The US FED is in a difficult spot. Chair Janet Yellen will have a very hard time, getting out of this messy situation. What’s the problem?

Two things. Number 1, they have become the world’s central bank not only US’s. Number 2, the only indicator that really matters for them is not based on the underlying economy but, it seems they are only interested in the performance of the equity markets, such as the S&P500 or the Dow.

We are in a situation where markets are heavily manipulated by the central banks, as well as the mainstream financial media and this will only result in a very negative outcome in the future. Ever heard the term “entropy” in physics? But that’s appropriate for another article!

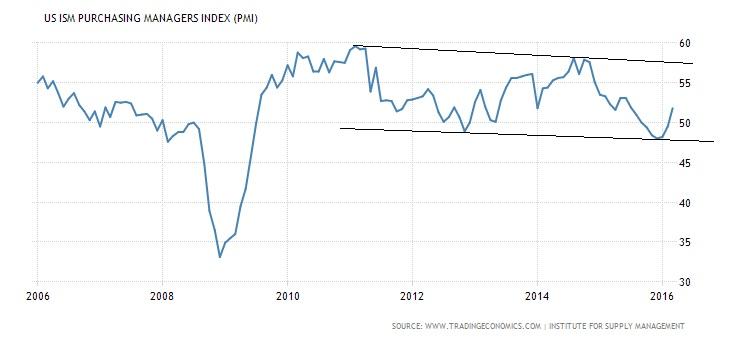

For example, last Friday’s ISM number was better than expected, moving up above the 50 level and there was an euphoria in the mainstream financial media about the “resilience” of the US economy, the “strength”of the US dollar and we even had members of the FED arguing about the timing of raising interest rates, whether it should be April or June.

So let’s get this straight. Back in December2015, we were arguing how many times the FED will raise rates in 2016, because of the “strength” of the US economy. Then in January and February, the FED argued that international conditions are not appropriate and growth in US is sensitive to developments outside the country, nowadays we are talking again about “resilience” and “strength” after just one good release, while Yellen leaves the door open for further accommodation if required! Within 4 months the sentiment and opinions among FED members and major media, swing from one side to the other, according to short term conditions that exist at the moment.

But the FED is a central bank, not a hedge fund, they should know better and keep economic performance and guidance, independent from stock market performance and market sentiment.

Of course, in the short term, it is indeed a positive development a move above the 50 in the ISM, as well as an improvement in labor conditions but, the medium to longer term data, tell us a different story. We would require a serious improvement in economic performance, to even argue that the deflationary threat is moving away and we can return back to normalizing policy.

In absolute terms, the ISM was better than expected than the previous reading but, take a look at the big picture.

The ISM is not going anywhere, simply rotating up and down, depending on seasonality and short term conditions, this is not what we would expect after the FED has thrown billions into the economy.

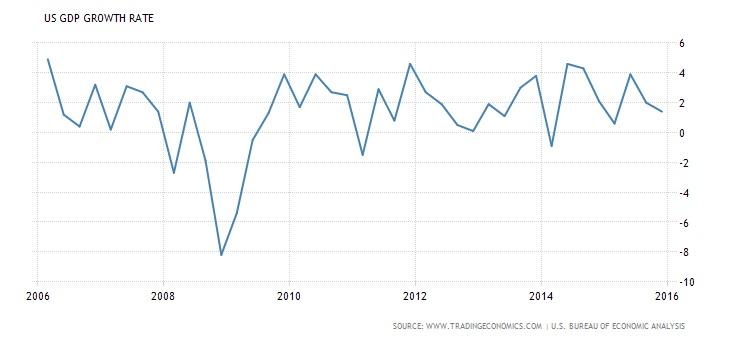

As you can see in the chart below, the GDP growth rate does not show any significant improvement in the economy, the argument for strong deflationary forces is valid here.

Manufacturing production is hovering around zero and I believe will stay low for at least the medium term as well.

