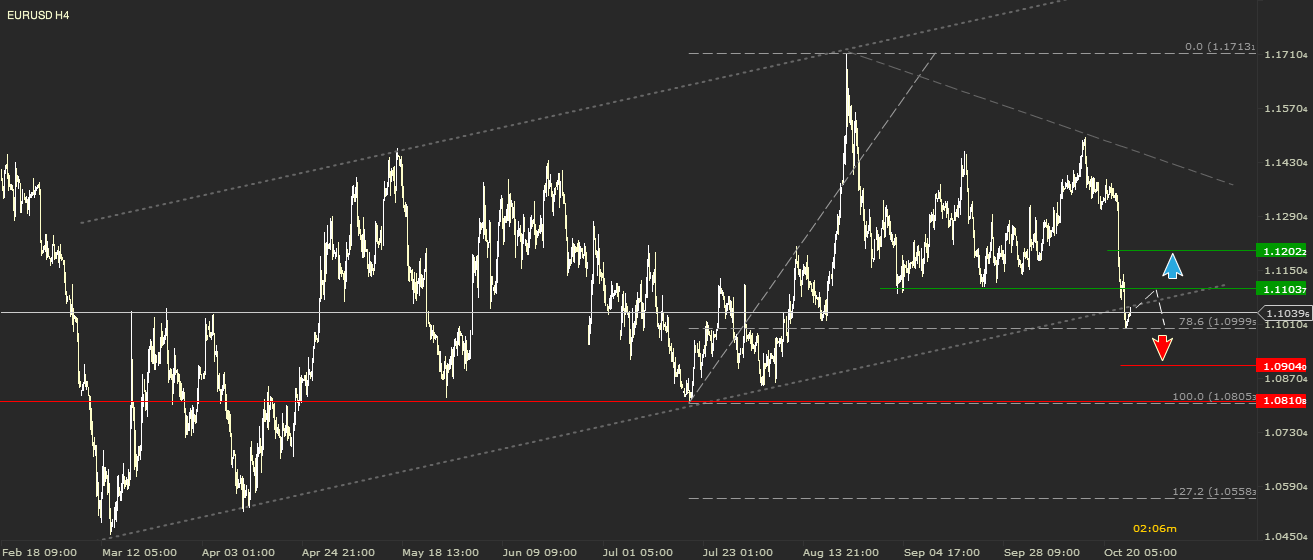

EURUSD - Break or False Break

The price of EURUSD dropped more than 350 pips last week and hit a new low in October. The biggest drop was triggered by the ECB monetary policy statements from the press conference held last week. The drop broke the line of the uptrend that started in February and stopped at 1.1000, which is also the 78.6 Fibonacci retrace from the last impulse of the rising trend. Theoretically, this is considered to be a strong bearish signal with regards to technical analysis. However, it might also result in a false break.

A break and close of a candle on the 240 minute chart, below 1.1000 would confirm the continuation of the down move towards the next round number level, 1.0900, while a stronger support is found at 1.0800. I tend to believe, though, that the price could be pushed back to retest 1.1100 before continuing the downward move. In this scenario I would also pay close attention to a breakout above this level.

