Fundamental Forecast for Dollar: Neutral

Remarks from Janet Yellen that she still expects a hike this year leveraged an uptick in core CPI and sent the USD higher

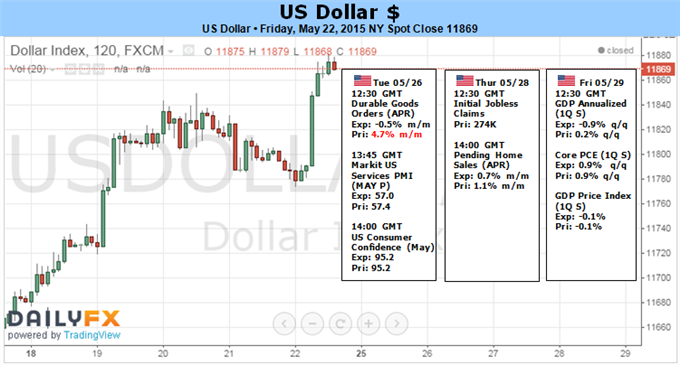

Key Dollar pairs (EURUSD, GBPUSD, USDJPY) start off at high profile levels with holiday liquidity and a view to GDP

See the 2Q forecast for the US Dollar and other key currencies in the DailyFX Trading Guides

There is little doubt in the market consensus that the Fed will be the first major central bank to hike rates, and that will maintain a long-term bid for the Dollar. Yet, in the interim, the particular timing of that launch can continue to cause wobbles for the Greenback. The past two months have been marked by consolidation and mild correction for the benchmark currency, while speculation over the fundamental and technical extent of the retreat has gathered volume. To end this past week, a well-timed combination of Fed Chairwoman Yellen commentary and an uptick in core inflation led to a strong rally to critical levels. Now sitting at the cusp of a revived bull trend and holiday-dampened liquidity conditions ahead, FX traders are looking ahead with a high level of anxiety.

Had we not experienced the Dollar’s strong push to close out the past week – moving it to a four-week high versus the Euro and four month high against the Yen – its standing would have already been impressive. The currency was already positioned for an impressive recovery with a three-day rally. Yet, with the combination of inflation data and carefully selected comments from the FOMC head, the FX market will spend the weekend on tenterhooks speculating whether a key breakout will be realized or rejected.

Under normal conditions, the biggest weekly rally in nearly two years (a 1.7 percent advance) would have proven strong support for the belief that the Dollar was returning to its bull trend. Yet, there are complications to this view. While the medium-to-long-term view for monetary policy, growth and haven appeal favor the Greenback; there are counterproductive pockets of speculation that can keep the ‘eventual’ view in the future and momentum sidelined.

Through market conditions, we have closed out an impressive week; but bulls have not yet crested the important hill. EURUSD has reached 1.1100, but not broken below. GBPUSD has returned to its critical 1.5500 border without marking the shift in control. USDJPY stands a 2015’s well-worn range highs – which also happen to be eight year highs. A decisive move to either break or reverse from these levels Monday is made difficult by the fact that there will be a drain on liquidity as the US, UK, Germany and Hong Kong will be offline for market holidays. A break would likely lead to disjointed volatility. A correction will be met with immediate skepticism.

Fundamentally, the charge for a recovery is hampered by the source of this most recent recovery. Yellen – like most of her colleagues – has attempted to be as clear as possible in her communication of monetary policy. They will not ‘pre-commit’ to decisions; but given current trends, it is likely that a hike is realized sometime this year. She carefully shaped this timeframe in her speech Friday. With Fed Fund futures still pricing a first hike out in January of next year, reinforcing a move sometime in 2015 can rouse the bulls. That said, it could be December rather than September. And, the CPI data that reinforced her bearing is similarly non-committal. Core inflation did tick up – and has slowly built support alongside wages these past months. However, it isn’t imminent.

In the week ahead, there are plenty of indicators and Fed speeches on the docket. Yet, few of them really hit the high-profile level that we would expect to single-handedly benchmark the timing for the first rate hike. One indicator in particular that should be kept on our radar is Friday’s 1Q GDP update. This is a revision, which most people would write off. However, given how fine the consideration for a data-dependent policy move is; a meaningful adjustment can trigger a sizeable response.

FXCM, L.L.C.® assumes no responsibility for errors, inaccuracies or omissions in these materials. FXCM, L.L.C.® does not warrant the accuracy or completeness of the information, text, graphics, links or other items contained within these materials. FXCM, L.L.C.® shall not be liable for any special, indirect, incidental, or consequential damages, including without limitation losses, lost revenues, or lost profits that may result from these materials. Opinions and estimates constitute our judgment and are subject to change without notice. Past performance is not indicative of future results.

Recommended Content

Editors’ Picks

AUD/USD posts gain, yet dive below 0.6500 amid Aussie CPI, ahead of US GDP

The Aussie Dollar finished Wednesday’s session with decent gains of 0.15% against the US Dollar, yet it retreated from weekly highs of 0.6529, which it hit after a hotter-than-expected inflation report. As the Asian session begins, the AUD/USD trades around 0.6495.

USD/JPY finds its highest bids since 1990, approaches 156.00

USD/JPY broke into its highest chart territory since June of 1990 on Wednesday, peaking near 155.40 for the first time in 34 years as the Japanese Yen continues to tumble across the broad FX market.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.