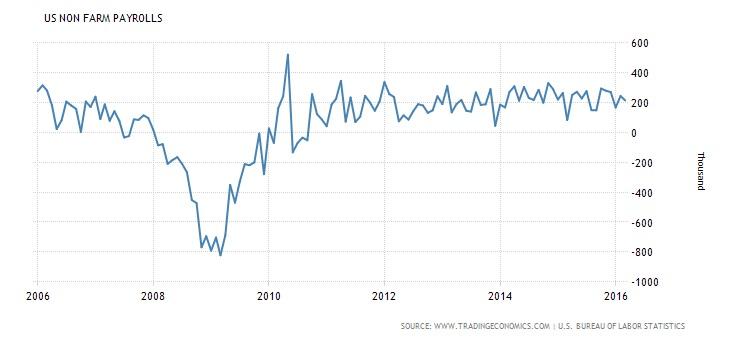

Unfortunately, we hear comments that argue that there is no need to worry about the loss of manufacturing jobs, “after all thisis not the 1950’s”. Overall, the US economy is creating jobs. Ok, then let’s take a look at the Non-farm payrolls.

Again you see the same pattern, there is no improvement, and data are just rotating around the mean value, depending on short term conditions and seasonality.

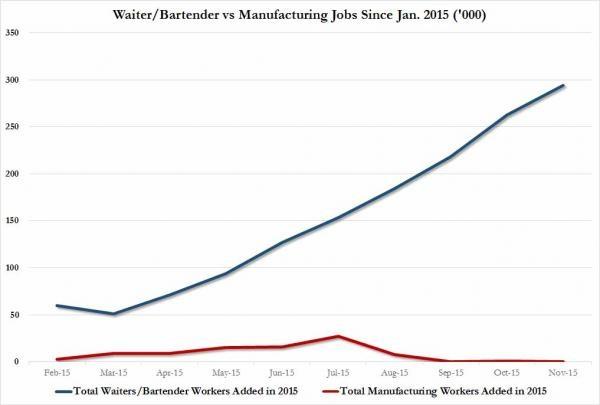

While, there are thousands of jobs lost in the manufacturing sector, the FED is happy because….there is a growing number of waiters and bartenders, as you can see below!

How they can raise interest rates with these kind of data is really beyond me! I sincerely hope that they will not make that mistake at this stage.

But let’s take a look at the markets themselves and examine the message they send.

Short term yields, on the 2y US Bonds, rose initially due to the better than expected ISM on Friday but, you can clearly see in which direction is the main trend. This is not the price behavior I would expect inthe bond market, from a central bank that wants to move back to normalizing rates.

While short term yields rose slightly, the 10y yields dropped further as you can see below.

Again, there is a clear divergence between theFED’s guidance and the expectations of the bond markets regarding the future.

But, the real dangers are not coming from US but rather from abroad.

Please ask yourself this, can the FED raise interest rates without hurting not only its own domestic growth but, also causing huge problems to China and emerging markets?

Unfortunately, the FED has become the world’scentral bank not only US’s and they strongly depend about what is happening in other economies too.

Take a look at an ETF called EMB, which tracks Emerging Markets’ Bonds.

Conditions have eased after the bad start atthe beginning of the year and yields dropped but we are now reaching a stage that we find technically an important resistance line and also fundamentally we cannot ignore the potential risks ahead for the EM economies.