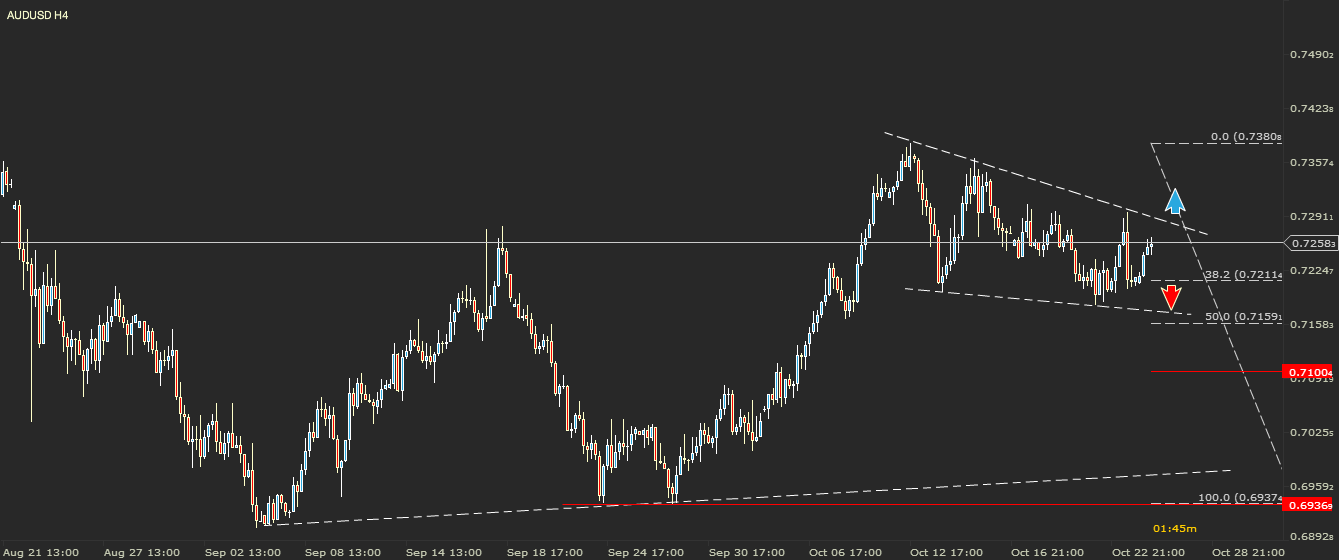

AUDUSD - Falling Wedge

AUDUSD has drawn on the four hours time frame, a Double Bottom which it had confirmed in the beginning of October, by breaking above the baseline. From 12th of October, after hitting a new high at 0.7380, the price started a new corrective move for a possible uptrend. This move has taken the form of a Falling Wedge that has found support in the area between 38.2 (0.7210) and 50% (0.7160). Considering the current price action I believe that there is a higher probability for the price to continue on the upside and break the upper line of the pattern. Continuing the move towards the previous high.

I would also pay close attention to the local support from 0.7200. A break below this level could trigger a drop towards 0.7150 or even 0.7100, invalidating the bullish scenario and the price pattern.

USDCAD - Lower Low on an Uptrend

A very interesting scenario has emerged on the USDCAD price action. The dollar lost against the loonie starting on the 30th of September. On October 15th, the price hit a new low for the current trend at 1.2832, right on the main trend line. The very interesting thing began with the fact that the low hit on 15th this month is lower than the one hit on the 18th of September. Normally this would be a strong bearish signal. Nonetheless, the trend line was not broken yet and the price bounced up from it so the main trend remains up.

In this given scenario, one should be attentive to the current price action. The price has reached a retrace of 61.8 from from the entire corrective move. A break above 1.3215 could trigger a continuation of the rally towards 1.3320 or even higher, towards 1.3452. The alternative would be a break below 1.3100 and the up move trend line. In this case I expect the price to retest 1.3000.

