Fundamental Forecast for Yen: Neutral

US Dollar/Japanese Yen exchange rate very sensitive to US Treasury Yields

Weekly Volume Report: USDJPY volume profile looks encouraging for bulls

For Real-Time SSI Updates and Potential Trade Setups on the Japanese Yen, sign up for DailyFX on Demand

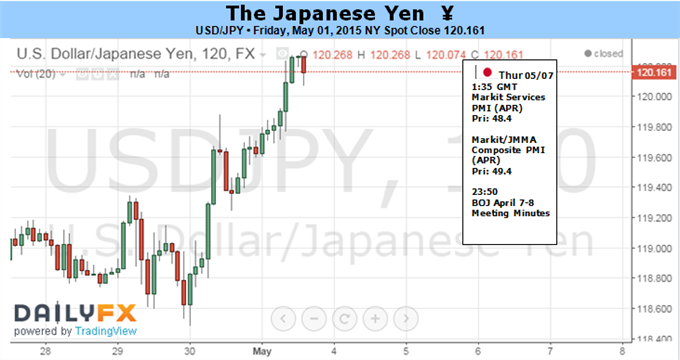

The Japanese Yen finished the week notably lower versus the US Dollar but stuck to its long-standing trading range. A big week for FX markets ahead might be enough to finally force a break in the slow-moving US Dollar/Japanese Yen exchange rate.

A sharp US Dollar rally pushed the USD/JPY to fresh 8-year highs through March and yet the pair has consolidated ever since. It has been a virtual stalemate for the Dollar and the Yen as both the US Federal Reserve and Bank of Japan have given relatively little reason to force a fundamental shift for either currency. And indeed this past week’s uneventful monetary policy decisions from both the Fed and BoJ maintained the status quo.

Any surprises in the upcoming US Nonfarm Payrolls report could nonetheless tip the scales and force major US Dollar volatility, while monetary policy meeting minutes from the Bank of Japan might spark noteworthy moves in the Yen. The US labor market report is often one of the biggest market-movers not only for the US Dollar and domestic financial markets but global counterparts as well. The interest rate-sensitive Japanese Yen will almost certainly react to any surprises.

Current consensus forecasts predict that the US economy added 225k jobs in April after a disappointing March result. Recent US Dollar weakness suggests few expect a material improvement in US economic data, and a worse-than-expected print could force the Greenback even lower.

The Bank of Japan Meeting Minutes due just a day before are less likely to force major moves in the Yen. Yet it remains important to monitor the central bank’s rhetoric in regards to future monetary policy moves. BoJ Governoor Kuroda sounded a surprisingly neutral tone at a recent press conference as officials show no real willingness to ease monetary policy despite notable disappointments in economic data. Pressure is building on the BoJ to ease further as recent inflation figures showed a sharp pullback in year-over-year Tokyo CPI growth. And though this may not be enough to force the Bank of Japan’s hand in itself, it remains of clear interest to monitor officials’ next moves.

It’s shaping up to be a fairly important week for the Dollar versus the Yen, and any major surprises could finally be enough to force the USD/JPY out of its narrow trading range.

FXCM, L.L.C.® assumes no responsibility for errors, inaccuracies or omissions in these materials. FXCM, L.L.C.® does not warrant the accuracy or completeness of the information, text, graphics, links or other items contained within these materials. FXCM, L.L.C.® shall not be liable for any special, indirect, incidental, or consequential damages, including without limitation losses, lost revenues, or lost profits that may result from these materials. Opinions and estimates constitute our judgment and are subject to change without notice. Past performance is not indicative of future results.

Recommended Content

Editors’ Picks

EUR/USD: The first upside target is seen at the 1.0710–1.0715 region

The EUR/USD pair trades in positive territory for the fourth consecutive day near 1.0705 on Wednesday during the early European trading hours. The recovery of the major pair is bolstered by the downbeat US April PMI data, which weighs on the Greenback.

GBP/USD rises to near 1.2450 despite the bearish sentiment

GBP/USD has been on the rise for the second consecutive day, trading around 1.2450 in Asian trading on Wednesday. However, the pair is still below the pullback resistance at 1.2518, which coincides with the lower boundary of the descending triangle at 1.2510.

Gold price struggles to lure buyers amid positive risk tone, reduced Fed rate cut bets

Gold price lacks follow-through buying and is influenced by a combination of diverging forces. Easing geopolitical tensions continue to undermine demand for the safe-haven precious metal. Tuesday’s dismal US PMIs weigh on the USD and lend support ahead of the key US data.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday. Most people expect the stablecoin to be backed by gold, considering BRICS nations have been accumulating large holdings of the commodity.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.