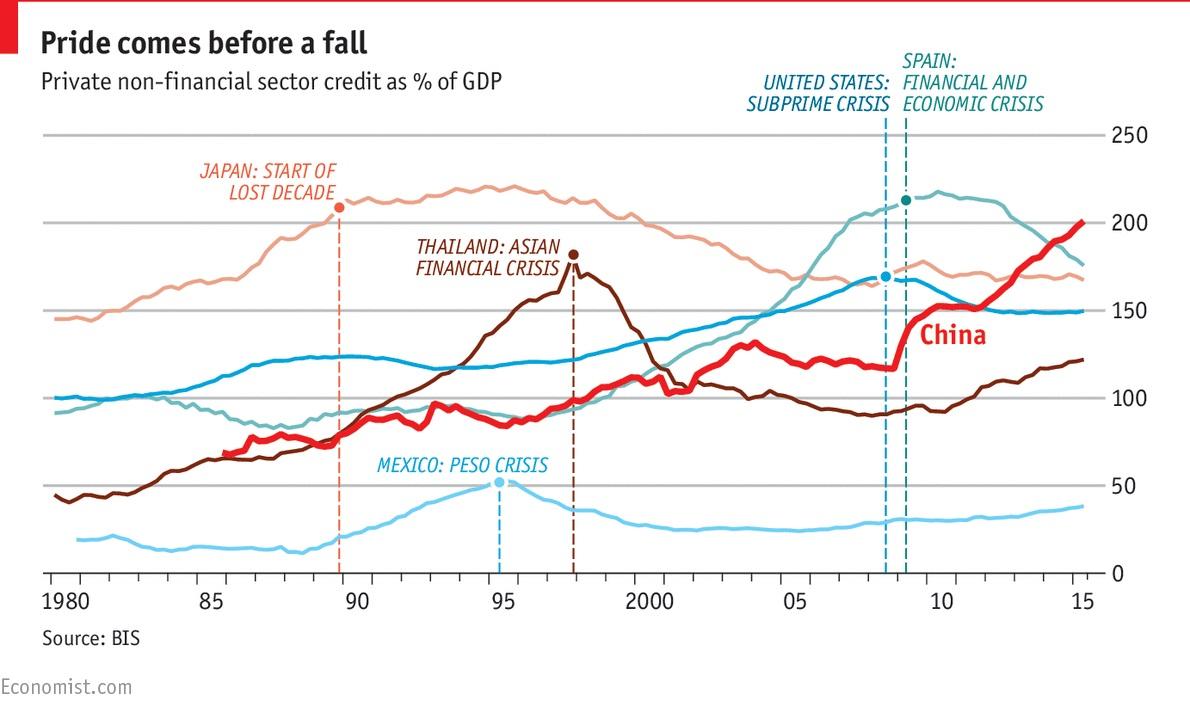

Furthermore, according to “The Economist” and I quote: “DEBT in China is piling up fast. Private debt, at 200% of GDP, is only slightly lower than it was in Japan at the onset of its lost decades, in 1991,and well above the level in America on the eve of the financial crisis of 2007-08. China’s binging borrowers seem to have run out of good investments.The value of non-performing loans in China rose from 1.2% of GDP in December 2014 to 1.9% a year later. Some big firms are earning too little to service their debts; instead, they are making up the difference by borrowing yet more.”

Please have a look at the following chart from the Economist:

So let me ask again” “How can you raise rates without hurting EM markets and creating a big problem with EM and Chinese debt?”

Is the situation improving in China, so we can potentially expect better conditions in the future?

The balance of trade is moving lower, indicating that they sell less goods to the rest of the world.

This is further justified by Industrial production which is moving lower every year.

I am afraid China will have to “export” its deflationary problems to the rest of the world and further depreciate its currency, if these conditions continue.

Let’s try to translate all these into actionable, trading ideas.

This is the Dollar index:

It is right in the middle of the bigger range, there is no trade there with appropriate reward/risk and I think it will get worse before getting better.

While, there was hype on Friday about the“resilience” in the economy and the dollar’s potential strength, the USD was moving lower against both the JPY and the EUR.

This is the chart of the USDJPY:

And this is the EURUSD:

Take into consideration that Crude Oil prices have broken lower and we expect higher volatility due to speculation regarding Saudi Arabia, Iran and Russia, potentially agreeing to “freeze” oil production, which I don’t think will happen. Nevertheless, it will bring some volatility. It is my opinion that Crude Oil will again be a very important catalyst for the global markets, since its impact in inflation and growth in EM markets and China.

I will be very cautious in the Currency markets as I expect further volatility due to Brexit fears and further deflationary forces from China and concerns about the Chinese debt.

The British real estate “bubble” is sending worrying signals and this is a macro factor to pay attention.

In my opinion the best opportunities will be in the equity markets based on risk reward characteristics.

We have interesting developments in the European Equity markets and if current conditions persist, I will be looking to initiate a SELL (short) position.