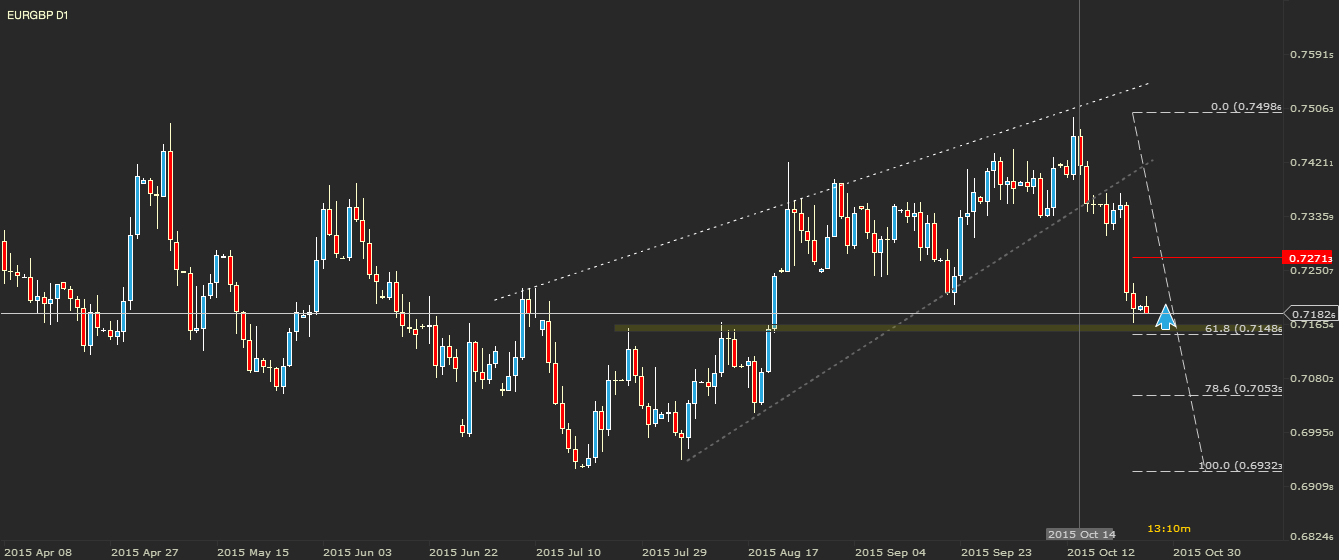

EURGBP - Close to Support

The Euro dropped across the board last week. EURGBP began falling from the 14th of October after it reached a new high at 0.7500. The drop broke below the trend line, confirming a Rising Wedge and headed towards 61.8 Fibonacci retrace from the entire up trend. Currently this currency pair is traded above a very strong support area formed of the retrace mentioned earlier and also some previous support levels. I anticipate a bounce from this support area which could retest 0.7270. Even if the price breaks below 61.8, I would wait for a correction. The next support for a possible fall is found at the 78.6 Fibonacci retrace.

Risk Warning: Financial Derivative Instruments are complex instruments and leveraged products that involve a high level of risk which can result in high losses, including the risk of losing the entire capital invested by the Client. Such instruments might not be suitable for all Clients. The Client should not engage in transactions with such Financial Instruments unless he/she understands and accepts the risks involved by trading Financial Instruments, taking into account his/her investment objectives and level of experience. Forex Rally warns that the information published on this website shall not be considered as a recommendation to buy/sell/keep a certain financial instrument and that past performance of Financial Instruments is not a reliable indicator of future performances.

Recommended Content

Editors’ Picks

AUD/USD holds higher ground above 0.6450 on risk-on mood

AUD/USD is holding higher ground above 0.6450 in the Asian session on Tuesday. The pair capitalizes on the extended risk-on flows into Asia from Wall Street overnight. Upbeat Australian Composite PMI also supports the Aussie ahead of US PMI data.

USD/JPY: Japanese Yen bounces off multi-decade low against USD, lacks follow-through

The Japanese Yen draws some support from the possibility of a government intervention. The divergent BoJ-Fed expectations and easing Middle East tensions cap the safe-haven JPY. Traders also seem reluctant ahead of the key US macro data and BoJ meeting later this week.

Gold price extends sell-off to test $2,300, US PMIs awaited

Gold price extends correction early Tuesday as the Middle East's woes abate. The pullback in the price of Gold could be attributed to profit-taking, as mentioned by Jim Wyckoff of Kitco News, alongside the risk-on trades. Focus shifts to key US PMI data.

Ethereum could see a brief rally, Justin Sun suspected of buying heavily

Ethereum's recent price movement hints at a potential rally despite ETH ETPs recording outflows. The recent price improvement follows the fourth Bitcoin halving and a suspected Justin Sun wallet purchasing large numbers of ETH.

After Monday's relief rally, attention shifts to earnings and policy fronts

With the easing of tensions in the Middle East, safe-haven demand reversed course; global stock markets experienced a modicum of relief. Indeed, in a classic relief rally fashion, Monday saw a rebound in the S&P 500, snapping a six-day losing streak.