EURUSD – Not what Draghi was hoping for

For months, the European Central Bank (ECB) and its President Mario Draghi have been calling for a weaker Euro exchange rate. A combination of the ECB adding more stimulus to reinvigorate the EU economy alongside the continual consistency of alarming data weakening the EU sentiment achieved some Euro weakness. However, for the bear run to continue it was repeatedly stated by analysts that demand for the USD would need to remain strong, otherwise the pair would appreciate very suddenly. Unfortunately for Draghi and the bears, USD profit taking across the board during last week resulted in the Eurodollar reversing to the upside.

This upside move was not encouraged by Euro strength but instead, USD weakness. Despite fears over Europe’s largest economy (Germany) heading for a recession intensifying following the latest German ZEW Survey falling into negative territory, heightened fears over global economic growth encouraged suspicions that the Federal Reserve might delay raising interest rates and as such, investors took profit on the Greenback.

Aside from Thursday’s EU Markit PMI’s, where economists will be looking for clues regarding whether the EU economy is stagnating, where the Eurodollar fluctuates is dependent upon how the markets react to US economic news. The United States economic release to really look out for is September’s inflation data. If suspicions arise that the Federal Reserve will unexpectedly continue QE, expect the Eurodollar to make moves towards 1.29 and 1.30.

Looking at the technicals on the Daily timeframe, the EURUSD technical patterns are currently painting an interesting picture. Not only does the pair remain inside the same bearish channel it has been involved in for months, meaning the pair can still technically move lower - but a bullish trendline within the channel has also formed. Therefore, if the USD does weaken over the upcoming week, there is a technical pattern that will support the pair moving to the upside.

If the Eurodollar appreciation continues, resistance can be found at 1.2884 and 1.2905. If the US inflation report suggests the Federal Reserve will conclude QE as planned, the USD is likely to strengthen and as such, support can be found at 1.2705 and 1.2624.

GBPUSD – Looking at a potential wedge pattern

In line with what has been noticed in the past few weeks, the Cable continued to struggle to find any direction last week and alternated between a bullish and bearish sentiment. The pair even recorded a new yearly low (1.5874) following the news that annualised inflation for September was 1.2%, way below the Bank of England’s (BoE) 2% threshold target before they will consider a rate increase. However, the pair then encountered a complete reversal on Wednesday afternoon when the US markets experienced a sell-off. Comments from James Bullard, renowned to be the most hawkish member of the Federal Reserve, on Thursday evening that the Fed might consider continuing Quantitative Easing (QE) led to the pair reversing all of its previous losses.

Volatility for this pair is likely to intensify on Wednesday next week with two crucial economic releases scheduled to be announced. GBP bulls will be hoping the BoE Minutes release will show that a third member of the Monetary Policy Committee (MPC) voted for a UK rate rise in October. Later in the afternoon, the United States inflation data for September is released. The recent FOMC Minutes suggested there is concern among the Fed that the higher valued USD would be detrimental to US inflation targets. If there is an unexpected slowdown in inflation, confidence in the Greenback will weaken quickly and as such, the GBPUSD could continue its reversal.

From a technical standpoint on the Daily timeframe, the pair is clearly experiencing a downtrend but appears to have pulled away from the bearish channel it previously found itself within. Instead, the GBPUSD has formed some sort of wedge pattern, which can lead to an upside rally later on. Before traders get carried away and see this wedge pattern as a “buy now” opportunity, it must be pointed out that this pair still have plenty of room to move both on the upside and downside, before a potential breakout.

If the Federal Reserve unexpectedly decides to continue with another round of QE later this month, this would encourage substantial USD weakness. As such, we could be looking at the right fundamental opportunity to exploit the technical advantage of the wedge pattern. At the same time, if the Fed conclude QE as planned and continue moving towards normalizing monetary policy, the pair can also move to the downside as well.

If the pair continues to move to the upside, resistance can be found at 1.6152 and 1.6225. If the pair moves in a bearish direction, support can be found at 1.650 and 1.6007.

USDJPY – An expected move

In line with expectations, the pair pulled all the way back from 110 to 105 over the past fortnight. Investors had previously priced in the Bank of Japan (BoJ) increasing stimulus, but the BoJ leaving policy unchanged in October encouraged the JPY to strengthen. Increased fears over the global economic outlook also increased safe-haven attraction towards the JPY. On the other side, fears over the global economic outlook raised suspicions that the Federal Reserve will delay normalizing monetary policy (raising rates). As such, the USDJPY pulled back.

There is a wide variety of Japanese economic data released over the upcoming week, but the pair is more likely to move in accordance with how the markets react to the latest Chinese GDP and US inflation data.

In regards to the former, there are concerns the GDP figure from China will be substantially below Beijing’s 7.5% target. An economist forecasting business in London has suggested China’s GDP figure will be 6.8%, a CNNMoney survey of economists forecast 7.2%. Confirmation of a lower than expected GDP figure would likely heighten fears over not only China’s economic growth but the global economy as well. As such, the demand for the JPY could really strengthen and encourage a further USDJPY pullback.

In reference to the now highly anticipated US inflation data, investors will be looking for guidance regarding whether the higher valued USD would have a detrimental impact on US inflation levels (as feared in FOMC Minutes). If there are no signs of that occurring yet, speculation will mount that the Fed will conclude QE as planned. As such, the USDJPY would be expected to move to the upside. The downside scenario is that the inflation data raises fears that the Fed will continue QE and delay raising rates. If this occurs, the USDJPY will pullback.

