Every week,we start our analysis by applying a top down approach, scanning the international markets for potential catalysts that could potentially trigger the next big move. This is the essence of Global Macro analysis, to identify what is driving prices at a fundamental level and then you may apply a technical strategy, to pinpoint the entry and manage your risk.

Last week,the global markets were driven mostly by two major events, the far better than expected NFP numbers in the US and the poor economic indicators, as well as the accommodative rhetoric coming out of the ECB. These two events are important as they affect sentiment greatly, as they provide vital clues about the future path of monetary policy, in both US and Europe. Therefore, we expect the FED to raise interest rates at the December’s meeting and we also expect the ECB to provide more accommodative measures in order to stimulate the economy by either extending the QE or cutting interest rates.

Those two important developments caused the US Dollar to appreciate, due to expectations of higher yields in the future and also the Euro to significantly drop because of expectations of further accommodative measures. We also briefly saw the European equity markets to run to higher levels, because of the possibility of more QE and we have witnessed in the past strong rallies on expectations of more dovish policies.

But, as we said previously, we are global macro traders and before we start trading, we try to understand in which environment we are at the moment, which fundamental conditions are driving prices and more importantly where we can find suitable opportunities and what are our risks.

So,although it was relatively easy to spot that the monetary policy divergence between the FED and the ECB is driving prices in the short term, we could see that at this particular point of time, things were different than similar situations in the past.

Allow me to explain further.

Weeks ago,as we could see the economic indicators in the Eurozone deteriorating, we considered it a high probability event that the ECB was going to be more accommodative and using our own technical analysis we were sellers of EURUSD,in the area between 1.1430-1.1310 with a target towards 1.08-1.09, as we explained in our live Monday’s meeting. We also liked the trading idea of getting long the USD against emerging market currencies and in particular the Singaporean dollar and we showed a very specific area where we would like to go long.

We were rewarded handsomely as the events unfolded but, right now we have very good reasons that make us thing differently and believe that the next big move might be different than most traders think.

This is why in our last report the previous week, we suggested paying closer attention to equity indices, as there are other factors that can prove more significant than the policy divergence and affect sentiment.

Question number 1, that we cannot find any conclusive and accurate answers, what is going on with China? How bad is the situation? Is the central bank there going to be successful reversing the situation with the accommodative measures they take? Emerging markets in the area are affected even more and as you can see in the chart below, the Emerging Markets ETF based on the MSCI Emerging Markets index is moving to monthly lows.

images courtesy of www.stockcharts.com

We also see that Copper futures an extremely important commodity that shows how healthy or not emerging markets are, is moving to new lows.

It is important to also take a look at the Commodities index.

I believe that it is very likely the FED to increase interest rates in December but, with the threat of global deflation looming, China and emerging markets in crisis,with commodities moving lower and with expectations that Oil prices will remain pressured at least until 2017 due to supply issues, let me ask this:

When is the NEXT hike going to happen?

If we assume that we will have an interest rate hike this December, when are we going to have the next one? When the FED says that this will happen “gradually”, then what is the meaning of “gradual” according to the FED? In every meeting, every other meeting, after 6 months?

You can see that international conditions and developments can completely change the outlook for interest rates in the US.

There are also other very practical problems, if USD keeps rising due to monetary policy expectations this causes the cost of USD funding to move higher and this is a major problem for emerging market economies, as they are facing a huge debt accumulated in USD and now they have to deal with an inverse carry trade.

The potential strength of the USD can affect the FED and make them worry about the impact in emerging market economies and the potential impact in their own economy, so this is a theme to watch.

So before deciding to pull the trigger in a trade, we must identify and understand the current environment. It was our suggestion from last week to pay attention to equity indices as we could see that there was an increased probability of a risk off event, due to international conditions and the uncertainty about what happens next with regards to monetary policies.