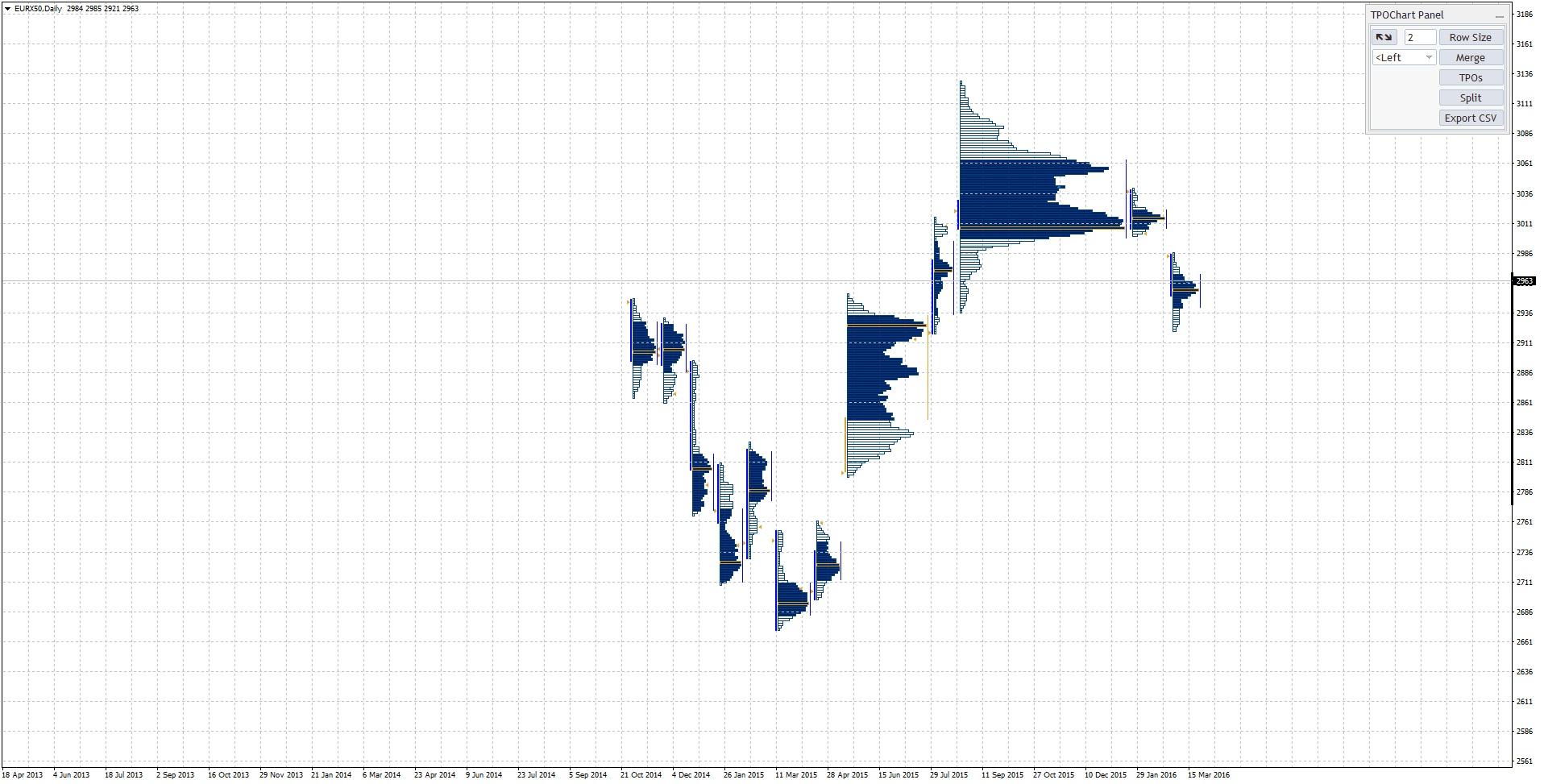

This is a daily profile chart of the Eurostoxx50.

