Fundamental Forecast for Dollar: Neutral

Euro rallies on S&P 500 tumbles, but is the Euro truly a new safe-haven currency? (Hint: no.)

Stocks surge ahead of key Jackson Hole Summit—what might we expect?

Look at real-time FX positioning data via our Speculative Sentiment Index

It was a difficult week for traders as the initial US Dollar breakdown left many (including us) looking for further losses. The Euro/US Dollar first saw its largest three-day advance in six years, but instead of continuing higher it subsequently posted its largest three-day decline since 2011. Such choppy price action made it near impossible to keep any real conviction in market direction or a lasting trading bias. A big week of economic event risk and the new month may nonetheless add clarity for the US Dollar and broader financial markets.

Traders should first watch for any surprises out of a highly-anticipated central banker symposium in Jackson Hole, Wyoming. US Federal Reserve Vice Chair Stanley Fischer will deliver a speech on inflation on Saturday, while Bank of England Governor Mark Carney and European Central Bank Vice President Vitor Constancio will also issue statements at the annual summit.

The critical question remains whether the US Federal Reserve will raise interest rates at its September meeting, and Fischer’s commentary will draw special scrutiny as US Dollar traders attempt to anticipate the Fed’s next moves. It was only two weeks ago that interest rate futures predicted a 60 percent chance of a September hike. Yet those same futures now show an implied 40 percent probability—a big reason why many traders may have rushed for the exits on their Dollar trades.

The next big question is how major global central banks will react to the recent bout of financial market volatility. To that end we’ll watch planned commentary from the BoE’s Carney and the ECB’s Constancio for clues on potential policy responses. We should also note that unplanned comments from other major central bank officials at the summit could likewise force big moves in key assets.

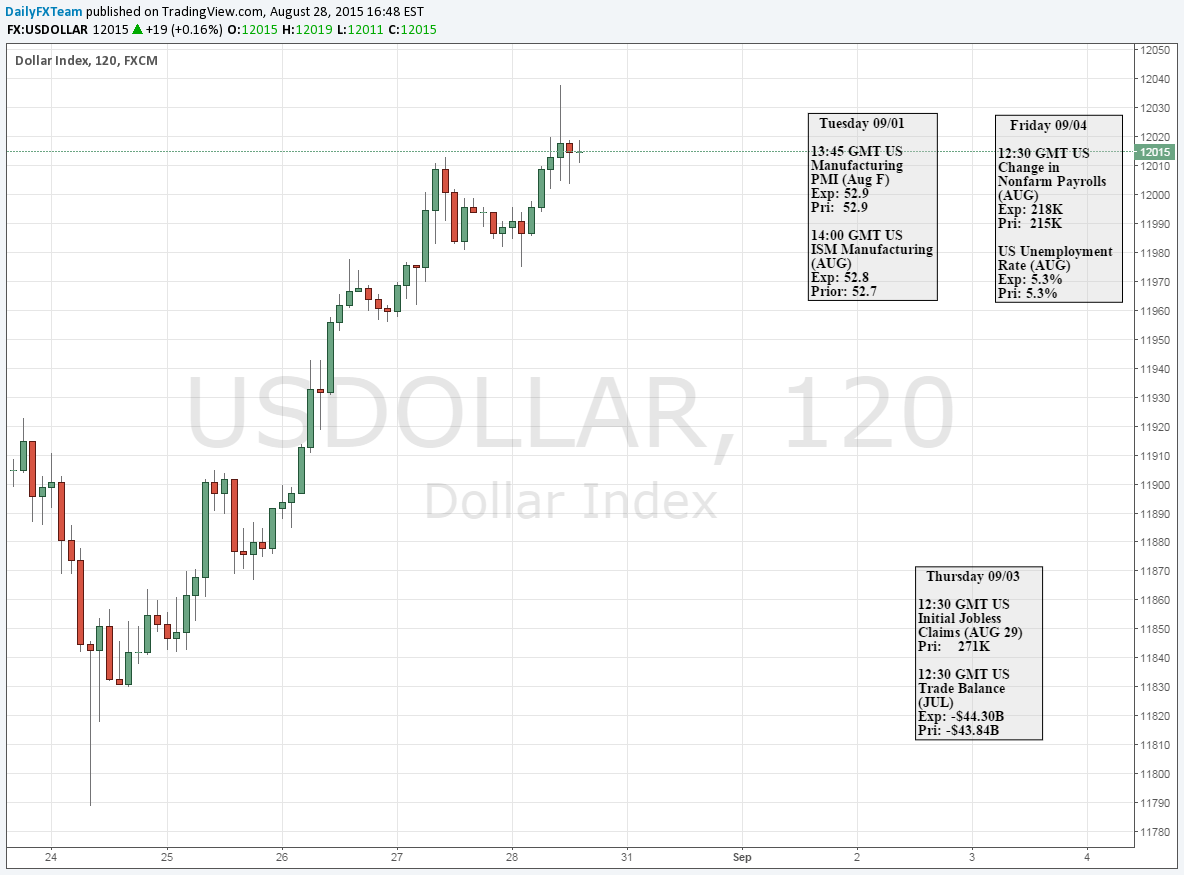

Beyond Jackson Hole, markets will turn to highly market-moving US Nonfarm Payrolls data on Friday for the next clues on US Federal Reserve interest rate moves. The US central bank is fairly unique as its mandate states it must pursue policies of maximum employment while controlling inflation. Recent market volatility and potential knock-on risks to global growth may already make Fed officials less likely to raise rates. But a disappointing US labor market report could sound the death knell for the possibility of a September rate hike.

The possibility of major surprises from global central bankers or US NFPs has pushed 1-week FX volatility prices near multi-month peaks, and the next several days promise to force meaningful shifts across financial markets. The fact that the Euro rallied and the Dollar tumbled as the S&P 500 sold off led many to claim the Euro was a new “safe-haven” currency. We think the opposite is true, but any renewed market turmoil could in fact lead more traders to dump USD-long positions and force Euro rallies. It will be critical to watch how markets open the week and begin trading into the first days of the new month.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.