Both the Stochastic Oscillator and RSI are ranging at present, meaning this pair could move in either direction. If demand for the USD returns, resistance can be found at 107 and 107.586. If the pair moves towards its trendline, support is located at 106 and 105.500

Gold – Now looking at a reversal

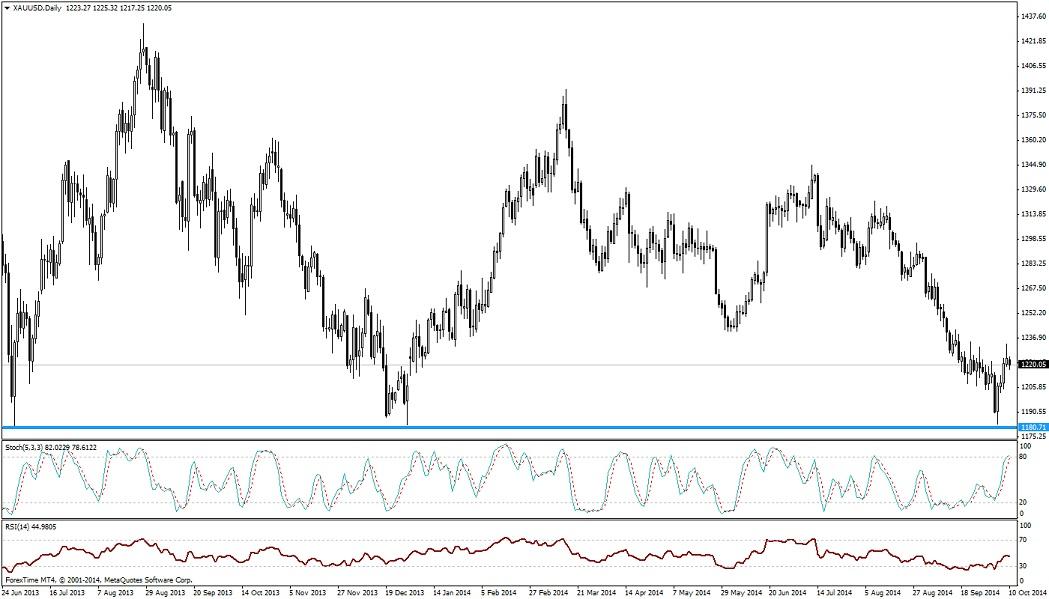

During the previous weekly review, we mentioned Gold declining and hitting the $1180 target a few weeks earlier than previously forecast.

Reaching the $1180 target also represented a “triple bottom” technical pattern on the Daily timeframe, encouraging investors to enter the market. At first, I was apprehensive this would be a false breakout – mainly due to the expectation the Federal Reserve will conclude QE later in October. The US market-sell off during the previous week, alongside comments from the Federal Reserve’s James Bullard that the Fed may not actually conclude QE after all has changed my weariness towards a false breakout. With the right fundamentals connecting together, we could now be looking at Gold going on a bull run.

As mentioned above, the two major economic releases over the upcoming week involve Chinese GDP and US inflation for September. However, despite all the political/economic uncertainty taking place around the globe, Gold has continued to trade only in accordance with US economic news. Therefore, investors in Gold must keep an eye out for the United States inflation data.

If the inflation data heightens anticipation that the Federal Reserve will delay normalizing monetary policy and continue QE, there are high chances Gold will become very attractive to investors. Gold seems to have found some resistance around 1250 but if this is surpassed, resistance can be found at 1270 and 1290.

However if the CPI data is in line with forecasts, expectations will increase that the Fed will conclude QE as planned. This would encourage Gold to erase its recent gains, with support found at 1220 and 1204.

Both the Stochastic Oscillator and RSI are suggesting that Gold could move in either direction.

Comparebroker is a comparison site and we spend hundreds of hours to keep the information up to date. However, users are advised to do their own due diligence and nothing can be perceived any advise. The content on the website is purely for education purposes only

Recommended Content

Editors’ Picks

EUR/USD stays weak near 1.0650 ahead of Eurozone PMI data

EUR/USD remains on the back foot near 1.0650 in European trading on Tuesday. Resurgent US Dollar demand amid a cautious risk tone weighs on the pair. Investors stay wary ahead of the preliminary Eurozone and US business PMI data.

GBP/USD eases below 1.2350, UK PMIs eyed

GBP/USD is dropping below 1.2350 in the European session, as the US Dollar sees fresh buying interest on tepid risk sentiment. The further downside in the pair could remain capped, as traders await the UK PMI reports for fresh trading impetus.

Gold could see a rebound before resuming the correction

Gold price sees a fresh leg down in Asia on Tuesday even as risk flows dissipate. Receding fears over Middle East escalation offset subdued US Dollar and Treasury bond yields. Gold remains heavily oversold on the 4H chart, rebound appears in the offing.

PENDLE price soars 10% after Arthur Hayes’ optimism on Pendle derivative exchange

Pendle is among the top performers in the cryptocurrency market today, posting double-digit gains. Its peers in the altcoin space are not as forthcoming even as the market enjoys bullish sentiment inspired by Bitcoin price.

Focus on April PMIs today

In the euro area, focus today will be on the euro area PMIs for April. The previous months' PMIs have shown a return of the two-speed economy with the service sector in expansionary territory and manufacturing sector stuck in contraction.