Let’s take a look at the SP500 first. The technical conditions were not ideal since lastweek, as we were back at the top of the range and the structure was suggestiveof a topping formation. We could see a balance (ranging) pattern at the highs,as indicated by the pink circle and we later broke outside the pattern, to the downside, an actual bearish signal.

We could see something similar to the Dow30 index.

As you can see we rallied back to the previous highs, where prices started balancing again, before the breakout to the downside.

This coming week we also have to consider how the markets will react to the tragic events that took place in Paris. Is the geopolitical turmoil and war on terrorism going to lead to a sell off in equities? We will be paying great attention to the equities but our longer term bias is negative.

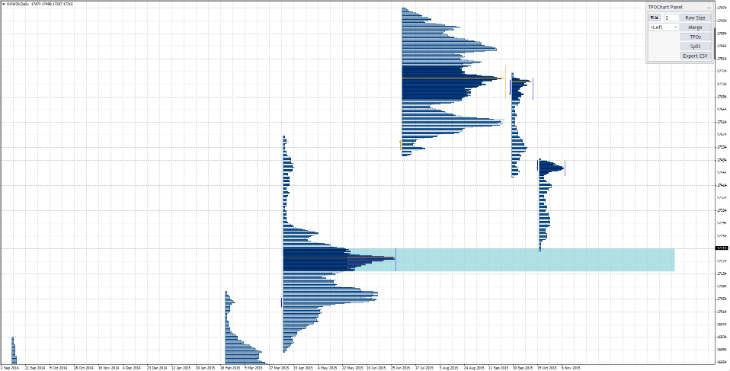

If you take a look at the daily market profile chart of the Dow30, you will see that we had a strong move down, but we are now near a High Volume Node that could act as short term support. However, our longer term view in negative and we would be looking to establish short positions at the right areas.

As currency traders, it is vital to pay attention to inter-market relationships because a potential selloff in equities and in particular in the European markets, will cause the EURUSD to move higher, as there are flows towards the EUR that acts as a safe haven currency.

You will notice in the EURUSD that the recent drop in equities has helped the EUR to stabilize around the trend line and it might move further higher if sentiment turns negative in equities. The question for us as traders is not whether EUR will move further down or reverse from here, we should consider this from a point of reward to risk for us. At these levels the reward/risk ratio is not the best one for us. If fundamentals don’t change significantly, I would prefer to sell again in resistance near the 1.09 - 1.10 level or, to start looking for a potential strong trend below 1.05, with parity as target. Of course, anything can happen but it is very important for us as traders to focus on the reward/risk that the trade offers.

Practically and short term, please be careful this week as negative sentiment can bring the EUR higher. Take a look at the profile chart and you will notice that we have formed a nice balance right at the bottom and price action has brought us to the highs of the balance.

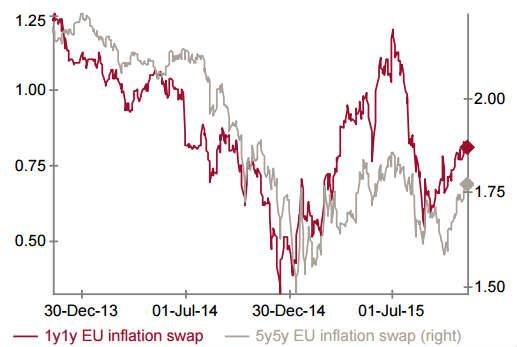

Please also pay attention to the fact that inflation expectations are changing in the Eurozone and it is not a guaranteed event that the ECB will definitely extent the QE. It is an environment highly dependent on data and developments. In the chart below you can see that inflation expectations are improving for 1y and 5y swaps.

So practically this week we will be trading the sentiment, following the flow in the equities and on Tuesday the 17th of November our focus will be entirely on the US Headline and Core CPI that is released. Expect a stronger CPI to reinforce the scenario for a rate hike in December but, a weaker CPI could provide support for those that argue the US economy is not ready yet for an increase in rates.

