Global Macro Analysis 30th November 2015

We have an important week lying ahead, a week that will probably not only reveal, what to expect in the major currencies in the short term but, can also set the tone for the first few months of 2016. The week is packed with economic releases and the focus once again will be on sentiment and expectations about future monetary policy. Particular attention should be placed on ECB’s meeting on Thursday, as we are expecting to see whether Mario Draghi will extent QE in the Eurozone and OPEC’s meeting in Austria on Friday as there are reports that some OPEC members including Iran, are putting pressure on Saudi Arabia to lower production.

Once again we are presented with three major macro catalysts that drive prices, the ECB’s QE program, the potential US rate hike and pace of tightening and perhaps the most important of all, the Chinese response to US monetary policy and a potential devaluation of the Yuan. The consequences to the global economy and to the risk environment cannot be underestimated.

The Week Ahead

The coming week is pivotal and unprecedented in terms of the gravity of the decisions to be made and we should expect or at least prepare for increased volatility. That also means that good trading opportunities will be created if we are prepared to pay attention to the news flow and fundamentals.

In the next few days there are important data releases that can move FX markets. Overnight on Monday we will see the manufacturing PMI from China and the Caixin PMI as well.The Caixin PMI in particular is critical to both commodities and the Aussie Dollar. With recent data showing a serious drop in industrial growth in Chinathere is little surprise that commodities continue to hit lows. The so called ’super-cycle’ of 10 years is expected to continue for some time with some analysts predicting a two of three year period of stagnation before any improvements will be seen.

The market will now be super sensitive to the Chinese manufacturing data, and whilst improvements have been seen in the services sector, it is the industry sector that mostly affects the global economies and thus market sentiment.

In Australia, also overnight on Monday, the RBA will make its decision on rates. The expectationis that with both the ECB and the Fed decision ahead this month, they are unlikely to change their policy but the language of the statement will be important to monitor for any clues as to future intentions. At their last meeting the door was left open to rate cuts, should conditions in China worsen,so we will be watchful for anything dovish in their tone.

On Tuesday, the UK will announce the Bank Stress Test results. This can impact both the GBP and the FTSE. Additionally, Carney will be speaking and that is always unpredictable, as he is prone to change his mind but, recently has indicated that we should expect rates to stay low until the middle of 2016 at least. With weak inflation Carney is in no hurry and he will also want to wait to see howthe ECB and the US policy decisions play out.

The US weighs in on Wednesday with ADP Non-Farm Employment change and of course the testimony of FED’s Head Yellen. Also on Wednesday, the Canadians have their rate decision the same day and are obviously very exposed to the outcome of the OPEC meeting on Friday.

Draghi faces his own dilemma on Thursday with the much anticipated ECB rate decision and monetary policy statement. We should be prepared for an upside surprise in the EUR, should the decision adopt a mild approach. In any event no assumptions can be made, especially as politics is involved which includes some German opposition to further easing. It may well be a good week to leave the Euro alone. There are better opportunities on offer elsewhere.

The week ends with another two major events. The all-important US NFP, with the implications that may have for the rate hike cycle and particularly the definition of the word ‘gradual’ and the OPEC’s meeting, where we wait to see, if Saudi Arabia will agree a reduction in their crude production, in order to support and improve the slumping prices. The expectation leans against such an agreement but, it is yet another decision we cannot assume. The consequences of change in this arena would be felt everywhere.

