Fundamental Forecast for Dollar: Neutral

The Dollar dropped to a two-month low this past week and closed out April with its first monthly decline in 10 months (DXY)

Will this week’s NFPs offer a clearer signal on rate expectations than this past week’s GDP/FOMC combo?

See the 2Q forecast for the US Dollar and other key currencies in the DailyFX Trading Guides

This past week, the USDollar posted its first drop on a monthly basis in 10 consecutive months. At the same time, the week ended on a rally that closed out the period little changed. We are in a phase of technical and fundamental limbo. A correction for the Greenback is not without its merits: the Dollar’s exceptionally consistent run can be overinflated by trend-following speculative interests that need to retrench and rate speculation has softened alongside the quality in data. Then again, the currency’s and economy’s ‘relative’ appeal is still exceptionally strong. With the Dollar transitioning from a steady bull trend to a period of consolidation and now suffering its most painful slide in a year, the burden to generate momentum on this week’s fundamental themes will be more evenly distributed.

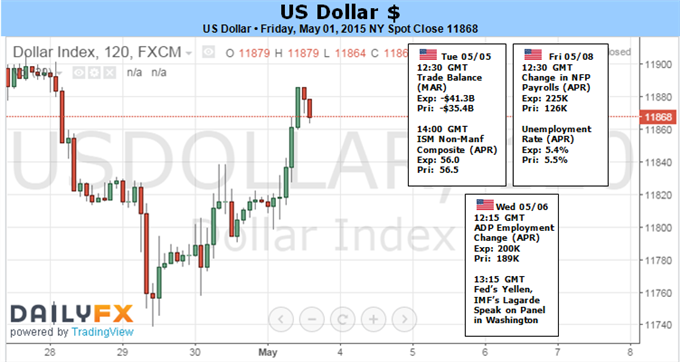

For fundamental traders, the most recognizable catalyst in the week ahead will be the April labor statistics due on Friday. It is not unreasonable to peg the NFPs the week’s top event risk. It is an easy-to-interpret indicator and taps directly into what has driven the Dollar and FX market generally through the past year: monetary policy expectations. However, there will be hurdles to overcome for this data to lock in a definitive currency move. The most prominent obstacle for the report will be its Friday release. There will be plenty of anticipation, but confirmation comes late in the week.

In the data itself, the elements that cut closest to the key determinants for monetary policy will carry the most weight. The unemployment rate is already well beyond levels previously set as targets, so its up- or downtick will generate lower amplitude waves. The missing element in the timing of the Fed’s liftoff is tangible inflation pressure. For that reason, the earnings data will likely prove the most important update. The current consensus is for a 2.3 percent increase in wages year-over-year, which would match the strongest pace since 2009. Should the data meet or ‘beat’ this forecast, it would tip the uneasy equilibrium in rate speculation that we were left with following this past week’s poor 1Q GDP reading and the FOMC’s suspiciously status quo statement. Alternatively, a ‘miss’ is likely to carry less weight as it fighting a current whereby the Fed remains well ahead of the policy curve.

Over the months, we have seen the influence of the payrolls data itself diminish as the market focuses on the ‘qualitative’ elements of the statistics (guidance given by Fed officials). However, given the persistent deterioration of US data recently – the Bloomberg US Economic Surprise measure hit a six-year low this past week – this headline may stir deeper emotion. A weak showing can reinforce the Fed Funds futures (the ‘market’) timing for a January 2016 first hike. Alternatively, a better reading can resuscitate the hawkish forecast.

Outside of the US docket, it will be important to keep track of external factors that can cause cross fundamental winds for the Dollar. The Euro, Pound and Australian Dollar may in particular encourage response for the currency. The Euro surged this past week (2.9 percent versus the USD) as optimism for a Greek deal struck a speculative nerve. The upcoming UK election has driven anxiety surrounding the Pound to its highest levels since the Scottish Referendum. And, the RBA is expected to deliver a rate cut Tuesday. Depending on how these events play out, the Greenback can play the foil to substantial volatility.

Finally, it is always wise to keep tabs on the general quality of risk trends. Though the correlation to equities, volatility levels and other traditional measures of ‘risk’ have waned; they would be quickly restored by a jolt of concerted panic or greed that shot through the market. A purge of speculative excess is necessary for the capital markets. It is just a matter of time and motivation. When the unwind occurs, capital will seek the security of US liquidity and regulations.

Recommended Content

Editors’ Picks

EUR/USD stays below 1.0700 ahead of US data

EUR/USD stays in a consolidation phase slightly below 1.0700 in the European session on Wednesday. Upbeat IFO sentiment data from Germany helps the Euro hold its ground as market focus shifts to US Durable Goods Orders data.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold manages to hold above $2,300

Gold struggles to stage a rebound following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% ahead of US data, not allowing XAU/USD to gain traction.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.