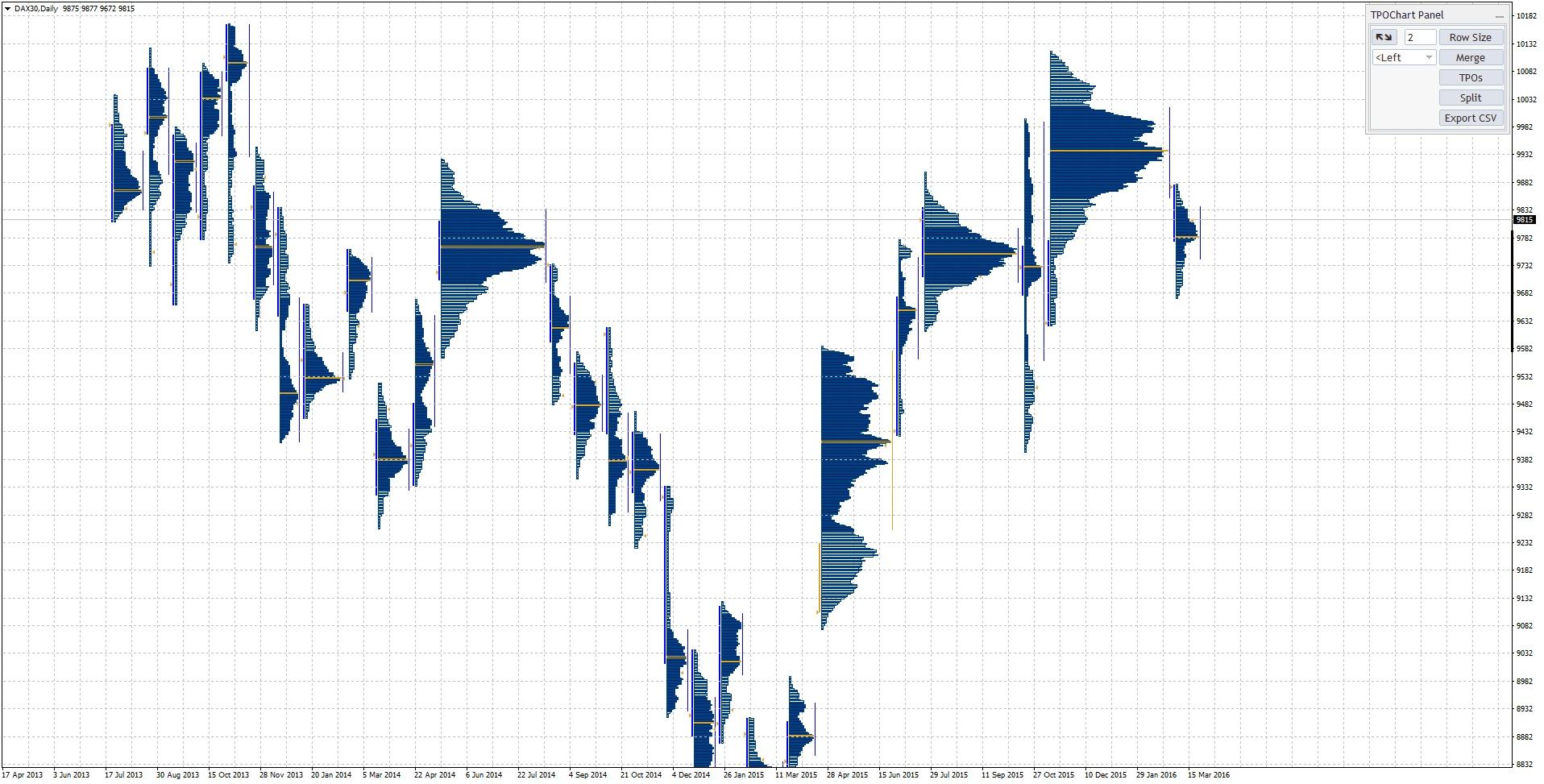

And this a daily profile of the DAX.

Both indices have broken outside their respective value areas, testing the lows of the balance and we have appropriate conditions for a stronger trend lower. Further accommodation below Value is a bearish indication and I will be looking for a breakout.