TheOpportunities

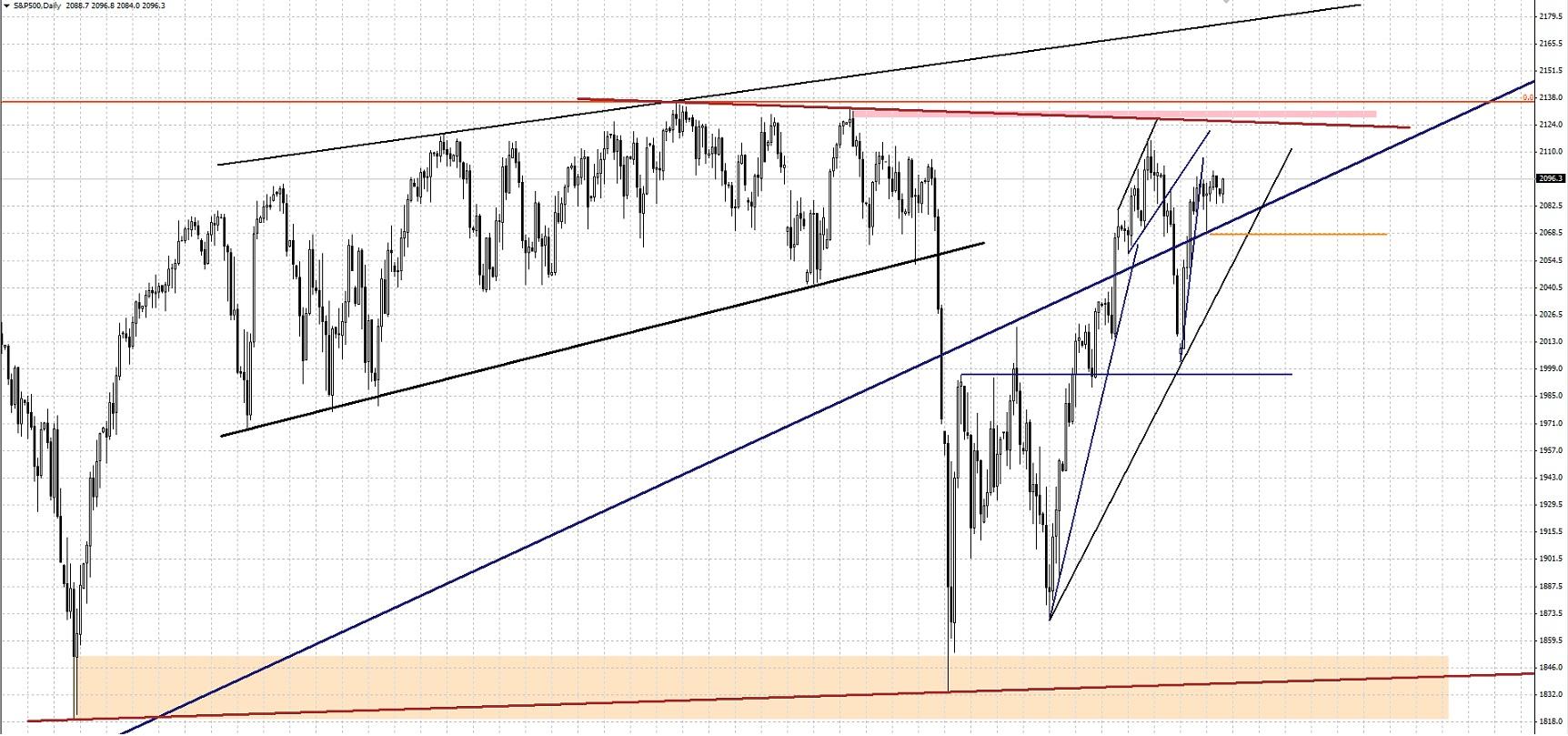

SP500

This equity index can provide early indications of shifts in sentiment and to identify whether we arein a risk on or risk off environment. We are approaching a strong resistance area but we are looking to initiate a short position only below 2070.

USDJPY

A look at the weekly chart shows us that we are in an uptrend and the target is now higher towards the upper trend line. A clean break can provide a strong move much higher. This is clearly driven by the upcoming US monetary policy decision.

USDCAD

Target here is1.40, weekly is showing a strong up trend, the best areas to enter, if US fundamentals remain strong, for pullback around 1.3190 or a break of 1.34496 to the upside. This of course will be affected by the BOC’s rate decision and the OPEC’s meeting.

USDSGD

This has moved down on a stronger than expected SGD GDP. Looking for a buy on pullback at support, provided that US policy remains hawkish.

