Fundamental Forecast for Dollar: Neutral

The PCE inflation gauge and NFPs will shape rate speculation that still has market pricing October hike

Expected easing efforts by the ECB, RBA and BoC can leverage the Dollar’s outlook for rate hikes

Want to test out all the premium tools and resources FXCM has to offer? We are holding an Open House

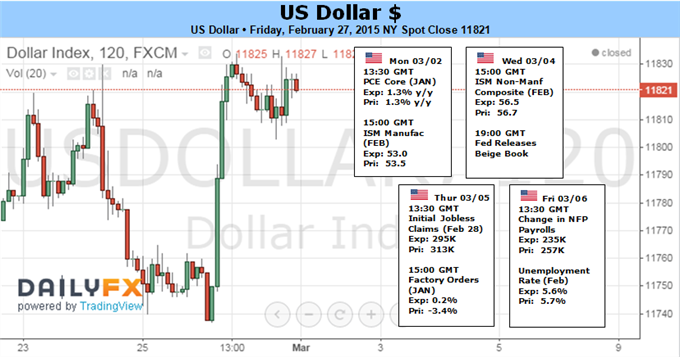

The Dollar received a jolt of volatility this past week in a rally that followed the CPI inflation report, but the currency was unable to escape the bounds of a month-long range. It will be increasingly difficult to maintain a range going forward however. Not only are major themes like US rate forecasts and risk trends developing, but we have a range of high profile event risk. While US indicators like the February NFPs will provide a clear connection to Dollar activity; policy decisions by some of the Fed’s largest counterparts – the ECB, BoE, RBA and BoC – can generate considerable indirect force.

For Dollar traders, the outlook is steeped in two key fundamental themes: monetary policy and speculative sentiment. It is the former that has fed the Greenback’s bullish trend these past nine months (the ICE Dollar Index secured an eighth consecutive rally – a record- while the Dow Jones FXCM Dollar Index closed the month slightly lower). Yet, just as clear as the ‘relative’ hawkish outlook for the Fed has generated such a resounding performance, we can also see its limitations shaped through the month-long consolidation pattern the benchmark established through February.

Compared to the ECB and BoJ (who are executing quantitative easing programs) or the RBA and BoC (which have recently cut their benchmark rates), the FOMC is exceptionally hawkish. Though it is still plotting the time frame for its first hike in a controlled normalization regime, a tightening move offers drastic contrast. Much of this has been priced in however. Currently, the market expects a first and second rate hike in 2015 – something the other majors cannot claim. To leverage further gains on this view though, the lead needs to be extended.

According to Fed Fund futures, the first move by the Fed is expected around the October 28 meeting. Alternatively, surveys for economists, analysts and primary dealers pegs it around June 17 or July 29. That opens the door for more progress. A few particular data points stand out over the coming week that can up the market’s expected time frame – or push it back depending on the outcome. At the start of the week, we have the PCE inflation measures. Given that this is the Fed’s preferred price gauge, a surprise here could generate a greater market response than the heft Dollar bid that followed last week’s CPI release. At the end of the week, the February labor data will be a media and speculative focus. While the payrolls and jobless figure are important, we know the general trend of the past five years. The missing puzzle piece for hikes is inflation. And that leverages the importance of the average hourly wages component which last month posted the biggest monthly jump since December 2008.

A change in tide and intensity of the US rate forecast is the most direct means to motivate the Dollar, but don’t write off the strengthening or weakening of its collective counterparts as a capable impetus. The ECB is set to activate its stimulus program while the RBA and BoC are expected to each supply a consecutive interest rate cut. There is plenty of room to broaden or close that gap.

There will be plenty on the docket – and no doubt newswires – to occupy our attention in the week ahead. Yet, it is important to maintain a firm grasp of the ‘big picture’. The view of US monetary policy compared to its conterparts is a node, but how collective monetary policy influences global investor sentiment is a central pillar. ‘Risk appetite’ has not contributed much to the Dollar’s cause – bullish or bearish – recently as it has not moved with conviction (regardless of what it seems the S&P 500 is doing). It is difficult to instill confidence of a robust extension of already mature risk accumulation trends. In contrast, the correct spark can ignite an explosive value gap to risk aversion and deleveraging. When this reallocation hits, the Dollar will gain at the extremes.

Recommended Content

Editors’ Picks

EUR/USD climbs to 10-day highs above 1.0700

EUR/USD gained traction and rose to its highest level in over a week above 1.0700 in the American session on Tuesday. The renewed US Dollar weakness following the disappointing PMI data helps the pair stretch higher.

GBP/USD extends recovery beyond 1.2400 on broad USD weakness

GBP/USD gathered bullish momentum and extended its daily rebound toward 1.2450 in the second half of the day. The US Dollar came under heavy selling pressure after weaker-than-forecast PMI data and fueled the pair's rally.

Gold rebounds to $2,320 as US yields turn south

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.