If you are a Forex trader by now I am sure you have read or heard on the news that NFP numbers were far better than expected last Friday in the US. It is the dominating catalyst in the markets and the main driver behind prices, as the majority of the market participants is expecting now an interest rate hike, by the FED in December’s meeting.

From a global macro point of view what should concern you is whether the US economy is actually doing so well and running the risk of overheating, therefore an interest rate hike is actually necessary or, is the FED actually basing their guidance on the wrong model and we are by far away from a booming economy. Are the latest NFP numbers a clear indicator of the economy’s health? Should the FED raise interest rates in December?

I believe that we are going to have an interest rate hike in December, unless we have strong deteriorating conditions in China or geopolitical tensions that would affect the international community.

But I am very skeptical whether the economic model that the FED’s hawks are using, is the most accurate one to justify an interest rate hike and it is also very unclear to me whether the economy is running at full capacity.

Allow me to explain further.

Economists at the FED try to make sense of the status of the US economy through theoretical models and one of that models is the “Philipps curve”. This is a model developed by a New Zealand economist, almost 60 years ago based on data about unemployment and wages taken from the times of the old British Empire, during the 1860’s! It seems Janet Yellen pays close attention to that model, as she said in one of her speeches at the past that the Phillips curve, “is a core component of every realistic macroeconomic model.”

This model in simple English says that if unemployment drops below its natural rate, it is becoming even more difficult to find highly skilled workers, therefore companies will have to offer higher wages in order to lure them. But higher wages will eventually lead to higher inflation, this is why as we said some of the FED’s hawks call for a rate hike now.

The truth is that this model is not very accurate and is leading to false conclusions about the economy and what should really be done next.

The first major problem that I identify is that we have to make strong assumptions about indicators that are unclear and highly debatable. For example, what is exactly the natural rate of unemployment in the US? Is it 5%? There are important economists that thing that right now the natural rate of unemployment is around 4% and if that is accurate then we still have a long way to go until we reach maximum capacity!

Others argue that nowadays the rate is around 6% and they also have some valid points, so which rate should we use in our assumptions, as the difference and the impact from 4% to 5% and 5% in these kind of models is important and can give us completely different results.

Furthermore, this model was quite popular in the 1970’s but in the last 10 years has clearly failed to give us accurate predictions, so why it is still used by FED officials to justify higher interest rates leaves me skeptical.

Since we are talking about economic models and global macro let’s discuss the impact of demographics as well.

Some argue that because unemployment is moving lower to the assumed natural rate of 5% as you can see below:

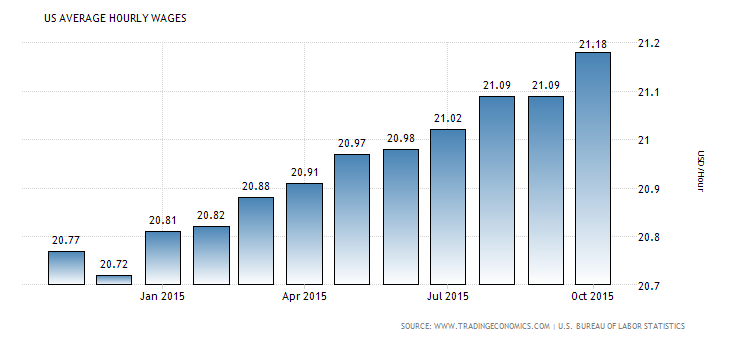

… and also because the Average Hourly Earnings are slowly rising:

The claim is that this is a textbook case for the Phillips curve model and we should expect higher inflation, therefore we must raise rates now.

But let’s take a look at demographics at the USA and determine if these assumptions are accurate.