EURAUD

We had the signal to sell a few weeks ago with a potential target of 1.3520. It is a good technical pattern and may have lower to go if Aussie rates stay unchanged and Draghi extents QE.

GBPUSD

The structure looks good for a short and the move down could be significant, if the fundamentals are quite bad for the UK.

This depends on the calendar events also which include PMI’s stress tests and Carney. This week will give some indications of the health of the UK economy

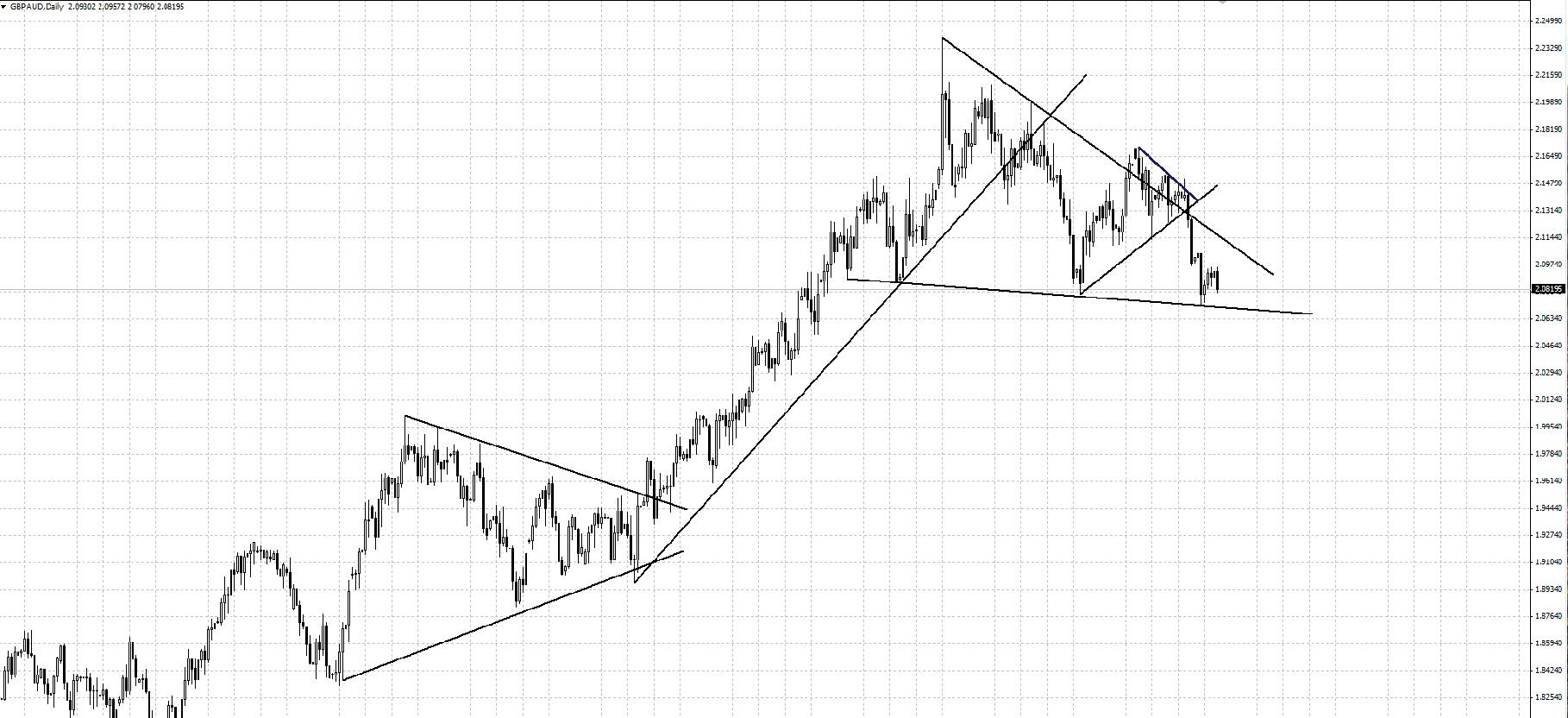

GBPAUD

Similar pattern with a triangular formation and could yield a significant move down. Risk/reward could be very good in this pattern.