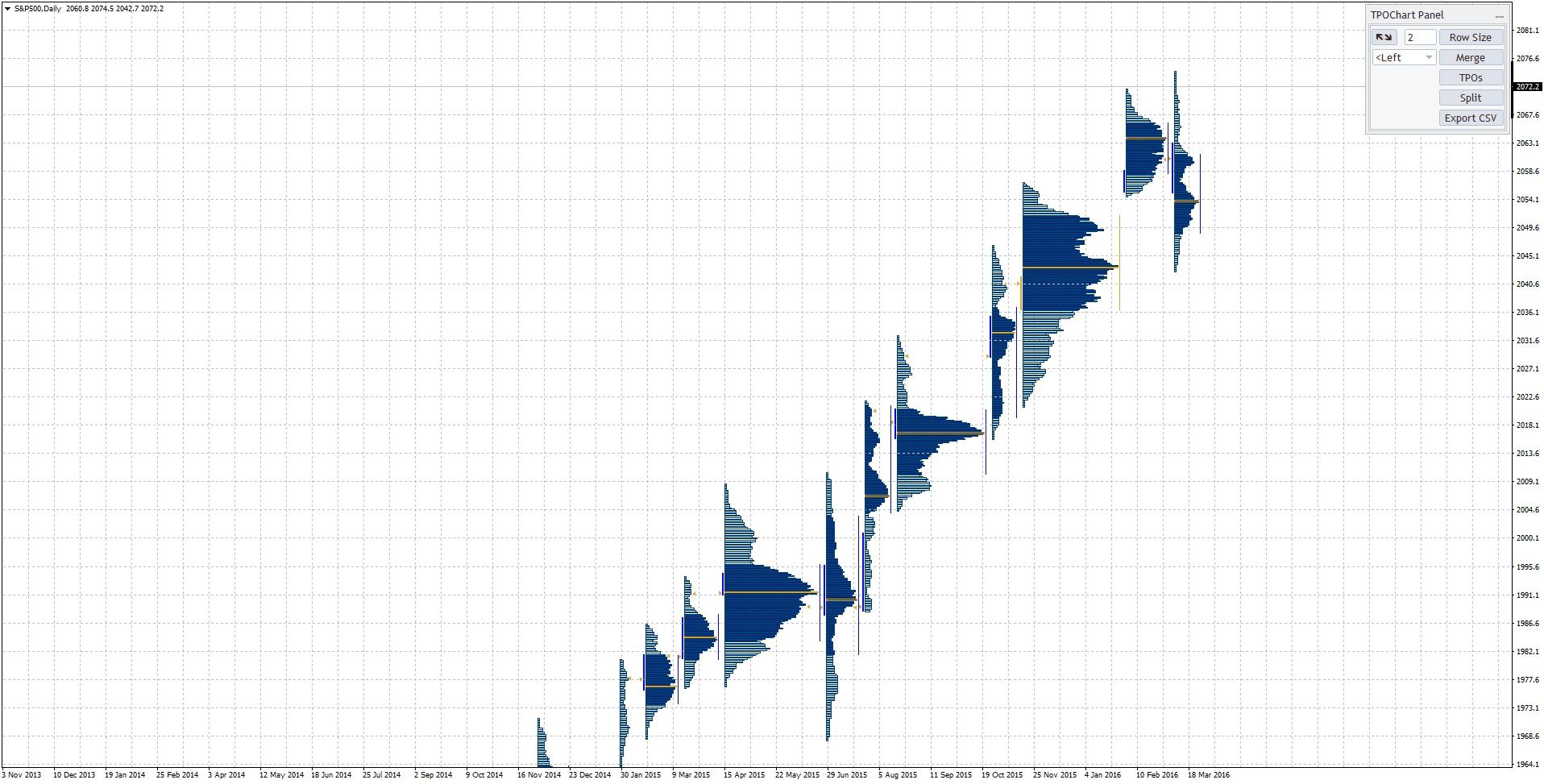

In the US market the S&P 500 has moved higher but with very thin volumes as you can see on the volume histogram profile. I would need to “see” the buyers stepping in and absorb the offer, if prices are going to move higher.

A move lower and acceptance below 2066 will mean that we have a short term top in place and I will be looking for prices to move further lower.