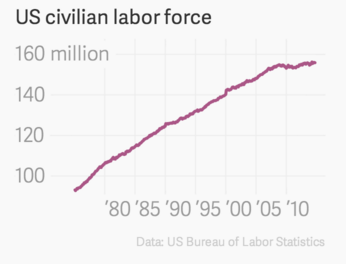

We can see that while the US civilian population is growing at the same rate as always, the US civilian labor force is flattening, it is still growing but the growth is losing momentum as you can see on the chart below:

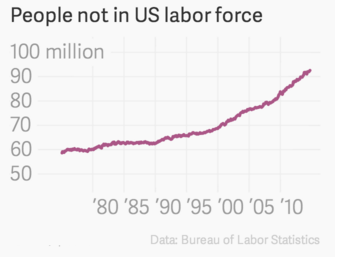

We also see that the number of people alive but not in the US Labor force is rising at an accelerating pace and we also see a surge of the people who are over 65 but not in the labor market:

So the conclusion is that while the population is growing at its normal rate, the labor force growth is flattening, while the number of people who are NOT in the labor force is accelerating sharply.

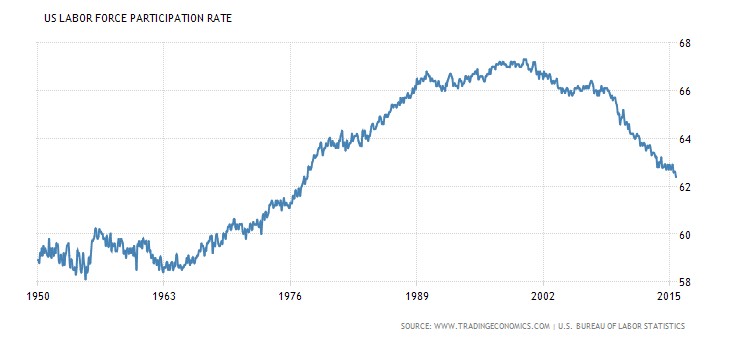

This can be attributed to the generation of baby-boomers who are now reaching retirement age and they get out of the labor force. These are millions of people who are expected to move into retirement so it safe to expect that over the next few years the labor force participation rate is expected to remain at low levels, as you can see below:

We also have many workers who are discouraged by the working conditions, they simply don’t like these part time jobs so they decide to stay out of the labor force and do not seek for a job until conditions improve. The number of these people remains at quite high levels and in my opinion can distort unemployment figures.

Now that you see these evidence allow me to ask again what is the natural rate of unemployment in the US, taking into consideration all these changes in demographics? A simple 1% statistical error can lead to completely different conclusions. If experienced economists with highly sophisticated econometric models cannot reach a definitive answer, then why do some FED members argue that the economy is close to overheating and therefore interest rates should rise?

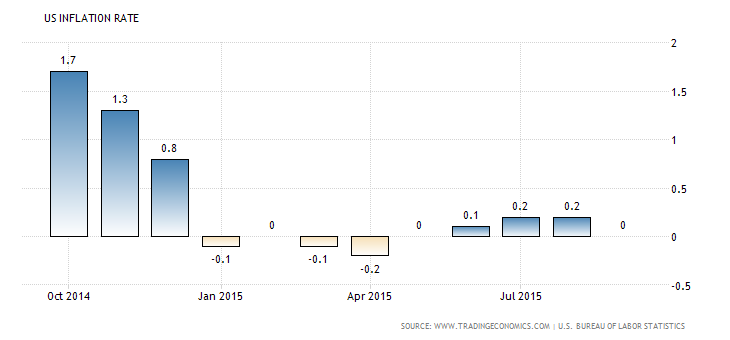

Unfortunately the current levels of inflation in the US do not agree with the rosy picture painted by the FED and before reaching any safe conclusions we must see an uptick in inflation which remains close to zero level.

There are also FED members who argue that it is not the actual date of the first hiking that matters but the pace of the potential hiking that matters the most. FED member Bullard has been quoted saying at Bloomberg that there is going to be a very hot debate about the pace of the tightening and meaning of the term “gradual”. Let’s assume that the first rate hike does happen in December, when is going to be the next one? In next meeting, every other meeting or international conditions (that means China!) are going to determine to the definition of gradual!

As global macro based traders, we pay close attention to such developments and debates since they provide vital clues about the current sentiment in the marketplace and the factors that affect it. This methodology allowed our traders to identify high probability trading ideas and extract significant profits from the markets. For example, last week it was the weak expectations about future inflation that helped us to locate great trading setups in the GBP currency and also to look for longs in the USD against the Singaporean dollar since we knew what a strong dollar and higher interest rates mean for emerging market currencies.