Medium to longe rterm, the most important catalyst continues to be China and just how they react to US policy. They may take a path of significant easing to support their own economy and this in turn will have consequences for emerging markets the global economy in general.

We have ahead a very news rich week, which has the potential to bring the edge in our favor, if we pay close attention and understand the bigger picture, take all necessary steps to control risk and know precisely the market structures that yield the highest probability of success.

Thank you!

Fotis Papatheofanous, MBA

None of the fotis trading academy nor its owners (expressly including but not limited to Marc Walton), officers, directors, employees, subsidiaries, affiliates, licensors, service providers, content providers and agents (all collectively hereinafter referred to as the “fotis trading academy ”) are financial advisers and nothing contained herein is intended to be or to be construed as financial advice

Fotis trading academy is not an investment advisory service, is not an investment adviser, and does not provide personalized financial advice or act as a financial advisor.

The fotis trading academy exists for educational purposes only, and the materials and information contained herein are for general informational purposes only. None of the information provided in the website is intended as investment, tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement, recommendation or sponsorship of any company, security, or fund. The information on the website should not be relied upon for purposes of transacting securities or other investments.

You hereby understand and agree that fotis trading academy, does not offer or provide tax, legal or investment advice and that you are responsible for consulting tax, legal, or financial professionals before acting on any information provided herein. “This report is not intended as a promotion of any particular products or investments and neither the fotis trading academy group nor any of its officers, directors, employees or representatives, in any way recommends or endorses any company, product, investment or opportunity which may be discussed herein.

The education and information presented hereinen is intended for a general audience and does not purport to be, nor should it be construed as, specific advice tailored to any individual. You are encouraged to discuss any opportunities with your attorney, accountant, financial professional or other advisor.

Your use of the information contained herein is at your own risk. The content is provided ‘as is’ and without warranties of any kind, either expressed or implied. The fotis trading academy disclaims all warranties, including, but not limited to, any implied warranties of merchantability, fitness for a particular purpose, title, or non-infringement. The fotis trading academy does not promise or guarantee any income or particular result from your use of the information contained herein. The fotistrainingacademy.com assumes no liability or responsibility for errors or omissions in the information contained herein.

Under no circumstances will the fotis trading academy be liable for any loss or damage caused by your reliance on the information contained herein. It is your responsibility to evaluate the accuracy, completeness or usefulness of any information, opinion, advice or other content contained herein. Please seek the advice of professionals, as appropriate, regarding the evaluation of any specific information, opinion, advice or other content.

Marc Walton, a spokesperson of the fotis trading academy, communicates content and editorials on this site. Statements regarding his, or other contributors’ “commitment” to share their personal investing strategies should not be construed or interpreted to require the disclosure of investments and strategies that are personal in nature, part of their estate or tax planning or immaterial to the scope and nature of the fotis trading academy philosophy.

All reasonable care has been taken that information published on the Fotis trading academy website is correct at the time of publishing. However, the Fotis trading academy does not guarantee the accuracy of the information published on its website nor can it be held responsible for any errors or omissions.

Recommended Content

Editors’ Picks

AUD/USD could extend the recovery to 0.6500 and above

The enhanced risk appetite and the weakening of the Greenback enabled AUD/USD to build on the promising start to the week and trade closer to the key barrier at 0.6500 the figure ahead of key inflation figures in Australia.

EUR/USD now refocuses on the 200-day SMA

EUR/USD extended its positive momentum and rose above the 1.0700 yardstick, driven by the intense PMI-led retracement in the US Dollar as well as a prevailing risk-friendly environment in the FX universe.

Gold struggles around $2,325 despite broad US Dollar’s weakness

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Bitcoin price makes run for previous cycle highs as Morgan Stanley pushes BTC ETF exposure

Bitcoin (BTC) price strength continues to grow, three days after the fourth halving. Optimism continues to abound in the market as Bitcoiners envision a reclamation of previous cycle highs.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Federal Reserve might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.