Fundamental Forecast for British Pound: Neutral

GBP/USD Continues to Carve Bullish Series as Retail FX Remains Short

GBP/USD First 6 Day Rally Since December 2013

For Real-Time SSI Updates and Potential Trade Setups on the Japanese Yen, sign up for DailyFX on Demand

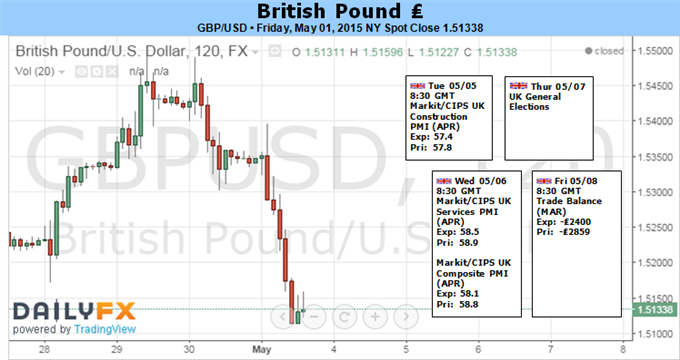

Headlines surrounding the U.K. election are likely produce increased volatility for GBP/USD, but the uncertainties clouding the fiscal outlook may only act as a near-term driver for the British Pound as the Bank of England (BoE) remains on course to normalize monetary policy.

A hung parliament is likely to produce near-term headwinds for the British Pound, and the GBP/USD may continue to give back the rebound from April (1.4564) as the pair struggles to retain the series of higher highs & lows ahead of the election. On the other hand, the formation of a coalition government may largely undermine the bearish sentiment surrounding the sterling, and market participants may put increase emphasis on the BoE’s quarterly inflation report due out on May 13 as Governor Mark Carney continues to prepare U.K. households and businesses for higher borrowing-costs.

Despite the weaker-than-expected 1Q Gross Domestic Product (GDP) report, the BoE may strike a more hawkish tone this time around as the sterling effect raises the risk for ‘a faster pickup in inflation,’ and an upward revision in the central bank’s price growth forecast may boost the appeal of the sterling as market participants ramp up interest rate expectations. With that said, the monetary policy outlook may continue to act as the biggest fundamental driver as market participants speculate on the BoE’s normalization cycle, and a material shift in the forward-guidance may generate a more bullish course for GBP/USD as the central bank reiterates that the next policy move will most likely be a rate-hike.

Nevertheless, the failed attempt to test the February high (1.5551) may keep GBP/USD capped going into the first full-week of May, and the failure to retain the bullish structure from April certainly raises the risk of seeing a further decline going into the election. In turn, former resistance around the 1.5000 handle will come on the radar as the pound-dollar searches for near-term support.

FXCM, L.L.C.® assumes no responsibility for errors, inaccuracies or omissions in these materials. FXCM, L.L.C.® does not warrant the accuracy or completeness of the information, text, graphics, links or other items contained within these materials. FXCM, L.L.C.® shall not be liable for any special, indirect, incidental, or consequential damages, including without limitation losses, lost revenues, or lost profits that may result from these materials. Opinions and estimates constitute our judgment and are subject to change without notice. Past performance is not indicative of future results.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.