Now, what about this week?

This week we are managing our long USD positions against the JPY and the SGD and we make sure to lock in some nice profits. If nothing else changes, we will be looking to add to our positions on pullbacks.

These are the charts we are looking. First the USDJPY:

And here is the USDSGD:

But in my opinion the most important charts in FOREX right now are the US equity markets as you can see below. I am paying close attention to the SP500 and the DOW30 because these inter market relationships allow me to understand sentiment and what is controlling the markets right now.

On early Monday morning it seems that the bad Chinese trade data over the weekend are playing a crucial role and some are paying attention to these. Over the next few hours we have Chinese CPI coming out and that could be a negative catalyst for the market if we have indications for further deflationary forces and slow growth.

This is the SP500.

And this is the DOW30.

Back on currencies, besides the USD crosses I am also paying attention over the next few weeks to GBP crosses as I think the Bank of England will closely follow the FED on monetary policy and if the FED finally hikes the next central bank more likely to follow is the UK’s.

I am watching especially the GBP against the commodity currencies like AUD and NZD, as a slowdown in China and a consequent drop in commodities will greatly affect these economies.

Please pay attention that the technical setup is not quite mature yet and I do not have a valid signal to enter but I do have GBPAUD and GBPNZD on my watch list. Deteriorating conditions in China and downward pressures in Crude can put pressure on the commodity currencies.

Here is the GBPAUD:

And here is the GBPNZD:

Thank you!

Fotis Papatheofanous MBA

None of the fotis trading academy nor its owners (expressly including but not limited to Marc Walton), officers, directors, employees, subsidiaries, affiliates, licensors, service providers, content providers and agents (all collectively hereinafter referred to as the “fotis trading academy ”) are financial advisers and nothing contained herein is intended to be or to be construed as financial advice

Fotis trading academy is not an investment advisory service, is not an investment adviser, and does not provide personalized financial advice or act as a financial advisor.

The fotis trading academy exists for educational purposes only, and the materials and information contained herein are for general informational purposes only. None of the information provided in the website is intended as investment, tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement, recommendation or sponsorship of any company, security, or fund. The information on the website should not be relied upon for purposes of transacting securities or other investments.

You hereby understand and agree that fotis trading academy, does not offer or provide tax, legal or investment advice and that you are responsible for consulting tax, legal, or financial professionals before acting on any information provided herein. “This report is not intended as a promotion of any particular products or investments and neither the fotis trading academy group nor any of its officers, directors, employees or representatives, in any way recommends or endorses any company, product, investment or opportunity which may be discussed herein.

The education and information presented hereinen is intended for a general audience and does not purport to be, nor should it be construed as, specific advice tailored to any individual. You are encouraged to discuss any opportunities with your attorney, accountant, financial professional or other advisor.

Your use of the information contained herein is at your own risk. The content is provided ‘as is’ and without warranties of any kind, either expressed or implied. The fotis trading academy disclaims all warranties, including, but not limited to, any implied warranties of merchantability, fitness for a particular purpose, title, or non-infringement. The fotis trading academy does not promise or guarantee any income or particular result from your use of the information contained herein. The fotistrainingacademy.com assumes no liability or responsibility for errors or omissions in the information contained herein.

Under no circumstances will the fotis trading academy be liable for any loss or damage caused by your reliance on the information contained herein. It is your responsibility to evaluate the accuracy, completeness or usefulness of any information, opinion, advice or other content contained herein. Please seek the advice of professionals, as appropriate, regarding the evaluation of any specific information, opinion, advice or other content.

Marc Walton, a spokesperson of the fotis trading academy, communicates content and editorials on this site. Statements regarding his, or other contributors’ “commitment” to share their personal investing strategies should not be construed or interpreted to require the disclosure of investments and strategies that are personal in nature, part of their estate or tax planning or immaterial to the scope and nature of the fotis trading academy philosophy.

All reasonable care has been taken that information published on the Fotis trading academy website is correct at the time of publishing. However, the Fotis trading academy does not guarantee the accuracy of the information published on its website nor can it be held responsible for any errors or omissions.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.