I also have another trading idea based on the drop in commodities and the fact that the Bank of England follows the FED with a bit of a lag. If the FED hikes the most likely central bank to be next is the BOE.

Therefore,I am looking to potentially get long the GBP against commodity currencies such as the AUD, the CAD and the NZD. Prices are still inside a triangular pattern,a balance if you prefer but I think we will have a breakout soon. Because Oil prices are very likely to remain pressured until 2017 at least, GBPCAD seems a decent long candidate, if we get a valid long signal.

You will also notice that we have a similar pattern in the GBPAUD.

If you are patient and wait for the right triggers, you can be rewarded handsomely!

Thank you,

Fotis Papatheofanous MBA

None of the fotis trading academy nor its owners (expressly including but not limited to Marc Walton), officers, directors, employees, subsidiaries, affiliates, licensors, service providers, content providers and agents (all collectively hereinafter referred to as the “fotis trading academy ”) are financial advisers and nothing contained herein is intended to be or to be construed as financial advice

Fotis trading academy is not an investment advisory service, is not an investment adviser, and does not provide personalized financial advice or act as a financial advisor.

The fotis trading academy exists for educational purposes only, and the materials and information contained herein are for general informational purposes only. None of the information provided in the website is intended as investment, tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement, recommendation or sponsorship of any company, security, or fund. The information on the website should not be relied upon for purposes of transacting securities or other investments.

You hereby understand and agree that fotis trading academy, does not offer or provide tax, legal or investment advice and that you are responsible for consulting tax, legal, or financial professionals before acting on any information provided herein. “This report is not intended as a promotion of any particular products or investments and neither the fotis trading academy group nor any of its officers, directors, employees or representatives, in any way recommends or endorses any company, product, investment or opportunity which may be discussed herein.

The education and information presented hereinen is intended for a general audience and does not purport to be, nor should it be construed as, specific advice tailored to any individual. You are encouraged to discuss any opportunities with your attorney, accountant, financial professional or other advisor.

Your use of the information contained herein is at your own risk. The content is provided ‘as is’ and without warranties of any kind, either expressed or implied. The fotis trading academy disclaims all warranties, including, but not limited to, any implied warranties of merchantability, fitness for a particular purpose, title, or non-infringement. The fotis trading academy does not promise or guarantee any income or particular result from your use of the information contained herein. The fotistrainingacademy.com assumes no liability or responsibility for errors or omissions in the information contained herein.

Under no circumstances will the fotis trading academy be liable for any loss or damage caused by your reliance on the information contained herein. It is your responsibility to evaluate the accuracy, completeness or usefulness of any information, opinion, advice or other content contained herein. Please seek the advice of professionals, as appropriate, regarding the evaluation of any specific information, opinion, advice or other content.

Marc Walton, a spokesperson of the fotis trading academy, communicates content and editorials on this site. Statements regarding his, or other contributors’ “commitment” to share their personal investing strategies should not be construed or interpreted to require the disclosure of investments and strategies that are personal in nature, part of their estate or tax planning or immaterial to the scope and nature of the fotis trading academy philosophy.

All reasonable care has been taken that information published on the Fotis trading academy website is correct at the time of publishing. However, the Fotis trading academy does not guarantee the accuracy of the information published on its website nor can it be held responsible for any errors or omissions.

Recommended Content

Editors’ Picks

US economy grows at an annual rate of 1.6% in Q1 – LIVE

The US' real GDP expanded at an annual rate of 1.6% in the first quarter, the US Bureau of Economic Analysis' first estimate showed on Thursday. This reading came in worse than the market expectation for a growth of 2.5%.

EUR/USD retreats to 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated to the 1.0700 area. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 with first reaction to US data

GBP/USD declined below 1.2500 and erased a portion of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold falls below $2,330 as US yields push higher

Gold came under modest bearish pressure and declined below $2,330. The benchmark 10-year US Treasury bond yield is up more than 1% on the day after US GDP report, making it difficult for XAU/USD to extend its daily recovery.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.