This week, I expect the release of the FOMC minutes, Brexit, potential ECB actions and Chinese worries to be the main catalysts to move prices.

Trade well and trade safely!

Thank you!

None of the fotis trading academy nor its owners (expressly including but not limited to Marc Walton), officers, directors, employees, subsidiaries, affiliates, licensors, service providers, content providers and agents (all collectively hereinafter referred to as the “fotis trading academy ”) are financial advisers and nothing contained herein is intended to be or to be construed as financial advice

Fotis trading academy is not an investment advisory service, is not an investment adviser, and does not provide personalized financial advice or act as a financial advisor.

The fotis trading academy exists for educational purposes only, and the materials and information contained herein are for general informational purposes only. None of the information provided in the website is intended as investment, tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement, recommendation or sponsorship of any company, security, or fund. The information on the website should not be relied upon for purposes of transacting securities or other investments.

You hereby understand and agree that fotis trading academy, does not offer or provide tax, legal or investment advice and that you are responsible for consulting tax, legal, or financial professionals before acting on any information provided herein. “This report is not intended as a promotion of any particular products or investments and neither the fotis trading academy group nor any of its officers, directors, employees or representatives, in any way recommends or endorses any company, product, investment or opportunity which may be discussed herein.

The education and information presented hereinen is intended for a general audience and does not purport to be, nor should it be construed as, specific advice tailored to any individual. You are encouraged to discuss any opportunities with your attorney, accountant, financial professional or other advisor.

Your use of the information contained herein is at your own risk. The content is provided ‘as is’ and without warranties of any kind, either expressed or implied. The fotis trading academy disclaims all warranties, including, but not limited to, any implied warranties of merchantability, fitness for a particular purpose, title, or non-infringement. The fotis trading academy does not promise or guarantee any income or particular result from your use of the information contained herein. The fotistrainingacademy.com assumes no liability or responsibility for errors or omissions in the information contained herein.

Under no circumstances will the fotis trading academy be liable for any loss or damage caused by your reliance on the information contained herein. It is your responsibility to evaluate the accuracy, completeness or usefulness of any information, opinion, advice or other content contained herein. Please seek the advice of professionals, as appropriate, regarding the evaluation of any specific information, opinion, advice or other content.

Marc Walton, a spokesperson of the fotis trading academy, communicates content and editorials on this site. Statements regarding his, or other contributors’ “commitment” to share their personal investing strategies should not be construed or interpreted to require the disclosure of investments and strategies that are personal in nature, part of their estate or tax planning or immaterial to the scope and nature of the fotis trading academy philosophy.

All reasonable care has been taken that information published on the Fotis trading academy website is correct at the time of publishing. However, the Fotis trading academy does not guarantee the accuracy of the information published on its website nor can it be held responsible for any errors or omissions.

Recommended Content

Editors’ Picks

AUD/USD jumps above 0.6500 after hot Australian CPI data

AUD/USD extended gains and recaptured 0.6500 in Asian trading, following the release of hotter-than-expected Australian inflation data. The Australian CPI rose 1% in QoQ in Q1 against 0.8% forecast, providing extra legs to the Australian Dollar upside.

USD/JPY hangs near 34-year high at 154.88 as intervention risks loom

USD/JPY is sitting at a multi-decade high of 154.88 reached on Tuesday. Traders refrain from placing fresh bets on the pair as Japan's FX intervention risks loom. Broad US Dollar weakness also caps the upside in the major. US Durable Goods data are next on tap.

Gold price cautious despite weaker US Dollar and falling US yields

Gold retreats modestly after failing to sustain gains despite fall in US Treasury yields, weaker US Dollar. XAU/USD struggles to capitalize following release of weaker-than-expected S&P Global PMIs, fueling speculation about potential Fed rate cuts.

Ethereum ETF issuers not giving up fight, expert says as Grayscale files S3 prospectus

Ethereum exchange-traded funds theme gained steam after the landmark approval of multiple BTC ETFs in January. However, the campaign for approval of this investment alternative continues, with evidence of ongoing back and forth between prospective issuers and the US SEC.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Fed might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.