Fundamental Forecast for British Pound: Neutral

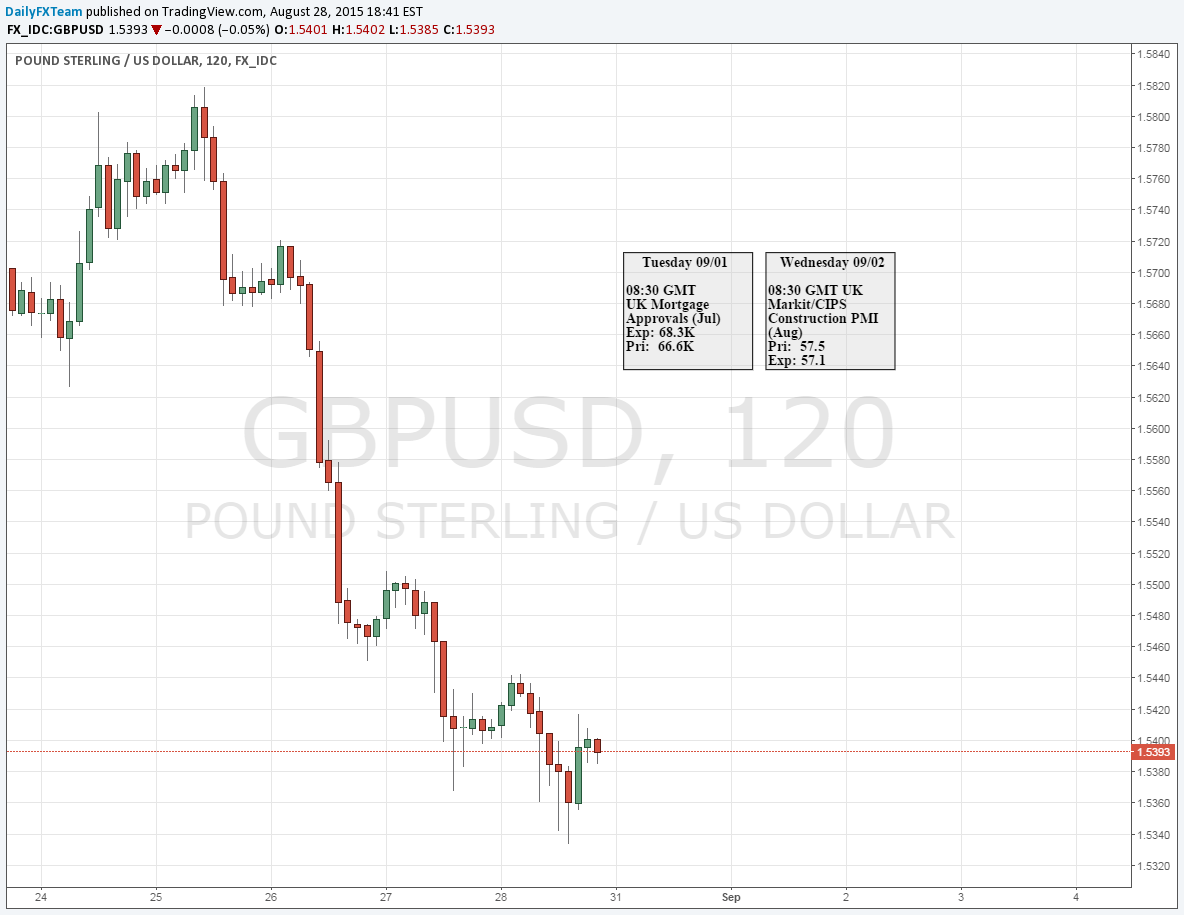

Continued unwind of carry trades saw the Cable trade higher into resistance at the 1.5800 level on Monday.

As the ‘risk on’ trade became more popular on Tuesday and thereafter, GBPUSD dropped to a key support level at 1.5350, staying a mere 11 pips off of the 2.5 month low.

For Real-Time SSI Updates and Potential Trade Setups on the British Pound, sign up for DailyFX on Demand

The British Pound was caught up in the rollercoaster risk-off/risk-on ride of the week in a very similar manner as the Euro and Japanese Yen; albeit with more subdued price action. With Mark Carney scheduled to speak over the weekend at the Jackson Hole Summit, near-term price action in the British Pound will likely be determined by whether or not Mr. Carney takes on a hawkish or more dovish tone. There are reasons that could be cited for either direction, as the panic exhibited earlier in the week is cause for concern when examining when to raise rates.

Just last week we were looking at a surprise inflation read out of the UK that created breaks of resistance as the Sterling trended higher. The Panic of Monday saw the Cable trade up to previous resistance at the 1.5800 level as carry trades quickly unwound in a ‘flight-to-safety.’ But as cooler heads prevailed while support was coming in across global markets, GBPUSD was free to float with expected monetary policy dichotomies as the Greenback strengthened against most major currencies. All told, the Sterling was one of the weakest performers on the week as that sucker-punch to global growth expectations raises a red flag on expected rate hikes out of the BoE.

From a technical standpoint, the Sterling caught support at a key 1.5350 level, which is the 50% retracement of the Financial Collapse low of 1.3500 to the seven-year high of 1.7190. The 61.8% retracement of this Fib retracement is at 1.5781, which is very near the top that was set on Monday and crossed on Tuesday as the Sterling trended lower.

Breaks below 1.5350 should be construed bearishly, as traders look to open short positions if and when the Sterling sinks to a 2.5 month low. Until then, this is a range with support that could provide an attractive risk-reward ratio by simply trading to the mid-line of the previous range.

Perhaps more attractive are setups in the Sterling against CAD, Aussie or Kiwi. This way traders can avoid the US dollar in the midst of the pandemonium over when/if/how/why this first rate hike may come out of the Fed. Each of these commodity currencies are presenting attractive technical setups against the British Pound, and this can be a prime way of trading the continued melt in commodity prices, which is one of the few themes that markets seem sure of at the current moment.

NFP on Friday will likely shape the weekly performance in GBPUSD; and the Bank of England rate decision in the following week could prove telling as to Monetary Policy Committee and Mr. Carney’s opinion on future rate hikes and policy trajectory given the multiple concerns for global weakness that are currently present.

FXCM, L.L.C.® assumes no responsibility for errors, inaccuracies or omissions in these materials. FXCM, L.L.C.® does not warrant the accuracy or completeness of the information, text, graphics, links or other items contained within these materials. FXCM, L.L.C.® shall not be liable for any special, indirect, incidental, or consequential damages, including without limitation losses, lost revenues, or lost profits that may result from these materials. Opinions and estimates constitute our judgment and are subject to change without notice. Past performance is not indicative of future results.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated below 1.0700. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 as USD rebounds

GBP/USD declined below 1.2500 and erased the majority of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold holds near $2,330 despite rising US yields

Gold stays in positive territory near $2,330 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield is up more than 1% on the day above 4.7% after US GDP report, making it difficult for XAU/USD to extend its daily rally.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.